The first comprehensive review of long-term jobless data amongst Australia’s geoscientists against mineral commodity price movements over the same period has revealed a startling direct link between the two trends.

The first comprehensive review of long-term jobless data amongst Australia’s geoscientists against mineral commodity price movements over the same period has revealed a startling direct link between the two trends.

As commodity prices dip, job prospects for geoscientists plummet – with little or no lag time between one outcome following the other.

The results confirm what the profession’s lobby group, the Australian Institute of Geoscientists, has suspected for some time – employment prospects for their membership are highly leveraged to prevailing minerals commodity prices.

The findings follow the first comprehensive assessment of eight years of jobless data sought and recorded by the Institute through the highs and lows of the resources boom and bust against the Reserve Bank of Australia’s monthly index of commodity prices relative to their importance to the Australian economy.

The groundbreaking research was undertaken by AIG member and Perth-based professional researcher, Mr Jonathan Bell of Alexander Research.

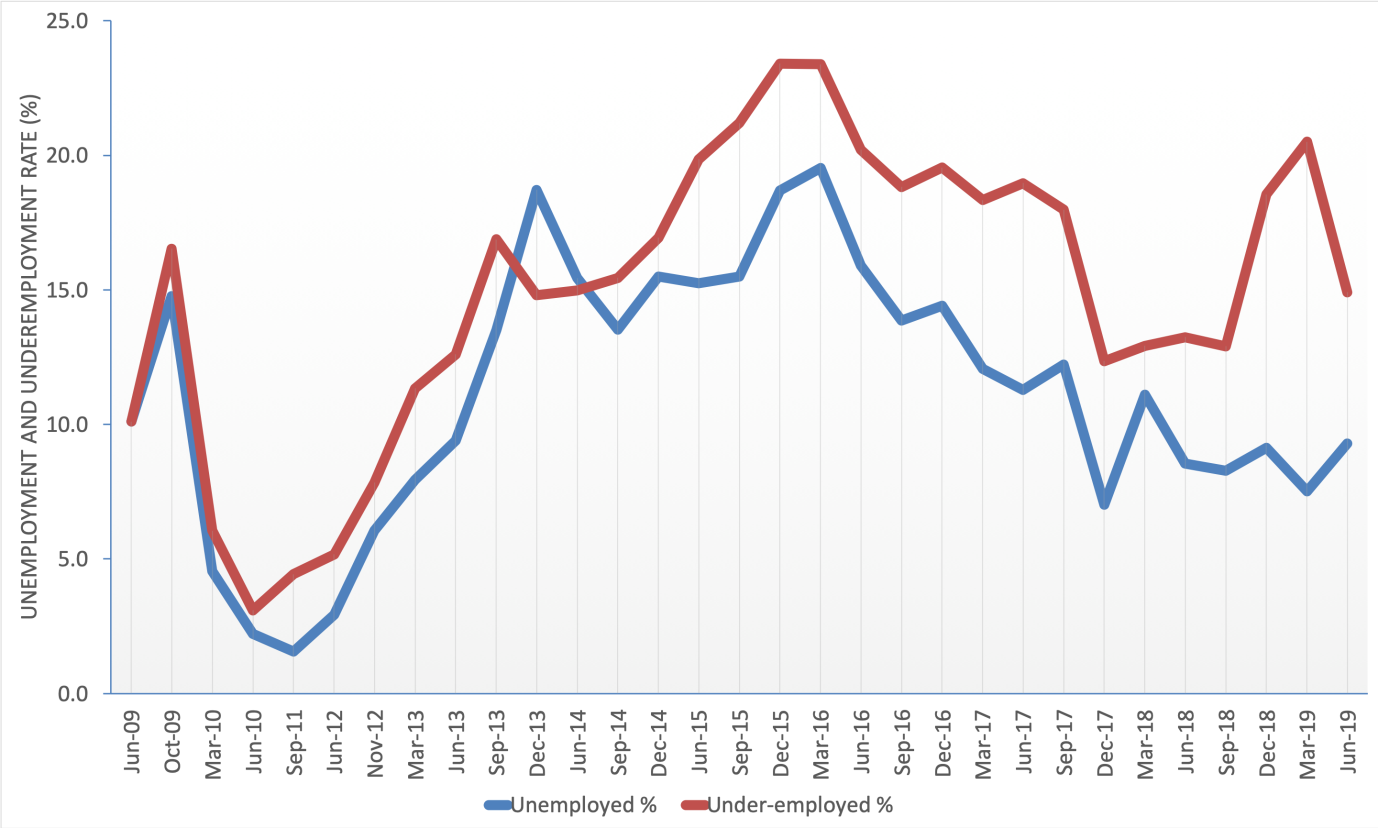

The AIG has been surveying its member’s employment levels since the start of 2009.

