The oil and gas industry is gearing up to deploy robotics across a wide range of applications in the upstream, midstream and downstream segments, primarily to drive productivity and efficiency amid volatility in crude prices, according to data and analytics company Globaldata.

The company’s latest thematic report: ‘Robotics in Oil & Gas’ reveals that the complex challenges, particularly in the exploration and production of hydrocarbons, are prompting companies to explore the potential of complexly engineered robotics solutions to work autonomously or in conjunction with field operators.

According to GlobalData, the global robotics industry is set to grow at a compound annual growth rate of 16% from US$98.2bn in 2018 to US$277.8bn in 2025.

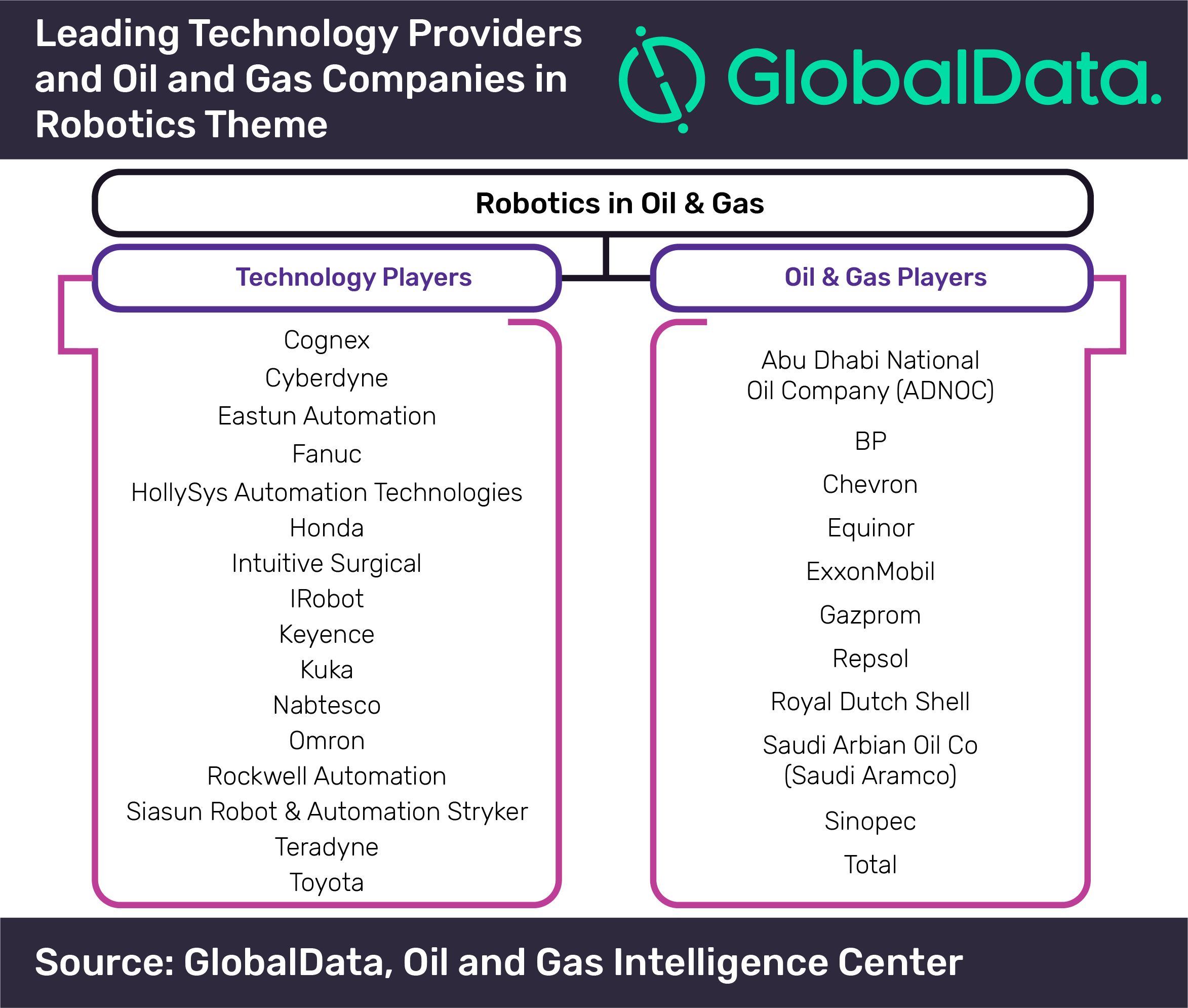

GlobalData’s thematic report identifies oil and gas companies such as Shell, ExxonMobil, Chevron, BP, Gazprom, Repsol, Equinor, Total, Saudi Aramco, Sinopec and ADNOC, as having considerable exposure to the robotics theme.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “Recent technological advancements are enabling operators to deploy robots in terrestrial, aerial and underwater configurations to carry out tasks that may be too risky to be undertaken by field personnel. Moreover, aging infrastructure is necessitating regular inspection of these assets, and autonomous drones are being used due to their sheer number and issues related to accessibility.”

However, the two major challenges in deploying robotics technologies in any industry are cost and reliability. Robotics are proving to be fairly reliable in enhancing operational efficiency in certain applications, such as material handling and preparation of land for drilling, especially when they are remotely managed by field operators. Nevertheless, it is yet unclear if the total cost of ownership of robots and drones has a positive effect on overall operational expenditure.

Puranik concludes: “To overcome this concern, robotics technology providers and oilfield service providers are devising new business models, such as Robotics-as-a-service (RaaS) to drive the deployment of these technologies in field operations and reduce uncertainty over the total cost of ownership of robots.”