The Abu Dhabi National Oil Company (ADNOC) has unveiled plans to invest US$45 billion with partners over the next five years to become a leading global downstream player. The plans were unveiled at the ADNOC Downstream Investment Forum, which took place today in Abu Dhabi, UAE. The event brought together more than 40 CEOs and 800 senior business leaders from the global oil and gas, energy, petrochemical and finance industries, as well as many other sectors.

Feature Articles

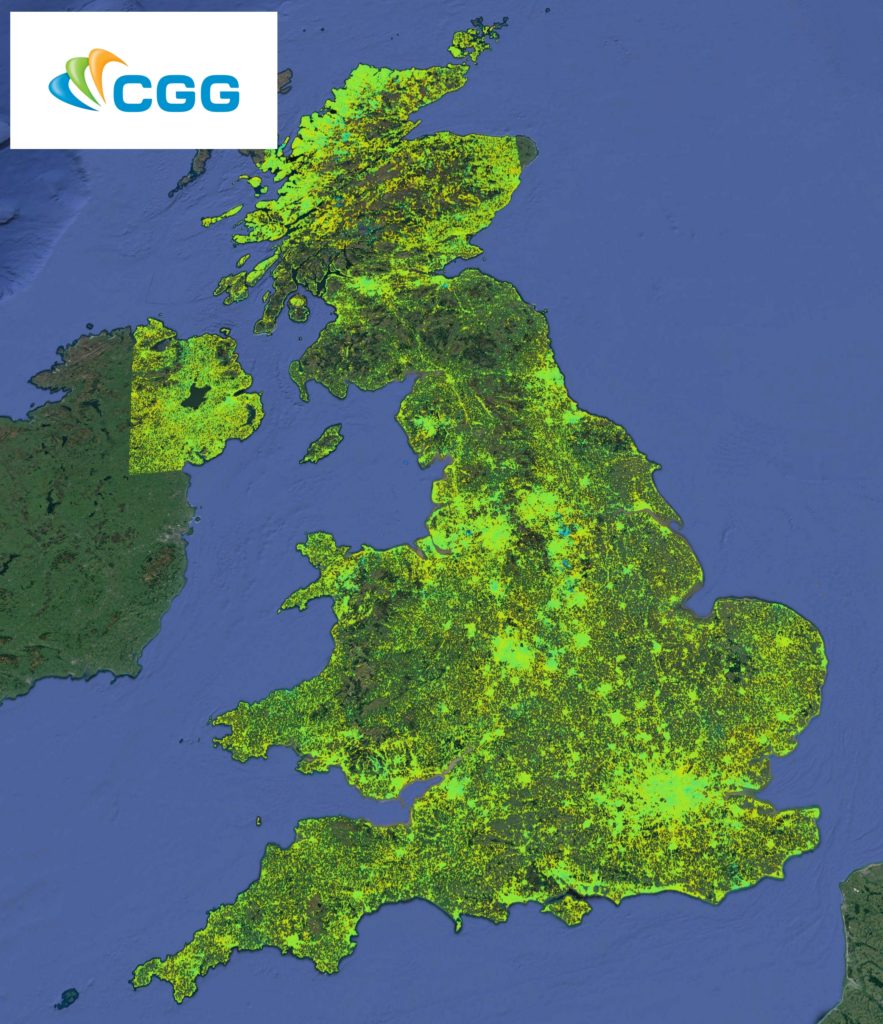

CGG Launches new MotionMap UK National Ground Stability Database

CGG’s NPA Satellite Mapping group has unveiled its new MotionMap UK product for companies involved in asset management, large engineering projects, property conveyancing, insurance disputes and risk management. In a media release CGG said the UK’s geological setting, mining legacy and engineering heritage has led to substantial changes above and below ground. From subsidence and heave across coal fields in the Midlands, to tunnelling-related ground settlement in London, the impact on the landscape is “extensive yet relatively unknown and extremely challenging to map”.

