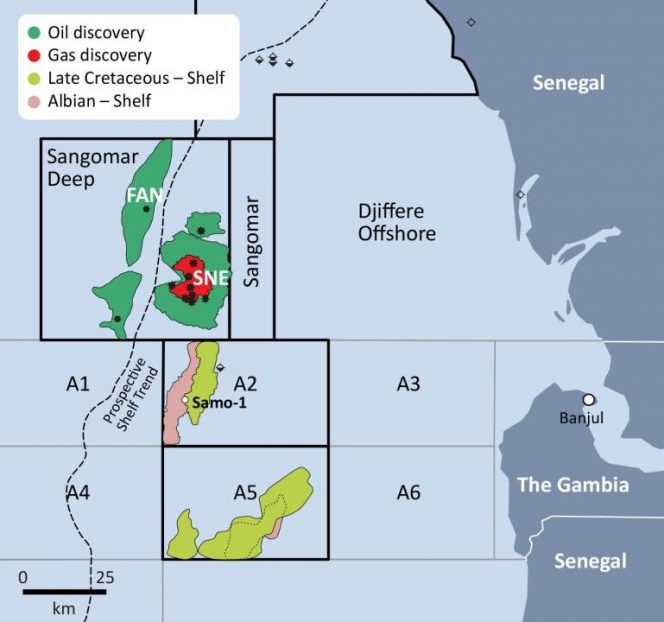

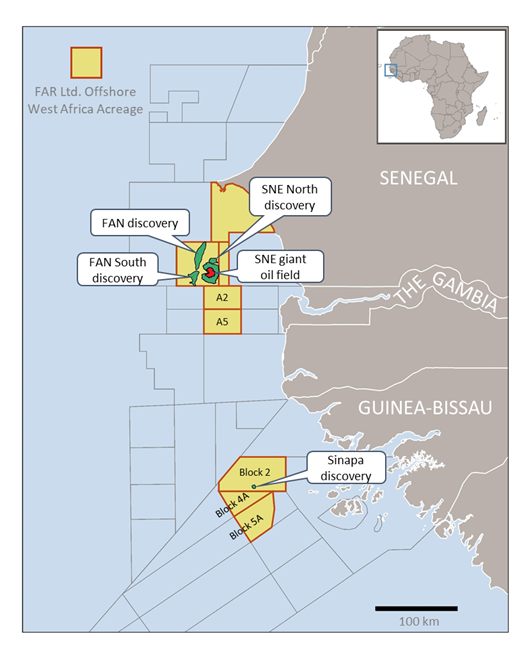

Lukoil has abandoned takeover plans for Australia’s FAR Limited and thus exited its ambitions to participate in the Woodside-operated Sangomar project offshore Senegal.

The Russian company had offered FAR 2.2c per share in February after it had failed to become a participant in the RSSD project via the acquisition of Cairn Energy’s stake in the discovery — which was scuppered by Woodside’s entry into the development.

FAR had sounded a note of caution over Lukoil’s proposal, which was not a legally binding offer and still subject to targeted and timely corporate due diligence by the Melbourne-based company.

The offer was also contingent on final Lukoil board approval, with no guaranteed that the proposal would have played out.

Subsequently, FAR announced that Lukoil had advised that its proposal would not be carried forward to a legally binding offer, having previously cautioned that there was no certainty that the proposal would necessarily eventuate.

Shareholder meeting

FAR has convened a shareholders meeting on 15 April 2021 to discuss and assess potential takeover offers.

It is expected that shareholders will be asked to approve the sale of FAR’s outstanding stake in Sangomar to Woodside, which has the support of FAR’s directors.

FAR said that it would update shareholders should a previous offer from Remus Horizons, or any alternative emerge and may reconsider their recommendation.

Remus Horizons made a conditional non-binding indicative proposal in December to engage in further discussions to evaluate its capacity, or to make an offer or announce an intention to make an offer to acquire 100 per cent of FAR’S shares for 2.1c cash per share.