Santos has snapped up a big basket of onshore and offshore ConocoPhillips assets in a $2.2 billion deal motivated by the Adelaide-headquartered oil and gas company’s big vision for future gas demand in Australia.

“We see a big future for gas,” Santos CEO Kevin Gallagher said as details of the purchase emerged.

“Through to 2040 it is the fastest-growing energy source and that’s why there’s such demand for our product across Asia.”

ConocoPhillips and Santos already have a long-standing partnership in the Northern Territory, the former as operator and major stake holder in the Darwin LNG plant, which gets feedstock from the Bayu-Undan offshore field in which Santos has an 11.5% share.

The American company has a 37.5% interest in the Barossa development — which counts Santos as a 25% partner and has been flagged as a future source of gas as Bayu-Undan goes into decline.

Mr Gallagher said the International Energy Agency’s prediction for gas to expand more than any other fossil fuel over the next 20 to 30 years aligned with Santos’ forecast.

“The acquisition of these assets fully aligns with Santos’ growth strategy to build on existing infrastructure positions while advancing our aim to be a leading regional LNG supplier,” he said.

“This acquisition delivers operatorship and control of strategic LNG infrastructure at Darwin, with approvals in place supporting expansion to 10 million tonnes per annum and the low-cost, long-life Barossa gas project.

“These assets are well known to Santos. It also continues to strengthen our offshore operating and development expertise and capabilities to drive growth in offshore northern and Western Australia.”

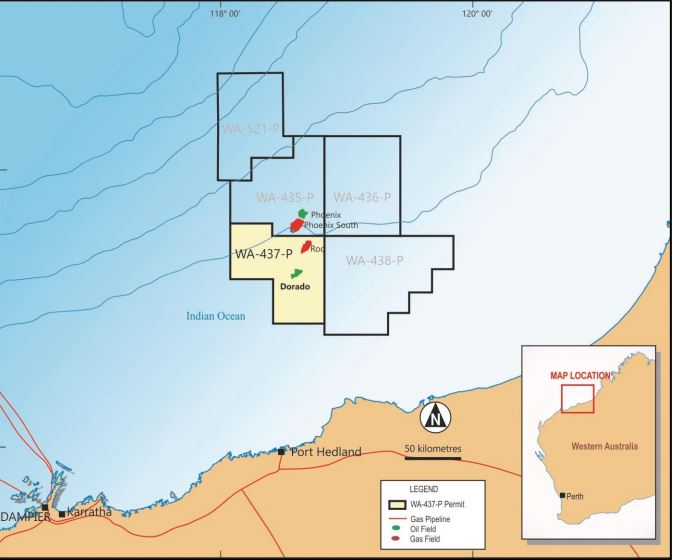

The deal comes just days after Santos revealed strong oil flows from the Dorado-3 appraisal well on the North West Shelf, confirming that the main oil pool in the field is capable of producing flow rates at the higher end of pre-drill expectations.

Last month the Baxter reservoir test had confirmed excellent productivity and fluid quality and last week Santos said the initial clean-up flow test of the Caley reservoir was conducted over a 12-hour period. This achieved a maximum measured rate of approximately 11,100 barrels of oil per day and 21 million standard cubic feet of associated gas per day through a 68/64” choke.

Santos said the oil rate was one of the highest ever out of a NWS appraisal well test.

The test was conducted over an 11m net interval between 3,999 and 4,015 metres Measured Depth and achieved with only 220 psi of drawdown. The Caley production was constrained by surface equipment, indicating the reservoir has the capacity to flow at significantly higher rates.

Gallagher described the test result as extremely positive.

“The test was conducted over only an 11m net section of the Caley from a total net reservoir interval of 53 metres, which demonstrates the high quality of the Caley reservoir.

“The results are very encouraging for development of the shallow-water Dorado field, with the test indicating very high potential flow rates of around 30,000 barrels per day from each single production well in the Caley reservoir. This positive result represents a significant step in progressing Dorado as one of Santos’ most exciting new development projects.”

The two test results have indicated the potential for flow rates on the upside of expectations and further enhance progress towards FEED early in the New Year.

The well will be plugged and abandoned to conclude Santos’ 2019 offshore drilling program.

Carnarvon Managing Director, Adrian Cook, added: “These results are the highlight of an incredibly successful 2019 appraisal program in which we have now confirmed a very large resource of oil and gas at Dorado and prolific production flow rates.

“Dorado is an exceptional project given these appraisal outcomes and is complemented by its local jurisdiction, it’s location in shallow water and its services advantages given its proximity to shore and supporting infrastructure which will aid development and operational costs.”