Energy storage solutions provider Hydrostor, has announced a preferred equity financing commitment of US$250 million from the Private Equity and Sustainable Investing businesses within Goldman Sachs Asset Management.

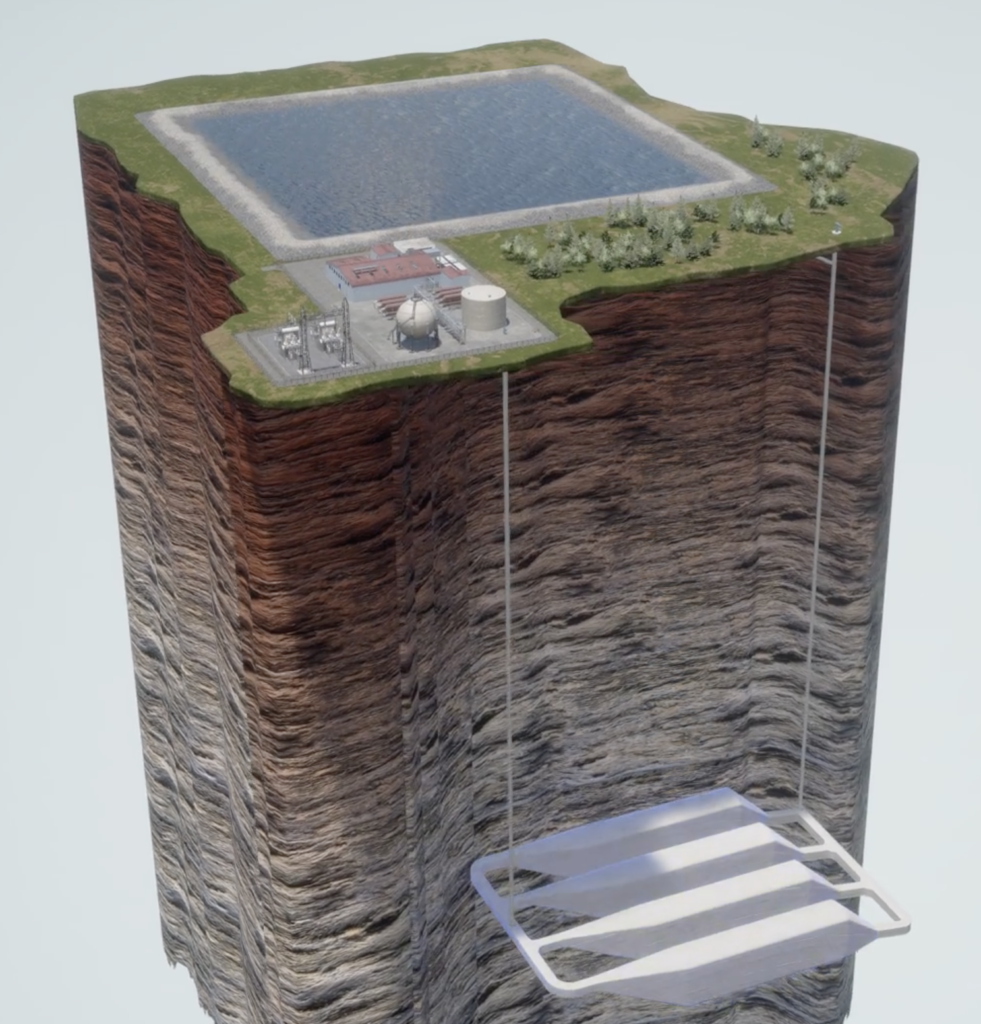

The investment proceeds will be used to support development and construction of Hydrostor’s 1.1GW, 8.7GWh of Advanced Compressed Air Energy Storage (A-CAES) projects in Australia and California that are well underway, and to expand Hydrostor’s project development pipeline globally.

Goldman Sachs will fund its investment in tranches tied to project milestones to match Hydrostor’s capital needs and accelerate project execution throughout development, construction, and operations alongside Hydrostor’s development partners. The financing will also support Hydrostor’s global development and marketing initiatives, including expansion of its project pipeline and capabilities in markets with significant near-term demand for flexibly sited long-duration energy storage.

Curtis VanWalleghem, Chief Executive Officer of Hydrostor, said: “We are delighted with this investment by Goldman Sachs. It is transformational for Hydrostor and validates the competitiveness of our proprietary A-CAES solution as well as the strength of our pipeline of potential projects.”

Charlie Gailliot, Partner and Head of Energy Transition Private Equity Investing within Goldman Sachs Asset Management, said: “As the world continues transitioning to sustainable and renewable energy sources, the need for utility-scale long-duration energy storage is clear, and Hydrostor’s A-CAES solution is well positioned to become a leading player in this emerging global market. We look forward to working with the Hydrostor team over the coming years and leveraging our firm’s global platform to support Hydrostor’s growth, which will play a central role in the ongoing energy transition.”

Curtis VanWalleghem added: “I would like to thank our existing investors, including ArcTern Ventures, Lorem Partners, Canoe Financial, and Business Development Bank of Canada, all of whom will remain our partners. Hydrostor’s evolution has been made possible by their support and support from various agencies of the Government of Canada. I would also like to thank outgoing directors Elisabeth Hivon and Tom Rand for their service and welcome Charlie Gailliot, Sebastien Gagnon, and Gunduz Shirin from Goldman Sachs to our board.”

Hydrostor describes itself as a company that supports the green economic transition, employing the people, suppliers and technologies from the traditional energy sector to design, build and operate emissions free-energy storage facilities. The company claims that its A-CAES technology can provide long-duration energy using proven components from mining and gas operations to create a scalable energy storage system that is low-impact, cost-effective, and can store energy from five hours and up to multi-day storage where it is needed.

Hydrostor has projects worldwide in various development stages for providing capacity of over 200 MW each.