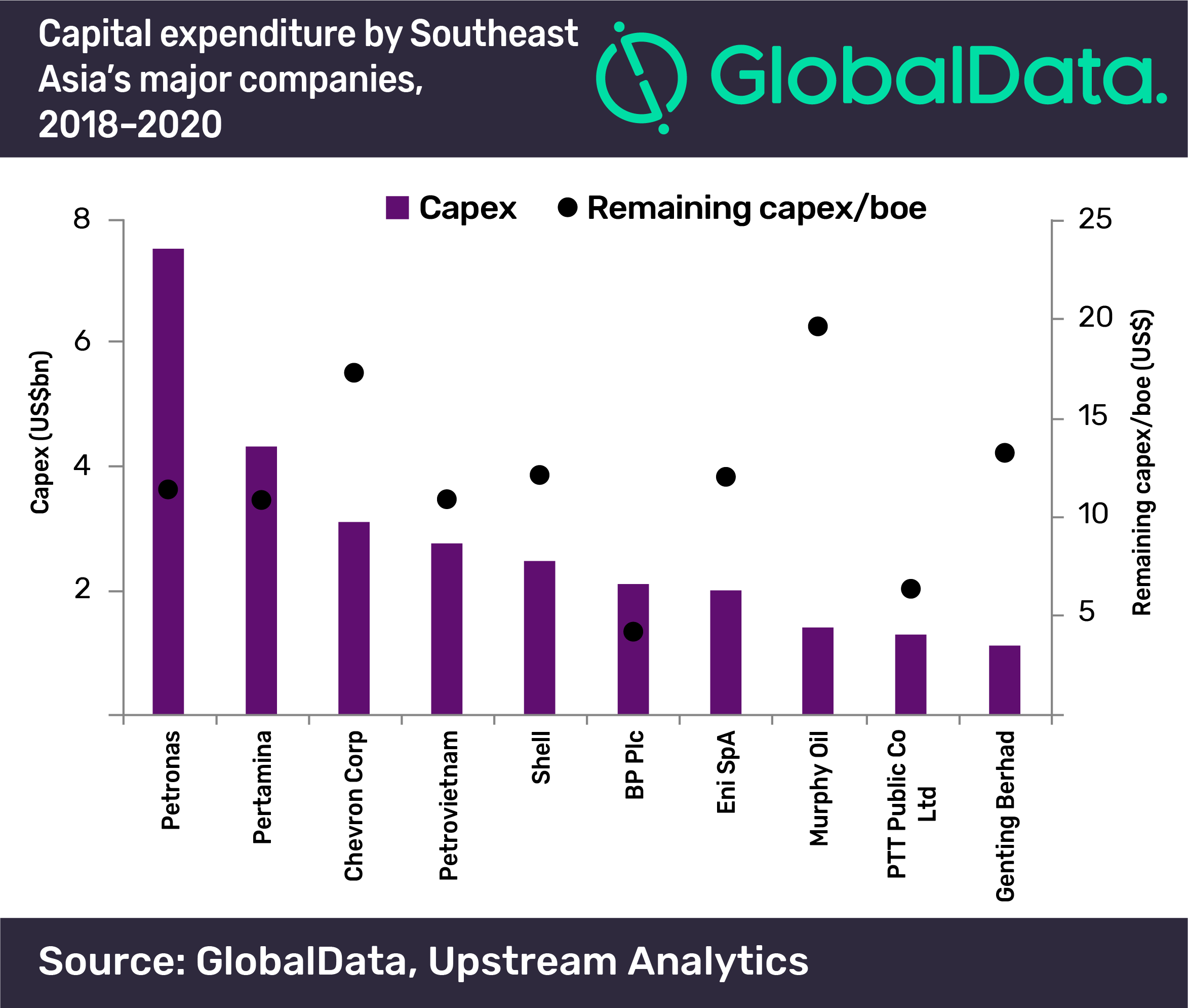

$46.3bn will be spent on Southeast Asia’s upstream capex by 2020

An average capital expenditure (capex) of $17.8bn per year will be spent on 336 oil and gas fields in Southeast Asia between 2018 and 2020, according to GlobalData, a leading data and analytics company. Capex on Southeast Asia’s traditional oil projects will add up to $8.3bn over the three-year period, while heavy oil fields will require $1.7bn over the same period. Investments into gas projects in Southeast Asia will total $43.4bn in upstream capex by 2020. Jonathan Markham, Oil & Gas Analyst at GlobalData said, “Shallow water projects will be responsible for over 63 percent of $46.

