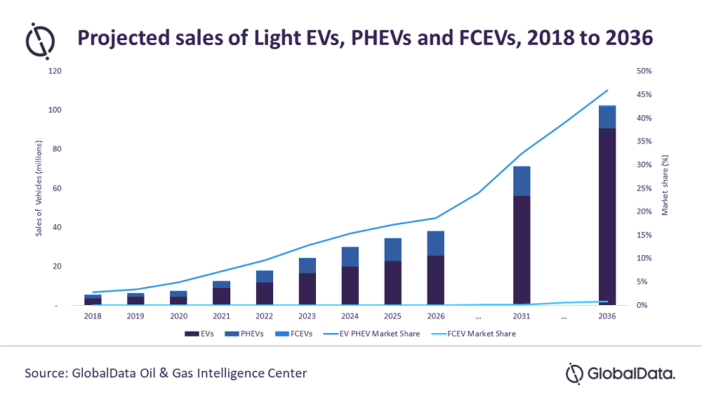

Electric vehicle (EV) sales have reached record numbers in recent years, with annual sales projected to increase ten-fold in the next 15 years, especially in China and Europe, due to favourable policies and auto manufacturer commitments.

That’s according to data and analytics company GlobalData, who said that 18 countries had set goals to end sales of gasoline and diesel passenger vehicles, nearly half of which are for 2030. China’s target is that 25% of all vehicle sales be electric by 2025, India’s is for 30% of passenger vehicles by 2030 and the US aims for 50% of all vehicle sales by 2030.

GlobalData’s latest report, ‘Oil and Gas Sector Strategies for Electric Vehicles (EV)’, reveals that electric mobility is one of the many ways oil and gas companies are diversifying their business to adapt to the energy transition that is already in motion. Companies including Shell, TotalEnergies, and Mitsui are developing EV charging, battery manufacturing, and other EV value chain capabilities through acquisitions and partnerships.

Miles Weinstein, Energy Transition Analyst at GlobalData, comments: “Taking another tactic, ExxonMobil has so far ignored charging infrastructure in favour of providing solutions to improve EV performance, such as EV battery thermal management. The company is also developing fluids, lubricants, and cooling solutions specifically for EV motors.

“This is a less risky foray into the EV market than building physical infrastructure and overlaps with the company’s current petroleum-based fluids production. On the other hand, Woodside has elected to avoid battery EVs altogether in favour of fuel cell electric vehicle (FCEV) infrastructure and the production of low-carbon hydrogen, which is a reflection of the overall lack of battery EV uptake in Australia to date.

“Despite their differences from other oil and gas companies’ strategies, they serve a similar purpose of diversifying oil and gas businesses into new markets in preparation for a decline in petroleum product sales for the transport sector.”

FCEVs have not seen large penetration into the passenger vehicle market due to higher capital and fuel costs. While the economics are expected to improve, especially in light of rising gas prices, GlobalData expects FCEVs to become more practical in the medium- to heavy-duty segment due to their longer range and quick refuelling time, while finding a smaller niche in the passenger segment.

Sales of light EVs, specifically passenger and non-commercial vehicles, are already outpacing those of plug-in hybrid electric vehicles (PHEVs), with the gap set to widen in the coming years. EVs saw their market share nearly double in 2021 compared to 2020. China and Europe are expected to see the most EV sales, while North America is expected to have about 60% as many sales as either region. South Korea will also have a notable number of sales, but the rest of the world will see significantly less. Where FCEVs are concerned, Europe is expected to see the most sales with China at a close second. South Korea and Japan will be additional important markets, with the North American market a fraction of the size.

Several auto manufacturers have set targets for EV sales and allocated funding toward electrification. Among the most ambitious are Daimler and Volvo’s targets for 50% of sales to be fully electric by 2025, while Renault Group’s target is 100% of European sales for EVs by 2030. Volkswagen Group plans to invest €35 billion (US$37 billion) in all-electric mobility through 2024.

Weinstein explains: “Almost all of the national targets set thus far exclude medium- and heavy-duty vehicles, suggesting that these segments could largely continue using conventional fuels beyond the 2030s. Demand for petroleum products has seen a rebound after 2020, but demand is not expected to return to 2019 levels until 2026, in part due to the increase in demand for EVs. Contributing factors to the EV push include issues like urban air quality and the diesel emissions scandal.”