The TTF gas price has risen 30% on Australian LNG strike risks.

Rystad Energy’s gas and LNG market update from senior analyst, Zongqiang Luo elaborated, saying the price for front-month gas at the Dutch Title Transfer Facility (TTF) surged by about 30% on Wednesday, 9 August, surpassing $12 per million British thermal units (MMBtu) on news of potential LNG facility strikes in Australia.

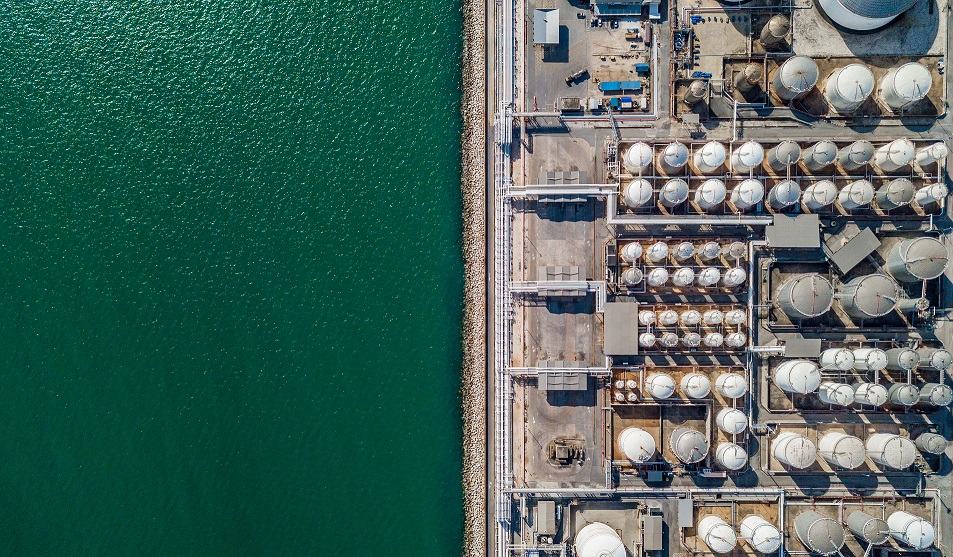

The potential strike would be led by Australian workers at Chevron and Woodside Energy Group, which may interrupt four LNG facilities. Any such strike could disrupt about half of Australia’s LNG export capacity and cause many Asian buyers to look elsewhere for their cargoes.

China and Japan purchased about 26 million tonnes of Australian LNG combined, more than 60% of the country’s exports in the first half of 2023.

This price surge reflects the likelihood of the strike materializing, impacting LNG supplies during the ongoing heatwaves, despite the ample gas inventories in Europe.

On the other hand, there has been a rise in Asian LNG prices, leading to increased competition for marginal cargoes between regions.

“Looking ahead, we expect the bullish outlook for gas prices to continue with fewer LNG imports to Europe, planned maintenance for Norwegian pipelines and continued heatwaves in multiple regions globally,” the update said.

The TTF gas price has risen 30% on Australian LNG strike risks.

Rystad Energy’s gas and LNG market update from senior analyst, Zongqiang Luo elaborated, saying the price for front-month gas at the Dutch Title Transfer Facility (TTF) surged by about 30% on Wednesday, 9 August, surpassing $12 per million British thermal units (MMBtu) on news of potential LNG facility strikes in Australia.

The potential strike would be led by Australian workers at Chevron and Woodside Energy Group, which may interrupt four LNG facilities. Any such strike could disrupt about half of Australia’s LNG export capacity and cause many Asian buyers to look elsewhere for their cargoes.

China and Japan purchased about 26 million tonnes of Australian LNG combined, more than 60% of the country’s exports in the first half of 2023.

This price surge reflects the likelihood of the strike materializing, impacting LNG supplies during the ongoing heatwaves, despite the ample gas inventories in Europe.

On the other hand, there has been a rise in Asian LNG prices, leading to increased competition for marginal cargoes between regions.

“Looking ahead, we expect the bullish outlook for gas prices to continue with fewer LNG imports to Europe, planned maintenance for Norwegian pipelines and continued heatwaves in multiple regions globally,” the update said.

Europe

Throughout the second week of August, the flow of Russian pipeline gas into the European Union (EU) will likely average 96 million cubic meters per day (MMcmd). Notably, gas flows through the TurkStream entry point in Bulgaria increased, averaging 52 MMcmd, up from the previous week’s 48 MMcmd. Additionally, Norwegian pipeline flows on 8 August reached a total of 332.5 MMcmd, marking a 9% weekly increase caused by unplanned maintenance at the Troll field. More large-scale planned maintenance will be conducted from late August, which could support TTF gas prices.

European storage facilities were 87% full as of 6 August. This trajectory of increasing storage positions Europe well to surpass the mandatory target of 90% full, which is set to take effect from 1 November, with months to spare.

Going forward, the prospect of European storage reaching capacity presents the possibility of increased utilization of Ukrainian storage facilities, which are now only 26% full. In recent years, Ukraine’s transmission system operator GTSOU has explored reversing pipeline flows to Ukraine. During the Covid-19 pandemic, when European gas demand was muted, traders used some spare capacity in Ukrainian facilities to store gas.

