Rystad senior analyst Lu Ming Pang says gas and LNG prices have picked up slightly, but continue to remain deflated worldwide.

In the latest Rystad Energy Gas and LNG Market Update, Lu Ming Pang said high storage levels continued to keep a lid on gas prices.

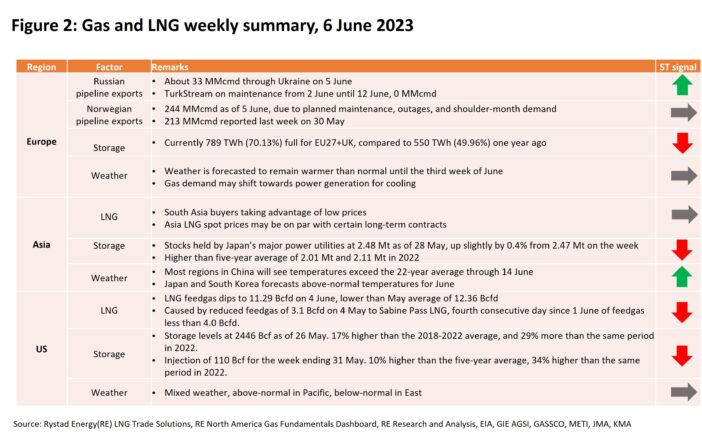

High storage levels and a relative lack of demand during the summer injection season continue to keep Asia Spot price around $9.26 per MMBtu and TTF price around $8.43 per MMBtu due to weak fundamentals.

Due to weak fundamentals, prices did not respond as they did in 2022 despite the disruption of gas pipeline supplies in Europe by multiple maintenance works. Another outage at Hammerfest LNG has failed to rock the market, with existing fundamentals remaining in control of the prices.

Lower LNG prices in Asia continue to invite pockets of demand back into the market, with South Asian buyers continuing to take advantage. However, they are not expected to set the market, as buyers from Northeast Asia still hold the prestige of being the kingmaker.

Europe

On 6 June, TTF prices climbed to $8.43 per MMBtu , surpassing the $7.90 per MMBtu reported last week on 31 May.

Prices have not increased by much despite supply disruption from maintenance in the TurkStream and Norwegian pipelines, and another outage at Hammerfest LNG, demonstrating demand weakness amidst higher-than-average storage levels.

In the early morning of Tuesday 6 June, prices surged to $9.55 per MMBtu, following a rally on Monday, 5 June, reaching as high as $8.92 per MMBtu.

This was a sharp increase compared to $7.42 per MMBtu as of the market close on Friday, 2 June, which was most likely driven by expectations of prolonged pipeline supply maintenance.

At the time of writing on 6 June, a downward trend has brought the prices back to the levels reported earlier.

Storage levels in Europe were around 789 Terawatt-hours (TWh) and 70.13% full as of the time of writing on 6 June, compared to 550 TWh and 49.96% full one year ago.

High storage levels have continued to keep prices depressed, as there is less of a rush to refill inventories, even with a 90% storage inventory target for European Union nations by 1 November 2023 looming.

Given the mild winter and already high storages, the EU looks set to reach those targets on schedule.

Russian gas pipeline flows are now at 33 MMcmd (Million cubic meters per day) as of 5June, mainly through the Ukraine Transit, after it was announced on 2 June that the TurkStream would undergo maintenance from 5 June until 12 June.

Norwegian gas pipeline flows into continental Europe, and the UK are at 244 MMcmd as of 5 June, higher than 213 MMcmd reported a week ago on 30 May.

However, this remains below the typical 300 MMcmd observed in the past year due to maintenance at Dvalin, Troll, Ormen Lange, Aasta Hansteen, Oseberg, and Vesterled, among others.

Despite the marked reduction in gas pipeline imports, the TTF price has not experienced an increase similar to that of last year. This is likely due to strong storage levels and relatively tepid weather.

