Shearwater Geoservices has completed the refinancing of its long-term secured debt portfolio.Shearwater Geoservices had issued a five-year US$300 million senior secured first lien bond and then executed a new $US300 million five-year bank term loan with net proceeds used to repay previous secured debt facilities. The bonds rank pari passu with the term loan. Shearwater has also established a US$50 million revolving credit facility (RCF) and a US$50 million guarantee facility.“Shearwater has established a strong foundation for growth and value creation as a global leader within the marine seismic industry in terms of capabilities, capacity and financial standing.

Latest News

Sercel Announces First Commercial Sale of its New 528 Land Acquisition System

CGG has announced the first major sale - by Sercel - of the Sensing & Monitoring business line of its next-generation 528™ cable-based land acquisition system to the Turkish Petroleum International Corporation (TPIC).

CGG said the client would deploy the system, representing a total of 8,000 channels, on a 3D seismic survey in Turkey, across challenging, semi-arid terrain.

Delivery of the system commenced at the end of March, with the survey expected to start in Q3 2024.

The sale follows the recent launch of Sercel’s new 528 and VE564 land seismic solutions, designed to maximize client return on investment by reducing downtime and boosting productivity even in the harshest of terrains.

Geopolitical tensions come to the boil with oil prices in sharp focus

Iran's launch of over 300 drones and missiles on Israel in the first ever direct attack on the Israeli soil from Iranian territory has increased geopoliticsl risk in the oil market, according to Rystad Energy's oil market update in reaction to the accelerating conflict.

Rystad Energy Senior Vice President Jorge Leon said that although the vast majority of drones and missiles were intercepted, no Israeli fatalities were reported and only minor damage at an Israeli military base was inflicted, the hostilities markedd an unprecedented and dangerous development in an already volatile region.

"As mentioned in our recent commentary, the likely Iranian retaliation increased the geopolitical risk in the oil market.Rystad Energy’s Geopolitical Risk Index increased to 1.22 during the first week of April," Leon said.

ACCC again warns southern states on gas supply

The Australian Competition and Consumer Commission (ACCC) has confirmed that Australia’s gas industry continues to deliver on its commitment to the domestic market.

However, in a new report the ACCC has again highlighted concerns that southern states are relying on gas from the north to keep the lights on.

Australian Energy Producers today said the ACCC Gas Inquiry March 2024 Interim Report reaffirmed the industry’s role in providing reliable and affordable energy to Australian homes and businesses.

The report, examining the third quarter of 2024, estimated east coast supplies would be 6PJ in surplus.

However, New South Wales and Victoria – which have stifled investment with bans and regulatory uncertainty – would rely on other states for gas supply, despite having their own untapped gas resources.

AEMO warns diesel-powered electricity looms without new gas supply

Concerns over the east coast gas market have deepened, with warnings gas generators may soon burn diesel at extra cost and emissions to plug energy shortages unless new gas supply is developed.

Weak demand shadows minor supply outages

Energy’s gas and LNG market update from senior analyst, Masanori Odaka:Spot prices in Asia remain under $10 per million British thermal units (MMBtu), well below those seen in the same period in 2022 and 2023, leading to revised optimization demand from buyers.In general, gas demand and consumption in the northern hemisphere is set to fall in the coming weeks as most countries enter the spring season.In Europe, April prices on the Netherlands-based Title Transfer Facility (TTF) fell 9.8% week-on-week to approximately $7.9 per MMBtu on 12 March.

