Senex Energy Ltd (ASX: SXY) has successfully delivered a major upgrade in gas reserves which the company says builds a foundation for established and continued growth in production, earnings and cashflow.

Stock spurt

Senex’s share price on the ASX was trading at 28c at close on 20 July, up 12% from a week earlier on and 115% up from its six-month low of 13c in the latter part of March.

In it’s June quarterly report Senex announce the following highlights:

• Fourth quarter FY20 production up 20% to 711 kboe with Surat Basin gas production up 43% to 518 kboe and Roma North facility de-bottlenecking achieving to >18 TJ/day.

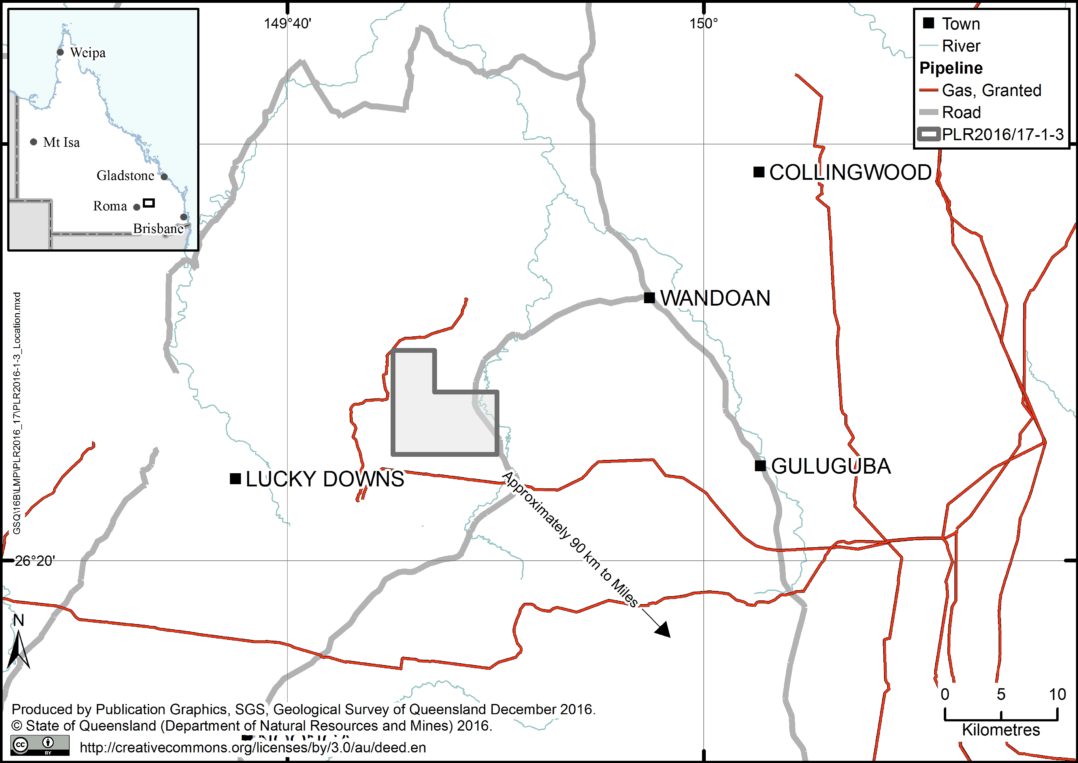

• Completion of the $400 million Surat Basin development delivering 56 TJ/day of gas processing capacity constructed; 80 wells drilled; a portfolio of high-quality domestic gas customers in place and current gas production above 37 TJ/day, ramping to 48 TJ/day (~18 PJ/year).

• Early works commencing on Roma North’s 24 TJ/day expansion and the agreement of contracts for Jemena to procure long-lead items, including compression equipment.

• Full year FY20 production up 73% to 2.1 mmboe, at the top end of upgraded guidance. Growth was underpinned by a 278% increase in Surat Basin gas production to 1.2 mmboe (~7.2 PJ).

• FY20 full-year earnings guidance re-iterated: Subject to audit completion, EBITDA is expected to be towards the top end of $45-55 million guidance range; peak net debt is now ~$60 million (from $80 million).

• A major Surat Basin gas reserves upgrade that delivered a 108% increase in 1P reserves to 210 PJ and a 21% increase in 2P reserves to 739 PJ from successful drilling and production performances.

• A new Atlas gas sales agreement with CleanCo for 2.55 PJ in 2021 which means that Atlas gas production is fully contracted for calendar year 2020

Managing Director and CEO Ian Davies commented: “Financial year 2020 was a year of focused and successful execution of our $400 million Surat Basin gas developments, which delivered outstanding project delivery performance and continued gas production outperformance.

“In less than two years since the Final Investment Decision was taken, we have successfully developed these critical gas resources for the domestic market, including delivery of first gas from Atlas in record time for a coal seam gas project in Queensland.

“Excellent drilling results and continued production outperformance contributed to a 108% increase in 1P Surat Basin gas reserves to 210 petajoules, and a 21% increase in 2P reserves to 739 petajoules.

“We also achieved full year production growth of 73% to 2.1 mmboe, at the top end of upgraded guidance range. At Roma North, contracts have been agreed for Jemena to procure long-lead items, including compression equipment, for the 24 TJ/day expansion.

“With gas processing infrastructure established and a growing reserves base, Senex has now successfully delivered on the foundations to achieve continued growth in production, earnings and cashflow from its valuable east coast Surat Basin natural gas position.”