The Australian Competition and Consumer Commission (ACCC) has approved Santos’ proposed acquisition of Quadrant Energy.

Under the proposed transaction which was announced three months ago, Santos will acquire 100% of Quadrant Energy for $2.15 billion in addition to potential contingent payments flowing from the Dorado offshore oil discovery.

After detailed investigation the ACCC said it was unlikely that the acquisition would result in a substantial reduction of competition in the supply of gas to users in Western Australia.

“The ACCC considers that a combined Santos/Quadrant will continue to face strong competition from a range of suppliers, including large LNG producers such as Chevron and Woodside,” ACCC Chair Rod Sims said.

“Most market participants believe the Western Australian domestic gas market is currently oversupplied. While the demand-supply balance could tighten in future, the ACCC considers that the proposed acquisition will not have a significant impact on future gas prices.

“In Western Australia, gas exporters are required to reserve 15 percent of their gas for the domestic market, so this should ensure that gas available for domestic customers continues to grow, and from a range of players,” Sims said.

The ACCC said it had approached relevant WA government departments and no concerns were expressed about the proposed acquisition.

Santos said completion was now expected to occur within weeks.

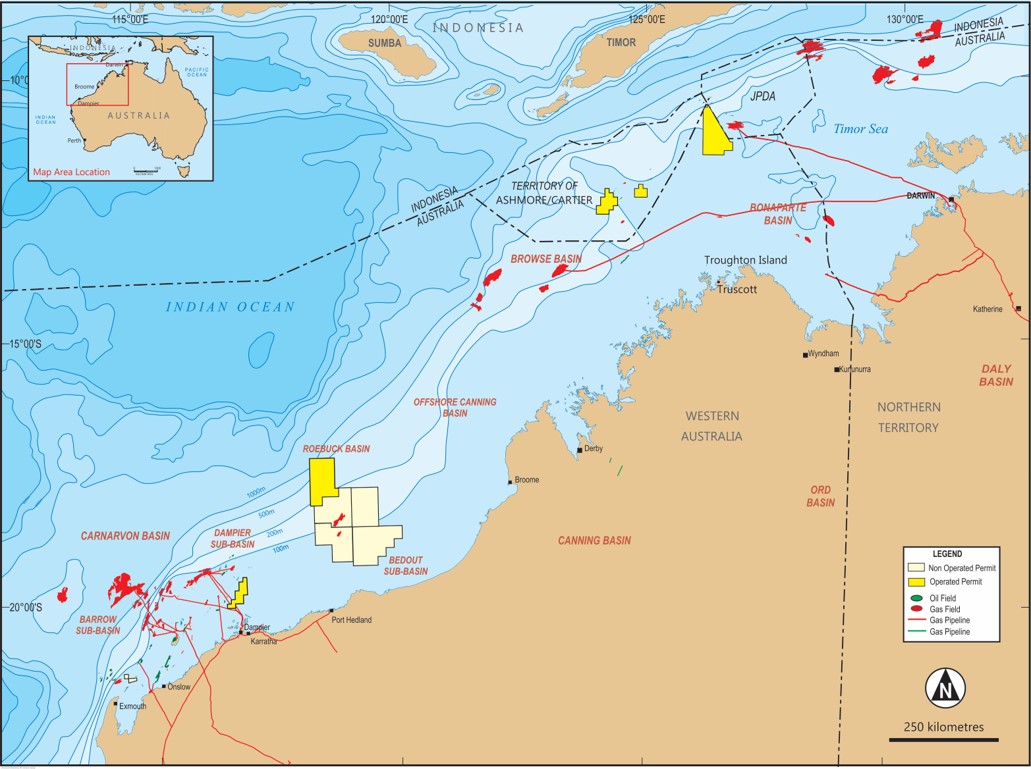

Santos Managing Director and Chief Executive Officer Kevin Gallagher said the acquisition would deliver increased ownership and operatorship of a high quality portfolio of low cost, long life conventional Western Australian natural gas assets.

“It is materially value accretive for Santos shareholders and advances Santos’ aim to be Australia’s leading domestic natural gas supplier.

“We already have very significant growth projects across our five core assets, and Quadrant’s recent oil discovery at Dorado is another exciting opportunity for us,” Gallagher said.