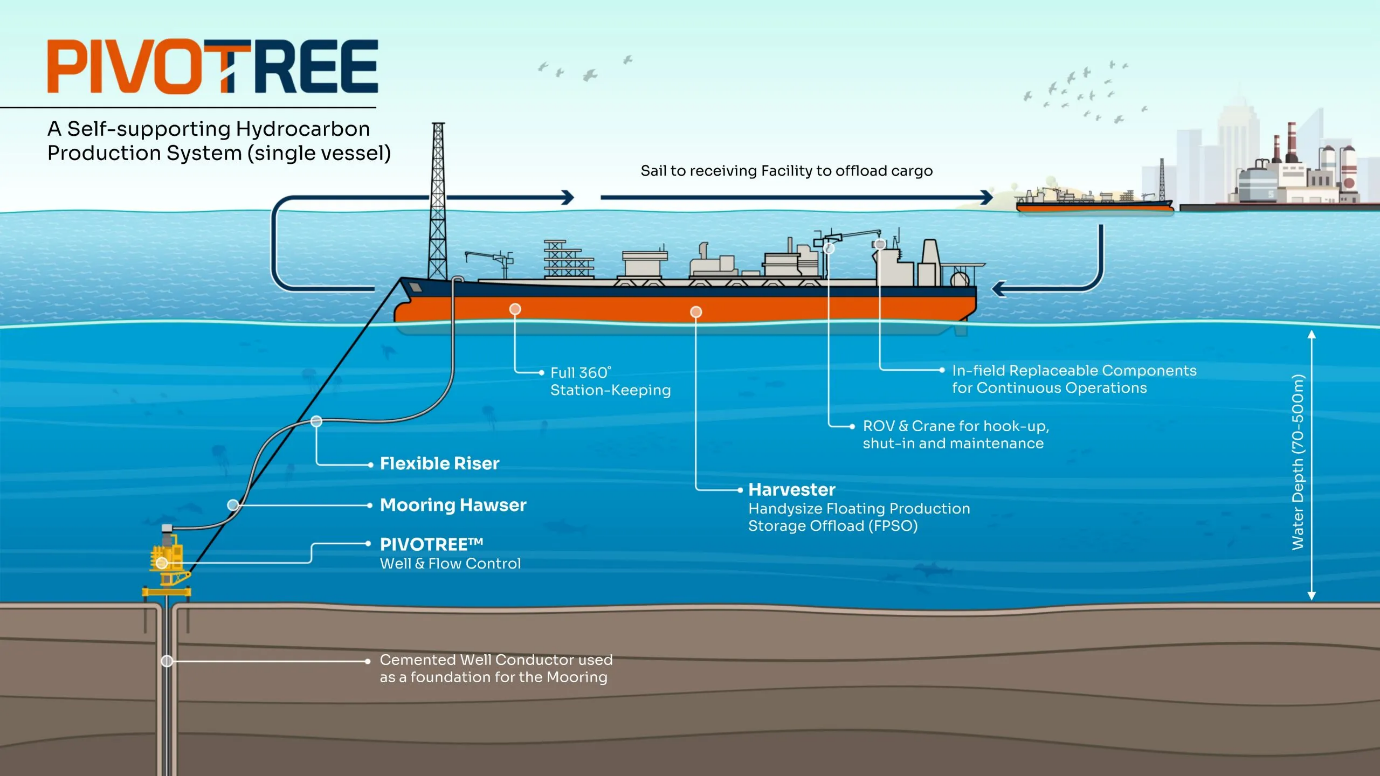

HARVESTER ENERGY AWARDED 2 NORTH SEA BLOCKS TO PROGRESS PATENTED SMALL-FIELD PRODUCTION SYSTEM

Harvester Energy (UK) Ltd, a wholly owned subsidiary of Harvester Energy Pty Ltd, has been awarded two blocks in the North Sea with confirmed oil reserves ideally suited to the company’s patented small-field development system.

Shearwater Awarded Seismic Survey for UK Carbon Capture and Storage Project

Shearwater has been awarded a contract for advancing Carbon Capture and Storage (CCS) capabilities in the United Kingdom by Spirit Energy.

The white gold rush and the pursuit of natural hydrogen

The buzz around natural hydrogen – dubbed white or gold hydrogen – is gaining global momentum as a potential gamechanger in the hunt for cost-effective, low-carbon energy sources. Rystad Energy research shows that at the end of last year, 40 companies were searching for natural hydrogen deposits, up from just 10 in 2020. Currently, exploratory efforts are underway in Australia, the US, Spain, France, Albania, Colombia, South Korea and Canada.

One of the most promising elements of white hydrogen is its cost advantage over other forms of hydrogen due to its natural occurrence.

CGG Aims to hit high notes with Hydrogen

CGG, which now calls itself “a global technology and Earth science leader”, has commenced a worldwide natural hydrogen screening project with industry support.