The Australian Gas Infrastructure Group (AGIG) has announced the successful commissioning of the Pluto Inlet Station – the new facility connecting the Pluto LNG Project to the Dampier to Bunbury Natural Gas Pipeline (DBNGP). The successful commissioning allows additional gas supply to reach Western Australian consumers. Woodside – which operates the Pluto LNG plant near Karratha in WA – engaged AGIG’s development group to undertake a Front End Engineering Design (FEED) study to convert an existing outlet meter station to an inlet facility, along with the required compression.

Latest News

APPEA says gas industry to play key role in hydrogen future

APPEA has welcomed the release of the Australian Labor Party’s National Hydrogen Plan. “There is tremendous interest in hydrogen as a new, cleaner fuel. Labor’s promise to direct $1 billion into funding of hydrogen research and commercial development would spur investment into this emerging technology,” said APPEA Chief Executive Malcolm Roberts. The Hydrogen Strategy Group, chaired by the Chief Scientist, Professor Alan Finkel AO, has highlighted the opportunity for Australia to export liquified hydrogen alongside liquefied natural gas (LNG) to meet the growing demand for cleaner energy across the Asia-Pacific.

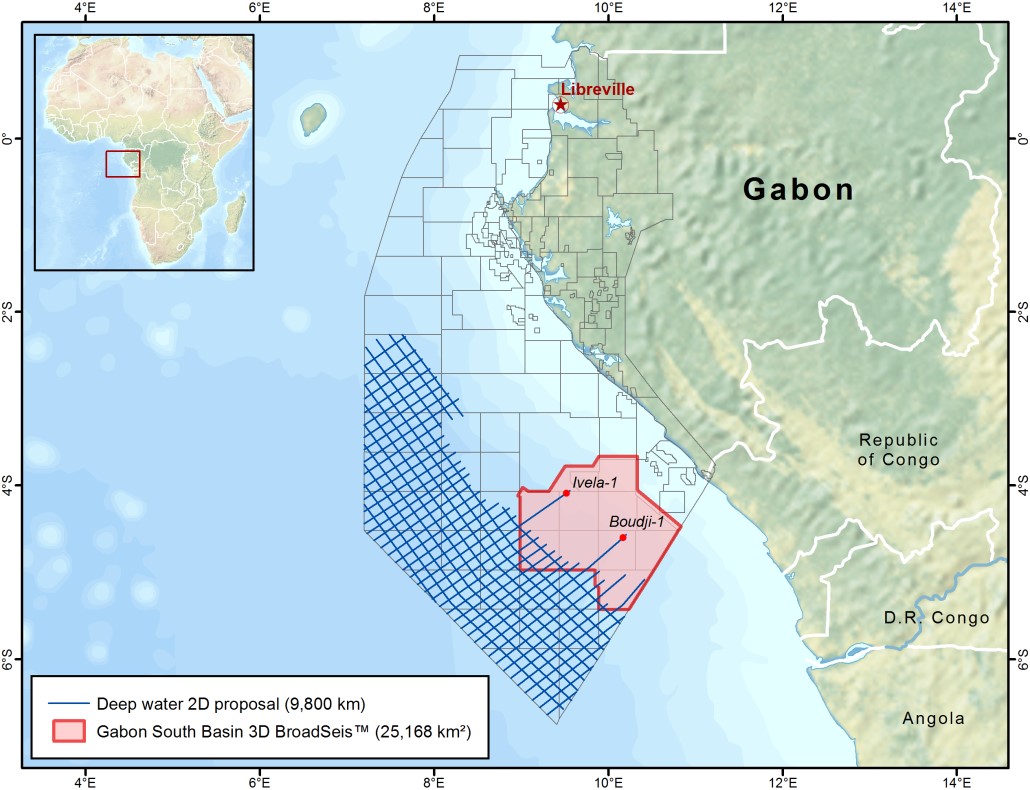

New CGG Survey Supports Gabon’s 12th Offshore Licensing Round

Building on the success of its 25,000 km2 3D BroadSeis™ survey, which led to the recent Boudji-1 and Ivela-1 oil discoveries, CGG is extending its Gabon multi-client data footprint with a 9,800-km long-offset 2D seismic survey in an unexplored deepwater area of the South Basin. A subset of the data over the offered license blocks will be available in advance of Gabon’s 12th offshore licensing round planned for June 2019. CGG said the new 2D data will help define the full extent of existing and new plays in the region.

