Will Beacham, of ICIS Chemical Business, says the US polar storm shut down 90% of US polypropylene (PP) capacity, 67% of ethylene and devastated other important products, sending ripples around global chemical markets and prices soaring.

More chemical plants and refineries across the Gulf Coast region have been hit by prolonged power and feedstock outages caused by freezing weather, snow and ice which have also halted logistics networks. More bad weather, forecast for later in the week, may prolong the disruption.

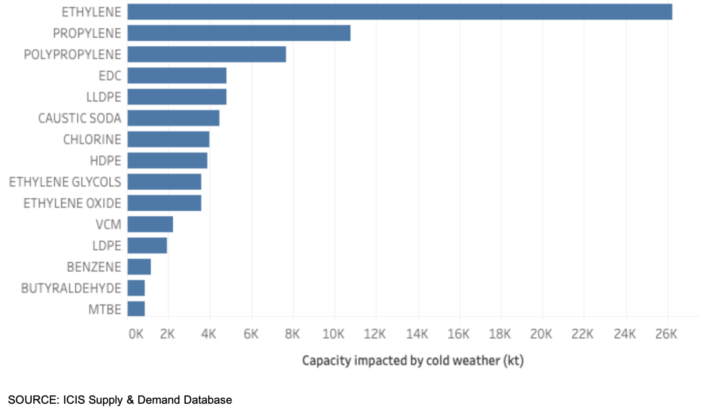

So far, ICIS has reported more than 60 plant outages as a result of the storm, with analysis using data from the ICIS Supply & Demand database showing that a wide swathe of the Gulf petrochemical sector has now been severely impacted.

Worst hit in volume terms is ethylene, with 26m tonnes of capacity offline, representing 67% of the US total. Around 11m tonnes, or 50%, of propylene capacity is also offline, with many of the region’s oil refineries also seeing curtailed production. More than 2m bbl/day of US oil refining capacity is shut down.

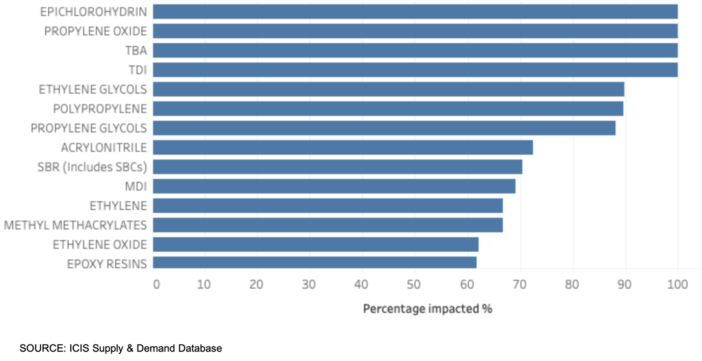

In percentage terms, the major commodities worst affected are epichlorohydrin (ECH) (100% of US capacity offline), propylene oxide (PO) (100%), toluene diisocyanate (TDI) (100%), ethylene glycol (EG) (90%), polypropylene (PP) (90%), propylene glycol (88%), acrylonitrile (ACN) (73%) and styrene butadiene rubber (SBR) (71%).

The outages are tightening global markets which were already suffering shortages of material and rising prices. Problems with the global container shipping system, plant outages plus healthy downstream demand have caused tightness, notably down the propylene and polyethylene (PE) chains.

Propylene and PP are likely to be one of the hardest-hit by the storms because the market was already in turmoil. The coronavirus pandemic has reduced demand for transport fuels, and led to oil refineries closing or cutting production, particularly in Europe and the US.

These closures had a knock-on effect on supply of propylene and PP, leading to price spikes. With US PP production capacity so highly concentrated on the Gulf Coast, even temporarily constrained productions capabilities will have a massive effect on an already tightly supplied market.

US propylene prices are at 10-year highs and inventories are roughly half of what they were a year ago. Consumption has outpaced production due to reduced propylene production over the last year.

PP inventories in the US hit seven-year lows in late 2020, partially driven by rebounding demand and partially driven by limited monomer availability. Some PP production issues also preceded this weather event.

The situation is less dramatic in PE. Constrained supply and demand for packaging has sustained global markets through the pandemic, with logistics challenges and outages causing shortages and price spikes in 2021.

With almost two thirds of US ethylene capacity now offline, global PE markets are likely to tighten further.

US methyl methacrylate (MMA) supply is also expected to be further constrained thanks to the storm, as Lucite has taken down its plant in Beaumont, Texas. Severe constraints in feedstock acetone continue to limit production. Due to high costs, a producer is heard to be levying a temporary acetone surcharge on orders starting this month.

GLOBAL MARKET IMPACT

With the Chinese New Year holidays coming to an end from 17 February, demand is picking back up in the world’s largest chemicals market. ICIS reported today that a supply shortage and improving demand after the holidays, supported China’s polyolefins market, leading to a surge in futures and spot prices.

Futures prices in China also rose sharply for styrene, mono ethylene glycol (MEG), polyester and polypropylene.

Prior to the holiday, domestic petrochemical trading had been robust accompanied by sharp price increases as market players anticipated strong post-holiday demand. Surging oil prices provided additional impetus for the uptrend.

In Africa, PE and PP sellers, from all origins, have withdrawn their offers in anticipation of disruption to US exports and a strong return post-holiday market.

Asia’s monoethylene glycol (MEG) prices surged on Thursday by 11% – the biggest daily gain on record – underpinned by tightening global supply, as the Chinese markets re-opened after a week-long holiday.

There are fears that US exports to Asia of key commodities such as ethylene could be disrupted by the storm-related outages.

Europe prices have also been buoyed by the storms. Rising upstream prices and bullish sentiment sent benzene prices up, and styrene prices are now at highs not seen since April 2018.

Additional reporting by: Lucy Shuai, Pearl Bantillo, Ben Lake, Judith Wang, Felicia Loo, Nurluqman Suratman, Amanda Hay, Tom Brown, Yashas Mudumbai, Helena Strathearn and Tarun Raizada.