It is currently the longest, continuous professional employment survey of its kind.

With eight years of data, the AIG and Mr Bell concluded the depth of the data base was now sufficient to gain genuine trend insights into just how or if geoscientist employment is leveraged to fluctuations in prices for Australia’s plethora of mineral commodities.

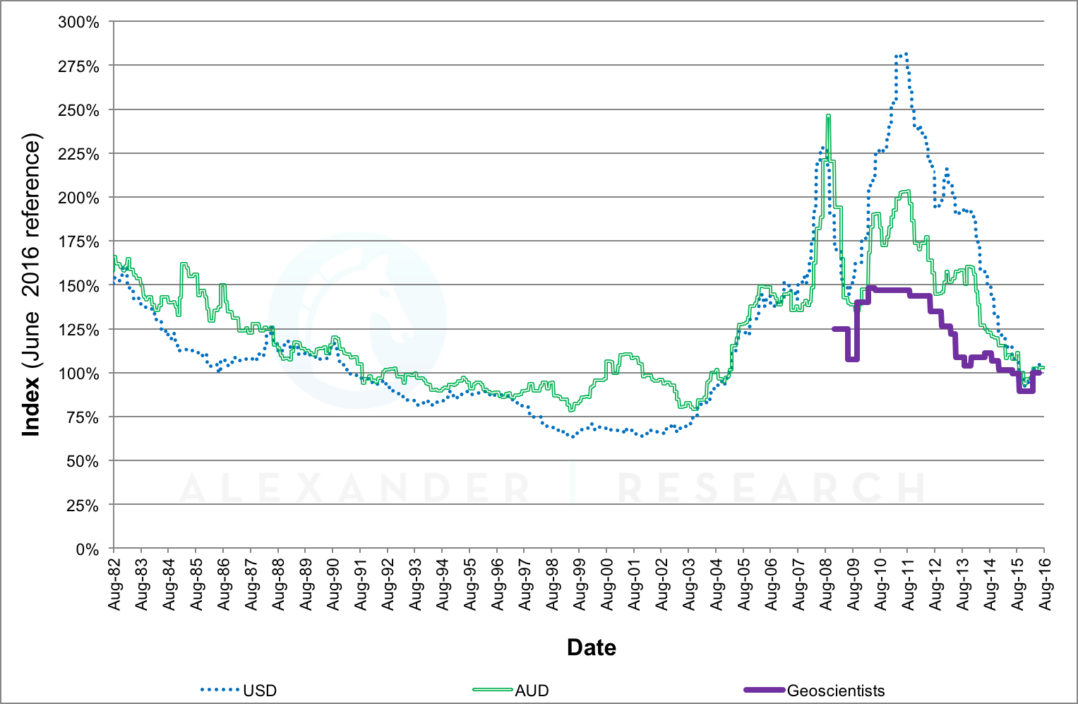

The AIG and Mr Bell said that by rebasing the data to the conditions as at 30 June 2016 (see figure 2), it is evident the amplitude of the geoscientist employment is muted compared to the commodity price variation.

However, the current geoscientist unemployment rate of 15.9% is very high relative to Australia’s overall unemployment rate of 5.7%, before taking into account the additional 20.2% underemployed geoscientists.

The data suggests that employers react very quickly to changes in the commodity price, and there emerged no strong evidence during the review to suggest that there is a lag effect between movements in the commodity price and full time employment.

The June 2016 quarter AIG jobs survey showed for the first time in years, a very small improvement in geoscientist employment levels. The RBA commodity price index also showed a small improvement over that quarter, highlighting the speed at which employment changes relative to the prevailing commodity prices.

Since the end of June 2016, Australia’s commodity prices have continued to increase by 6% in USD and 3% in AUD terms.

The AIG and Mr Bell said that in the current domestic and global equities market environment for mineral commodities, the ability to increasingly quantify and analyse employment levels is important to managing the future needs of the geoscience sector.

Consequently, the long standing nature of the AIG’s survey was critical to those outcomes.