With EU storage facilities at ample levels, reverse flows to Ukraine had climbed to about 460 million cubic meters (MMcm) as of July 2023, the highest level since January 2022, with Hungary tripling its gas flows to Ukraine at 260 MMcm for a single month.

Gas flows from Slovakia to Ukraine via the Budince entry point have also jumped from zero to 17 MMcmd since 1 August 2023. It is worth noting, however, that most reverse flows to Ukraine in 2020 were either consumed locally or carried onward rather than being re-delivered to the EU market. Additionally, the economics and feasibility of large-scale reverse flows from the EU to Ukraine are unclear.

The TTF gas price has risen 30% on Australian LNG strike risks.

Rystad Energy’s gas and LNG market update from senior analyst, Zongqiang Luo elaborated, saying the price for front-month gas at the Dutch Title Transfer Facility (TTF) surged by about 30% on Wednesday, 9 August, surpassing $12 per million British thermal units (MMBtu) on news of potential LNG facility strikes in Australia.

The potential strike would be led by Australian workers at Chevron and Woodside Energy Group, which may interrupt four LNG facilities. Any such strike could disrupt about half of Australia’s LNG export capacity and cause many Asian buyers to look elsewhere for their cargoes.

China and Japan purchased about 26 million tonnes of Australian LNG combined, more than 60% of the country’s exports in the first half of 2023.

This price surge reflects the likelihood of the strike materializing, impacting LNG supplies during the ongoing heatwaves, despite the ample gas inventories in Europe.

On the other hand, there has been a rise in Asian LNG prices, leading to increased competition for marginal cargoes between regions.

“Looking ahead, we expect the bullish outlook for gas prices to continue with fewer LNG imports to Europe, planned maintenance for Norwegian pipelines and continued heatwaves in multiple regions globally,” the update said.

Europe

Throughout the second week of August, the flow of Russian pipeline gas into the European Union (EU) will likely average 96 million cubic meters per day (MMcmd). Notably, gas flows through the TurkStream entry point in Bulgaria increased, averaging 52 MMcmd, up from the previous week’s 48 MMcmd. Additionally, Norwegian pipeline flows on 8 August reached a total of 332.5 MMcmd, marking a 9% weekly increase caused by unplanned maintenance at the Troll field. More large-scale planned maintenance will be conducted from late August, which could support TTF gas prices.

European storage facilities were 87% full as of 6 August. This trajectory of increasing storage positions Europe well to surpass the mandatory target of 90% full, which is set to take effect from 1 November, with months to spare.

Going forward, the prospect of European storage reaching capacity presents the possibility of increased utilization of Ukrainian storage facilities, which are now only 26% full. In recent years, Ukraine’s transmission system operator GTSOU has explored reversing pipeline flows to Ukraine. During the Covid-19 pandemic, when European gas demand was muted, traders used some spare capacity in Ukrainian facilities to store gas.

With EU storage facilities at ample levels, reverse flows to Ukraine had climbed to about 460 million cubic meters (MMcm) as of July 2023, the highest level since January 2022, with Hungary tripling its gas flows to Ukraine at 260 MMcm for a single month.

Gas flows from Slovakia to Ukraine via the Budince entry point have also jumped from zero to 17 MMcmd since 1 August 2023. It is worth noting, however, that most reverse flows to Ukraine in 2020 were either consumed locally or carried onward rather than being re-delivered to the EU market. Additionally, the economics and feasibility of large-scale reverse flows from the EU to Ukraine are unclear.

Throughout the second week of August, the flow of Russian pipeline gas into the European Union (EU) will likely average 96 million cubic meters per day (MMcmd). Notably, gas flows through the TurkStream entry point in Bulgaria increased, averaging 52 MMcmd, up from the previous week’s 48 MMcmd. Additionally, Norwegian pipeline flows on 8 August reached a total of 332.5 MMcmd, marking a 9% weekly increase caused by unplanned maintenance at the Troll field. More large-scale planned maintenance will be conducted from late August, which could support TTF gas prices.

European storage facilities were 87% full as of 6 August. This trajectory of increasing storage positions Europe well to surpass the mandatory target of 90% full, which is set to take effect from 1 November, with months to spare.

Going forward, the prospect of European storage reaching capacity presents the possibility of increased utilization of Ukrainian storage facilities, which are now only 26% full. In recent years, Ukraine’s transmission system operator GTSOU has explored reversing pipeline flows to Ukraine. During the Covid-19 pandemic, when European gas demand was muted, traders used some spare capacity in Ukrainian facilities to store gas.

With EU storage facilities at ample levels, reverse flows to Ukraine had climbed to about 460 million cubic meters (MMcm) as of July 2023, the highest level since January 2022, with Hungary tripling its gas flows to Ukraine at 260 MMcm for a single month.

Gas flows from Slovakia to Ukraine via the Budince entry point have also jumped from zero to 17 MMcmd since 1 August 2023. It is worth noting, however, that most reverse flows to Ukraine in 2020 were either consumed locally or carried onward rather than being re-delivered to the EU market. Additionally, the economics and feasibility of large-scale reverse flows from the EU to Ukraine are unclear.