BP Commits to Sell Gas to Alaska LNG Project

The Alaska LNG Project has reached a "historic milestone" as BP Alaska and Alaska Gasline Development Corporation (AGDC) announced the parties have agreed to key terms of a Gas Sales Agreement, including price and volume. The terms are captured in a Gas Sales Precedent Agreement which was signed on May 4, 2018. In a statement Alaska Gas Development Corporation said both the parties anticipate finalizing a long-term gas sales agreement in 2018 for AGDC to purchase BP Alaska’s share of 30 trillion cubic feet (TCF) of gas from the Prudhoe Bay and Point Thomson units.

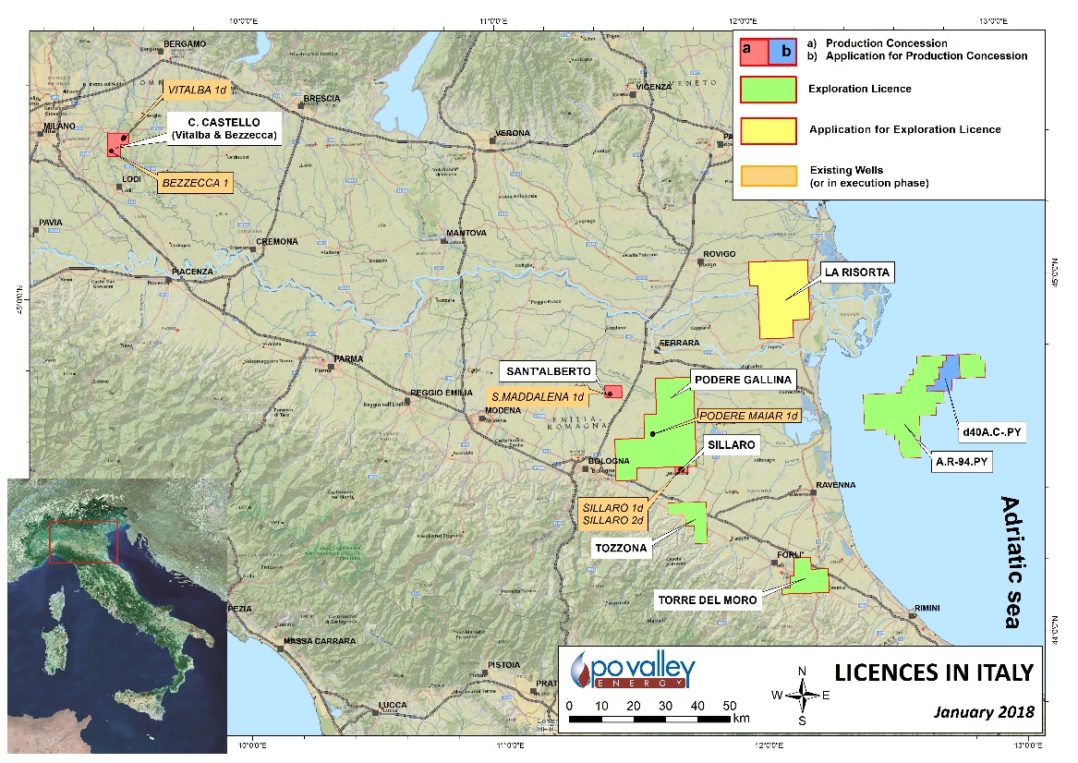

Po Valley raises funds for Italian operations

Po Valley Energy Limited has secured funding of $2.5m through the issue of a convertible note with a conversion price of $0.042 per share and a maturity of three years. The ASX-listed company said the funds will be used to expedite a final investment decision for its successfully drilled onshore Selva field in Italy and to complete seismic work on its large oil condensate/gas Torre del Morro explorations licence. Company directors Kevin Bailey and Michael Masterman both intend to participate in the note issue for $700,000 and $300,000 respectfully, subject to shareholder approval, Po Valley said.

