Rystad Energy’s North America gas and LNG market update from analyst Ade Allen says after a muted shoulder season for North American gas markets, summer has arrived with a bang and demand is set to surge.

Strong supply and cooler weather kept prices low in the last few months, but as temperatures rise across the region, the need for cooling in residential and commercial settings means pricier gas is on the horizon.

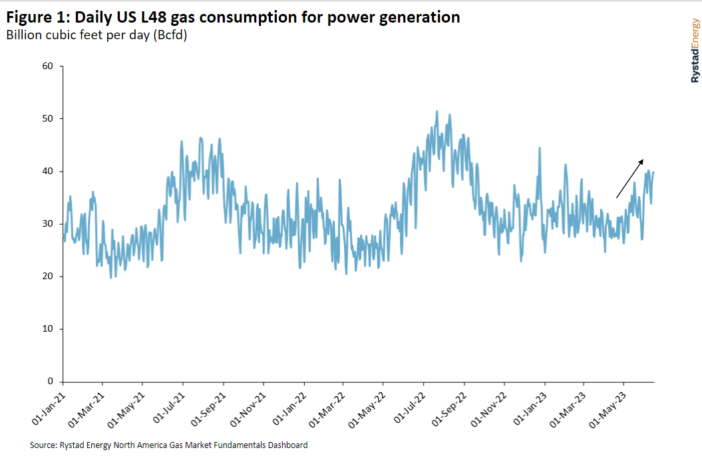

The frequency of Cooling Degree Days (CDDs) has a significant impact on gas demand, and as much of the US deals with a crippling early-summer heat wave, there will be a material uptick in gas demand.

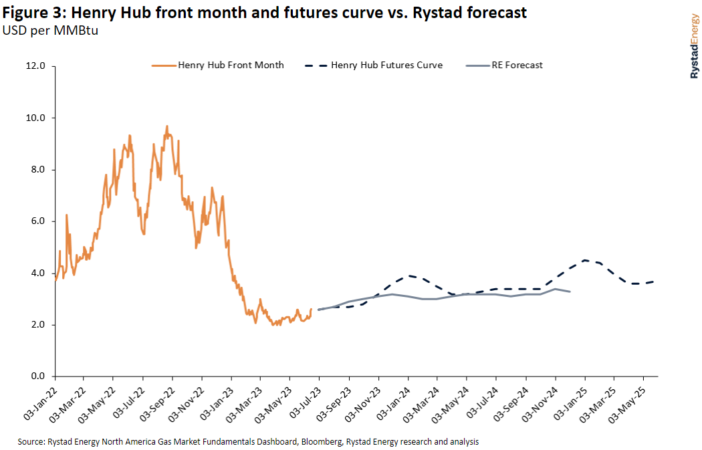

Rystad Energy modeling projects daily Lower 48 gas power demand will reach 50 Bcfd this summer due to limited coal-to-gas switching and domestic gas price competitiveness.

We expect gas for power demand for the summer period (June to August) to average 42.4 Bcfd, with demand peaking in July at 45.0 Bcfd.

South-Central and East regions will utilize the most, averaging 12.7 Bcfd and 18.5 Bcfd, respectively.

As the trajectory of Cooling Degree Days changes with warmer weather, domestic balances will see a significant impact via increases in gas-for-power demand.

Our estimates indicate CDDs will average 332 Fahrenheit days over the summer period (June to August), which is on par with the same period in 2022.

Weather is unpredictable and our forecasts are conservative as a result, so if temperatures are warmer than the three-year average, gas for power demand averages will be higher than expected.

This week could serve as a precursor for regional gas demand overshooting estimates as temperatures in Texas are expected to average over 100 degrees Fahrenheit, potentially putting the grid to the test.

As of yesterday, per the Electricity Reliability Council of Texas (ERCOT), natural gas represents ~56% of the fuel mix.

At those levels, natural gas is running at around 81% utilization relative to summer capacity, so if temperatures remain elevated, the regional market can expect higher gas demand.

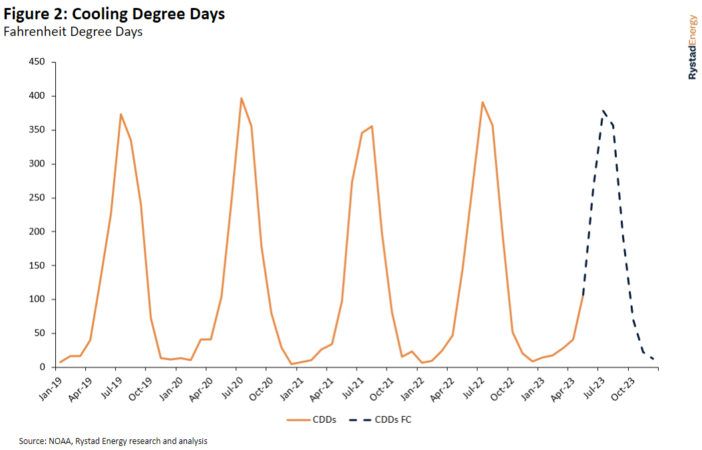

Summer gas-for-power demand will have material implications on 2023 balances and short-term Henry Hub prices.

The domestic market has been loose in 2023, as the market dealt with elevated inventories due to a warmer-than-normal winter in 2022/23.

This scenario, combined with the growth in supply, has precipitated the decline in Henry Hub prices and diminished the price outlook for 2023.

Our estimates indicate prices will remain subdued in 2023, however, the uptick in summer demand will provide some much-needed tightening for domestic balances and set a short-term floor for Henry Hub prices.

We estimate summer Henry Hub prices will average $2.73/MMBtu (+2.5% premium to the current futures curve) and $2.91/MMBtu for the balance of 2023.

Our central view indicates the futures curve is discounting the implications of summer gas demand, and barring a material weather event, we could see narrower-than-expected weekly injections, which will change the trajectory for Lower 48 storage and provide short-term bullish price action.

However, regional dynamics via elevated South-Central storage continue to provide steep contango between cash and prompt Henry Hub prices.

Nevertheless, we expect record gas consumption from the power sector to tighten domestic balances and narrow relative contango.