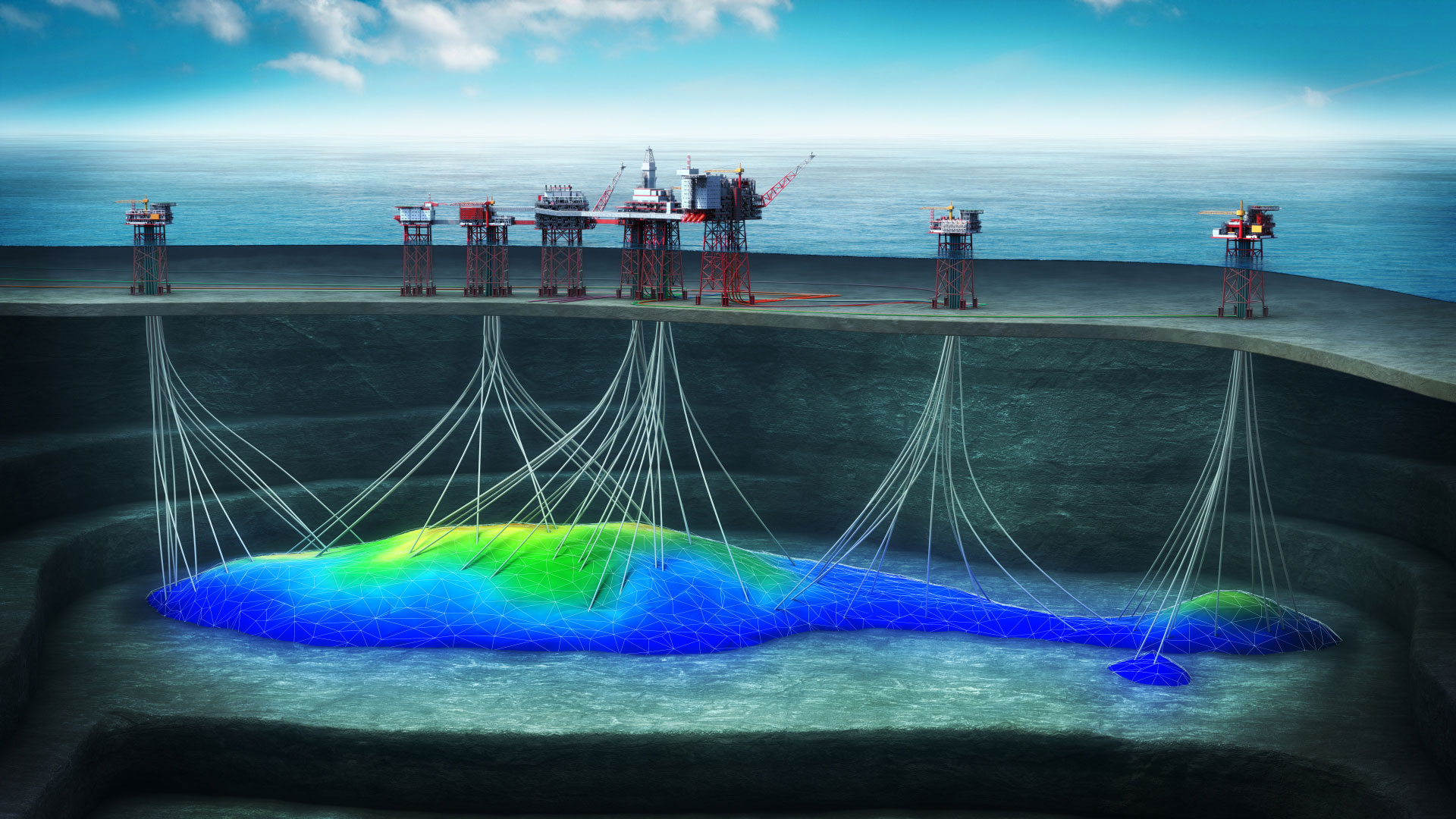

Woodside announces Scarborough contracts

Woodside has awarded four contracts for front-end engineering design activities for the proposed Scarborough project located offshore Australia. The Perth-headquartered company said the contracts were for engineering activities related to the upstream development’s floating production unit, the export trunkline, and the subsea umbilical risers and flowlines. Woodside said each contract includes an option to progress to execute phase activities, which is subject to, among other conditions, a positive final investment decision (FID) being taken on the project by the Scarborough Joint Venture.

China to account for 44% of Asia’s crude oil refining capacity in 2023

China will drive the majority of growth in the crude oil refining industry in Asia between 2018 and 2023, contributing 44% of Asia’s crude oil refining capacity within five years. That was the conclusion drawn by data and analytics company, GlobalData, in its company report entitled: 'China Crude Oil Refinery Outlook to 2023'. The report reveals that the total refining capacity of China in 2018 was 15,994 thousand barrels per day (mbd), which was 46% of Asia's total refining capacity in 2018. The country’s total refining capacity is forecast to increase at an average annual growth rate (AAGR) of 4.

Schlumberger revenue beats estimates ahead of upbeat forecast for 2019

Schlumberger has reported fourth quarter net earnings of US$538 billion, or 39c a share, compared to losses of US$2.2 billion, or $1.63 per share, in the corresponding period a year earlier. Schlumberger Chairman and CEO Paal Kibsgaard commented, “Full-year 2018 revenue of $32.8 billion increased 8% year-on-year and grew for the second successive year. Performance was driven by North America, where revenue of $12.0 billion increased 26% due to the results of our OneStim® business, which grew by 41%. Full-year international revenue of $20.4 billion was essentially flat compared with 2017.

Aker BP commits to $500m exploration spend in 2019