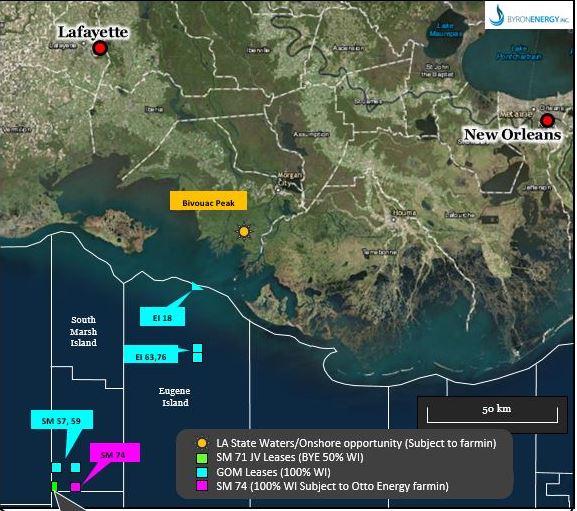

Byron hits 90% production mark in Gulf of Mexico

ASX-listed Byron Energy has hit 90 percent production capacity at its SM 71 F platform in the Gulf of Mexico, ramping up operations following a pipeline shut-in earlier in April. Production from the company’s SM 71 F platform began on March 23 from the SM 71 F1 and F2 wells with the F3 well following suite on April 6. For the period March 23 to April 25, the three wells produced a total gross sales volume of 83,000 barrels of oil and 55.5 mm cubic feet of natural gas.

Blue Energy raises concerns over hydraulic stimulation

Blue Energy is concerned about that additional layers of regulation governing hydraulic stimulation could burden an already labouring oil and gas industry. Barely two weeks after the Northern Territory government lifted the moratorium on hydraulic fracturing in the north of Australia, Brisbane-based Blue Energy welcomed the development, but also noted some concerns in its quarterly activities report released last week.

Schlumberger profits surged in Q1

Schlumberger has posted an increase in profit and revenues during the first quarter of 2018 compared to the same period last year. The company announced revenues of US$7.8 billion for the first quarter of 2018, a 14% increase compared to US$6.9 billion in the same period of 2017. In addition, net income attributable to Schlumberger was US$525 million in Q1 2018 compared to US$279 million in the year-before period, an increase of 88%. Inthe last quarter of 2017 Schlumberger recorded a loss of US$2.3 billion.

Eni to spend US$1B a year on exploration

Italian oil company Eni said it expects production to increase by 3.5% per year over the next four years and has plans to invest US$1.1 billion per year on exploration activities in its quest to discover two billion barrels of new resources. This was revealed by Eni CEO Claudio Descalzi in the company’s 2018-2021 Strategic Plan, which builds on the transformation started by the company back in 2014. Descalzi said over the past four years, in a very low price environment, Eni had increased its hydrocarbon production and restructured its mid-downstream businesses to drive positive structural result.

Searcher expands its Offshore Argentina Seismic and Well Database

Searcher Seismic announced it has expanded the Offshore Argentina Seismic and Well Databasewhich is being carried out in anticipation of the 2018 Argentina Offshore Bidding Round 1. Since late 2016, Searcher Seismic has been collating, organising, reimaging, interpreting and evaluating a vast amount of offshore data from the Argentina continental shelf areas. The original data required considerable adjustments, editing and QC enhancement, which allows the industry to easily utilise the rectified data sets for further analysis. Searcher now holds 11,171 km of Pre-STM broadband reprocessed data and over 100,000 km Post-STM processed open file 2D and 1,865 km² 3D.