Australia’s Talon Petroleum is making a bid for 100 % takeover of EnCounter Oil, which is the owner of two UK North Sea licenses.

EnCounter, a private UK-based company, was formed in 2012 by the former executive management team of EnCore Oil and was involved in 25 wells and produced significant hydrocarbon discoveries at Breagh, Cladhan, Catcher, Varadero. EnCore was acquired by Premier Oil in 2011 for £221 million.

Talon said the completion of the transaction is subject to final legal and financial due diligence on EnCounter and all required shareholder approvals.

The company is looking to build on its newly incorporated UK North Sea strategy. Last October Talon entered into an agreement with Corallian Energy to earn a 10% interest in License P2396.

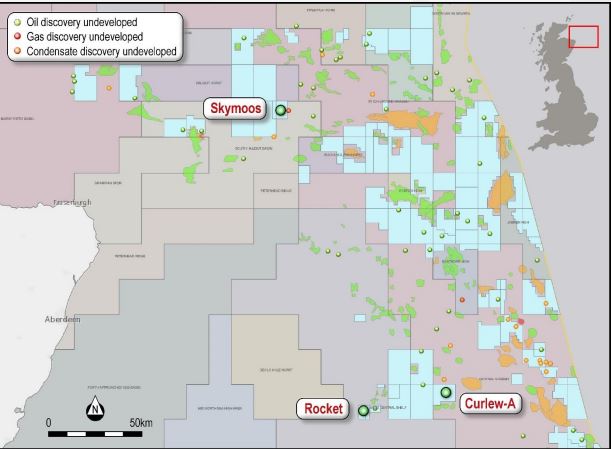

The license is located in the prolific Central Graben area of the UK North Sea and contains the Curlew‐A discovery made by Shell in 1977. Curlew‐A contains an independently certified gross 2C Contingent Resource of 45mmboe. Appraisal drilling at Curlew‐A is currently scheduled for 3Q 2019

Talon stated that the EnCounter transaction provides the company with a 100% ownership of two recently awarded, high-impact exploration licenses which are being readied for farm-out.

Talon Managing Director, Matthew Worner, said: “The transaction with EnCounter Oil is a significant step forward in Talon’s UK North Sea strategy. Talon is extremely pleased to be executing this deal with EnCounter Oil, with the company acquiring both the highly-prospective Skymoos and Rocket prospects.

“The company set about its strategy to assemble a compelling portfolio of UK North Sea opportunities only six months ago. To have brought in three exciting and highly prospective assets in such a relatively short period of time is a particularly pleasing outcome, and Talon will continue to build on this during the year.

“A farm-out process to secure industry funding for drilling both Skymoos and Rocket will now commence, and we look forward to drilling an appraisal well at Curlew-A which is currently planned for 3Q 2019.”

Subject to final legal and financial due diligence on EnCounter, Talon shareholder approval, and regulatory approvals, Talon will acquire 100% of the issued share capital of EnCounter for a 100m ordinary Talon shares, subject to a 12-month voluntary escrow period; a 150m Performance Shares converting to ordinary Talon shares upon the successful farm-out of the Skymoos Prospect, and Talon electing to move into the drilling phase of License 2363 on or before September 30, 2021; and 150m Performance Shares converting to ordinary Talon shares upon the successful farm-out of the Rocket Prospect, and Talon electing to move into the drilling phase of License 2392 on or before September 30, 2021.

Presently, EnCounter is the holder of 100% interest in two exploration licenses in the UK Continental Shelf, License 2363 and License 2392, which contain the Skymoos and Rocket exploration prospects. The addition of these two licenses adds significant exploration upside potential to the Talon portfolio and come with very modest work commitments in the initial phase, Talon explained.