Wei Xiong

Senior Analyst

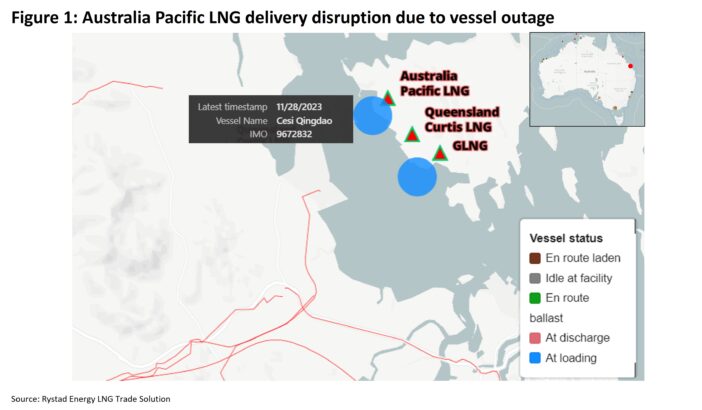

Despite freezing temperatures in Northwest Europe and delivery disruptions at Australia Pacific LNG due to vessel outages, Title Transfer Facility (TTF) prices were down 8.7% to $13.71 per million British thermal units (MMBtu) on 28 November from the previoius week’s highest level.

Ongoing bearish sentiment is due to a muted gas demand outlook and ample inventories in the northern hemisphere.

Underground gas storage facilities in Europe were 97.4% full at 111.98 billion cubic meters (Bcm) as of 26 November, compared to the five-year midpoint at 98 Bcm, despite the start of net withdrawals in early November.

Likewise, Asia spot LNG prices and US Henry Hub prices edged lower to $16.42 per MMBtu and $2.84 per MMBtu respectively on 28 November, from $16.465 per MMBtu and $2.99 per MMBtu a week earlier.

Further LNG supply disruptions in Australia

LNG exports from the 9 million tonnes per annum (Mtpa) Australia Pacific LNG (APLNG) facility on Australia’s east coast are presently disrupted, hindering the departure of LNG tanker CESI Qing Dao.

Two cargoes have been delayed so far with more delays possible. Rystad Energy’s LNG Trade Tracker shows that the plant’s 30-day rolling average utilization was around 100% as of 27 November compared to 120% a week earlier.

APLNG typically exports one cargo every 2-4 days, meaning the disruption could impact around 0.3 million tonnes (Mt) of LNG if the problems persist for two weeks. Feedgas to APLNG has been reduced with increased flows redirected to eastern Australia’s local gas market.

Elsewhere in Australia, Shell’s 3.6 Mtpa Prelude FLNG is expected to restart operations in early December following maintenance which began in late August, with the outage estimated to have impacted about 1 Mt of production.

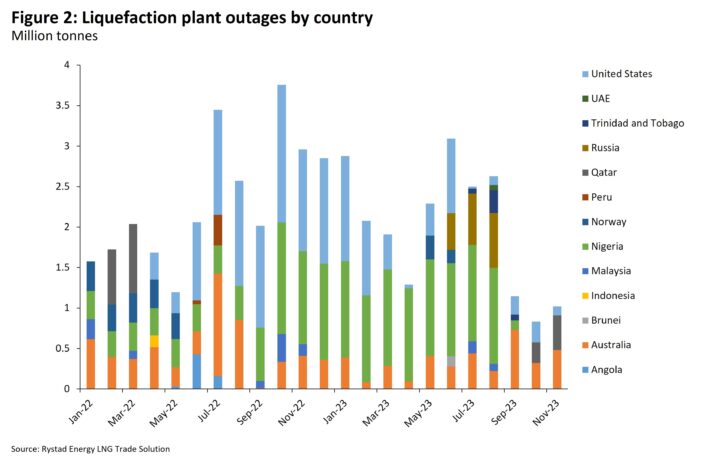

In mid-November, Chevron’s Gorgon LNG plant resumed operations at its third liquefaction train with 5.2 Mtpa of capacity following an electrical incident last month, which led to a production loss of 0.2 Mt. For 2023 to-date, over 3.7 Mt of production has been lost in Australia due to liquefaction plant outages.

Figure 2: Liquefaction plant outages by country

Cold snap in Northwestern Europe

Northwest Europe has started to see temperatures fall below seasonal norms this week.

In Germany, the region’s largest gas-consuming country, temperatures are expected to be below zero through 9 December alongside snowy conditions.

This will drive up heating demand but is unlikely to reverse the current bearish demand outlook, given soft industrial activity and healthy renewable energy output in the region.

High storage levels are also hindering gas prices from moving higher.

Germany’s underground storage facilities were 99% full as of 26 November, compared with 97.8% this time last year.

Piped gas flows into Europe have been largely stable in recent weeks.

Russian flows were up from 82.57 million cubic meters per day (MMcmd) a week earlier to 92.45 MMcmd as of 26 November.

Flows from Norway fell slightly to 345.59 MMcmd on 27 November from 352.19 MMcmd a week earlier.

Some procurement by Asian importers

In terms of LNG buying activity, cooling temperatures prompted CPC in Taiwan (China) to purchase LNG this week for delivery early next year.

Pakistan also purchased one LNG cargo for January 2024 delivery, with Thailand buying four cargoes in total for delivery next January and February.

This has pegged Asia spot LNG prices at $16 per MMBtu.

However, most other Asian importers remain sidelined on sluggish demand.

China is poised to enter the year’s peak gas demand season with temperatures in Beijing remaining below zero and below seasonal norms this week.

However, most days in the coming week are expected to be above historical norms.

Winter weather is still a wildcard in determining China’s gas demand for the year, with its industrial sector – the nation’s largest gas consuming sector – continuing to see lagged recovery.

In October, China’s manufacturing Purchasing Managers’ Index (PMI) fell into contraction territory at 49.5, with only September’s number showing expansion during this year’s second half.

Rystad Energy is now forecasting that China’s gas demand for 2023 will be up 6.1% year-on-year to 389 Bcm, marginally below our earlier forecast of 395 Bcm.

China’s LNG imports this year are forecast to grow 6.7% year-on-year to 68.1 Mt, also below our earlier forecast of 71.5 Mt, and below 2021 levels of around 80 Mt.

US price upside from LNG exports offset by high gas storage levels

Feedgas to US liquefaction plants remains at record-high levels, registering at 14.47 billion cubic feet (Bcf) per day on 27 November, up from 14.16 Bcf per day a week earlier.

While the current 30-day rolling average utilization of US liquefaction plants is close to 106%, Henry Hub prices remain muted amid high gas inventories.

US underground storage levels are currently at a combined 3.78 trillion cubic feet (Tcf), compared with 3.5 Tcf this time last year and the five-year midpoint of 3.73 Tcf.

Weather-wise, the US east is expected to experience some days with below-normal temperatures in the coming fortnight, with temperatures in other part of the US likely to be above seasonal norms.