The weather is forecasted to remain warmer than normal until the third week of June, which may keep gas demand for heating depressed but increase gas demand for power towards cooling instead.

Hammerfest LNG went offline again on 31 May due to a gas leak and is expected to return to service on 7 June. This is right after returning to service eight days behind schedule on 27 May, following a compressor outage on 4 May.

US

US Henry Hub prices remain deflated at $2.23 per MMBtu at the time of writing on 6 June, lower than the $2.30 per MMBtu quoted in last week’s report.

This maintains the downward trajectory of prices since the highs observed in 2022, with strong supply and storage fundamentals effectively suppressing HH prices, even into the summer injection season.

Storage levels increased to 2,446 Bcf (Billion cubic feet) as of 26 May, which is 17% higher than the five-year average and 29% more than during the same period last year.

The injection of by 110 Bcf is 10% higher than the five-year average injection and higher than the 82 Bcf injection last year.

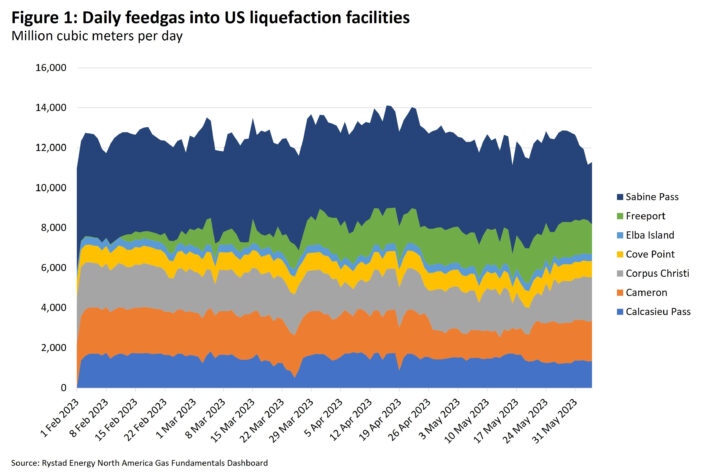

Feedgas into US liquefaction was at 11.29 Billion cubic feet per day (Bcfd) on 4 June, and typically averaged about 12.36 Bcfd in May.

Sabine Pass LNG contributed to this decline, which had feedgas fall to 3.1 Bcfd on 4 June, below the typical average of 4.6 Bcfd seen in May.

This was the fourth consecutive day, starting on 1June, where feedgas fell below 4.0 Bcfd, suggesting ongoing maintenance.

Sabine Pass LNG is expected to begin maintenance on two out of six of its trains this month.

Asia

Similar to the US and Europe, high inventory levels in Asia have mostly kept Northeast Asian utilities out of the spot market in recent months, with prices now around the $9.26 per MMBtu mark on 6 June due to a dearth of demand from the region’s biggest importers.

This is a slight increase from the $8.80 per MMBtu quoted last week, as Asian spot LNG prices have followed the TTF price increase.

May 2021 was the last time prices were this low.

The reduced prices continue to invite the interest of South Asian utilities; however, with prices falling even further, certain off-takers with long-term contract LNG prices comparable to current LNG prices may return to the market to take advantage of the situation.

Assuming a constant of $0.50 per MMBtu, the current Asian spot LNG price compared to the current Brent price of $75 per barrel gives an 11.5% slope, which may be on par with some contracts signed in recent years.

This remains contingent on having sufficient LNG storage and sustained demand.

Japan storage levels were at 2.48 Million tonnes (Mt) as of 28 May, remaining in line with 2.47 Mt from the previous week. This remains higher than 2.11 Mt during the same period in 2022 and higher than the five-year average of 2.01 Mt.

Japan is forecasting a more than 40% probability of above-normal temperatures in several northern and central regions for June, with at least a 40% probability of above-normal temperatures expected across the country until August.

Likewise, South Korea is forecasting a 50% probability of experiencing above-normal temperatures across the entire country until the third week of June. This probability reduces to 40% heading into the last week of June.