Iran’s launch of over 300 drones and missiles on Israel in the first ever direct attack on the Israeli soil from Iranian territory has increased geopoliticsl risk in the oil market, according to Rystad Energy’s oil market update in reaction to the accelerating conflict.

Rystad Energy Senior Vice President Jorge Leon said that although the vast majority of drones and missiles were intercepted, no Israeli fatalities were reported and only minor damage at an Israeli military base was inflicted, the hostilities markedd an unprecedented and dangerous development in an already volatile region.

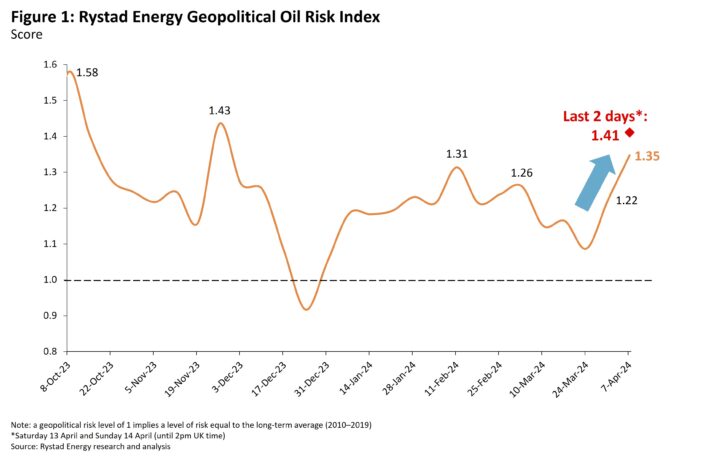

“As mentioned in our recent commentary, the likely Iranian retaliation increased the geopolitical risk in the oil market.Rystad Energy’s Geopolitical Risk Index increased to 1.22 during the first week of April,” Leon said.

“Following the Iranian attack our weekly Geopolitical Risk Index increased to 1.35 during the second week of April (7 April to 13 April), the highest level since the start of the year.

“Moreover, when focusing only on the last two days (13 April and 14 April—until 2pm UK time), the Geopolitical Risk Index jumped even further, to 1.41.

“As an Iranian retaliation became imminent in the run-up to Saturday, April 13,oil prices started to increase.

“Brent spot rose to $92 per barrel while front-month futures closed at $90.5 a barrel on Friday.”

Rystad Energy’s calculated ‘fair value’ of Brent for the month of April based purely on supply and demand fundamentals, is around $84 per barrel.

“That means the 10% increase we saw last week can almost entirely be attributed to the ongoing conflict.”

“The big question now is where do we go from here?

“Is this the start of a direct war between Israel and Iran and its allies, or was Iran’s attack a calibrated and well-telegraphed retaliation?

“The implications for the oil markets would be very significant.

“A possible interpretation of recent events suggests Iran’s actions were a “measured retaliation.”

Invoking Article 51 of the UN Charter, Iran argued that its attack was a legitimate act of self-defense in response to an attack on its consulate in Damascus, said to be by Israel, but Israel does not usually claim responsibility for such actions.

“The Permanent Mission of the Islamic Republic of Iran to the UN declared that “the matter can be deemed concluded,” indicating no further plans for aggression but maintaining readiness to respond to any Israeli counterattacks.

“This situation mirrors the events of 8 January 2020, when Iran launched missiles at two Iraqi military bases hosting US troops in retaliation for the US drone strike earlier that month that killed Qasem Soleimani, a major general in the IRGC.

“That Iranian retaliation was notable for being a direct and open attack on US military bases, though it resulted in no US fatalities.

“Despite initial fears of further escalation, tensions subsided in the weeks following.

Although the scales of the two incidents differ, a similar parallel might be drawn regarding yesterday’s attacks.

“The symbolic nature of the recent attacks is unprecedented, yet they resulted in no major damage, allowing both sides to claim a measure of victory.

“The Iranian government praised the attack on Israel as achieving a “level of success that exceeded expectations” and described it as the “biggest drone attack in the world.”

“Meanwhile, Israel boasted of a 99% interception rate that averted much of the potential damage, possibly helping to avoid further escalation.

“The response from Israeli forces remains uncertain as Israel’s war cabinet convenes to determine its next steps.

“In this context, multiple scenarios are being considered.

The most favourable outcome would be the de-escalation of tensions, with the US playing a crucial role.

“White House National Security Council Advisor John Kirby has expressed that he sees no reason to escalate tensions further.

“President Joe Biden is also actively engaging in diplomatic efforts with the G7 to reduce tensions.

Still, it is unlikely that geopolitical risk premium will drop to levels prevailing before 1 April anytime soon.

It is expected to stabilize or gradually decrease, as the markets had already partially priced in an Iranian response, anticipating it before the weekend.

In a worst-case scenario, a forceful retaliation by Israel could trigger a spiral of escalation, potentially leading to an unprecedented regional conflict.

Under such circumstances, geopolitical premiums would increase significantly.

Moreover, a new round of US sanctions on Iran and stricter enforcement could further impact market prices, adding to the economic pressures already at play.

“Another significant unknown is how OPEC+ would react in this scenario.

Increasing geopolitical tension has undoubtedly complicated the job of OPEC+ to carefully manage the oil market.

“Currently, the group has extended its voluntary production cuts until the end of the June.

“The group will most likely decide whether to unwind those cuts at the 2 June Ministerial Meeting.

Still, if the geopolitical situation in the region escalates further, the group could hold an extraordinary meeting in the coming weeks.

“With almost 6 million bpd of spare capacity, the group could easily increase production to limit upside price pressure if the conflict escalates.

“But would they?

“We believe they would for three reasons:

1) sustained higher oil prices would fuel inflation again in the West and prompt central banks to postpone any monetary normalization efforts, leading to weaker global economic growth;

2) today’s world is very different from that of 1973 when an oil embargo was imposed. Geopolitical alliances are different now and OPEC would not want to repeat mistakes that prompted a global energy crisis with long-lasting implications;

3) OPEC has always emphasized, and proved, that the organization is not a political entity and that its role is solely to coordinate and unify the petroleum policies of its member countries.

“It is also relevant to highlight the Gulf states’ interest in regional de-escalation has multiple motivations.

The mainland China-led agreement in March 2023 to restore Saudi Arabia–Iran relations and the US-led Abraham Accords to restore diplomatic ties between Israel and the UAE and Bahrain, signed in September 2020, play an important role.

“But also, after years of fighting an expensive war with the Houthi militia, the Saudi–Emirati coalition failed to secure victory or counter Iran’s influence.”