Norwegian E&P company Aker BP is upping the ante this year with a turbo-charged exploration program in 2019 aimed at tripling production by 2025. The company said from the launchpad of a strong performance in 2018, it now plans to cut production costs from US$12 to US$7 per barrel and to significantly increase dividend payments to shareholders. “Excellent execution and rapid change towards lower cost, lower emissions and improved efficiency are key ingredients to value creation in Aker BP.

Montara back on line after maintenance shutdown

Jadestone Energy has restarted production at the Montara oil field after a shutdown for maintenance and inspection dating back to November 2018. The independent oil and gas company announced that operations had restarted at the field, located offshore north-west Australia, on January 11 and that production volumes would be ramped up while final checks are concluded. The entire facility will be restarted, including both the oil production system and the gas system, which enables gas-lift and gas re-injection so as to optimise production operations as rapidly as possible.

Australian LNG hit new highs in 2018

Australian LNG exports reached 69.5 Mt in 2018, up 23.0% from 56.5 Mt in 2017, EnergyQuest has revealed in its latest LNG report. The energy advisory firm said the start-up of the Ichthys project during 2018 and continued good performance of Wheatstone, which started production from Train 2 during 2018, has made a major contribution to the growth in Australian exports. The long-awaited Prelude project also began production in late December with the first cargoes expected in early 2019. The report further revealed that: Notwithstanding media headlines about “record” Queensland LNG exports, east coast exports only grew by 0.3 Mt.

Norway anticipates accelerated oil and gas production

The Norwegian Petroleum Directorate’s has predicted that oil and gas production will recover from a slight dip in 2019 and increase in the period 2020 to 2023 as it approaches record production set in 2004. The NPD Director General, Bente Nyland, said: “The activity level on the Norwegian Shelf is high. Production forecasts for the next few years are promising and lay a foundation for substantial revenues, both for the companies and the Norwegian society. There is considerable interest in exploring for oil and gas.