CGG GeoSoftware has donated its Jason and HampsonRussell seismic reservoir characterization software suites to Delft University of Technology (TU Delft) in the Netherlands. The donation of a full HampsonRussell suite and the renewal of an enhanced Jason package will enable students at the Department of Geoscience & Engineering to expand their theoretical and practical knowledge of quantitative reservoir characterization and inversion techniques.

Company Updates

Bass Oil lifts daily oil output by 20% in South Sumatra

In a market update Melbourne-based Bass Oil said it had made significant improvements to its oil producing Tangai-Sukananti KSO, in Indonesia’s prolific South Sumatra Basin. This had lifted the company’s 2018 daily field output from 550 barrels of oil per day (bopd) earlier this year, to a current 650 bopd, “with further gains of between 150 to 250 bopd expected over coming weeks”. “The significant production uplift is a direct result of the successful completion of field optimisation work pursued by Bass over the past six months.

Bank of China & Goldman Sachs selected to drive Alaska LNG project

The Alaska Gasline Development Corporation (AGDC) has engaged the Bank of China and Goldman Sachs to serve as global capital coordinators to AGDC’s Alaska LNG project. This follows the Bank of China along with Sinopec and CIC Capital signing a joint development agreement with AGDC in November to collaborate on the advancement of Alaska LNG. The signing of the agreement was witnessed by U.S. President Donald J. Trump and China President Xi Jinping. Bank of China and Goldman Sachs will assist AGDC with raising equity and debt financing for the continued development of Alaska LNG.

Trelleborg Announces New Rotary Seal for High Pressure Oil & Gas Applications

Trelleborg Sealing Solutions has announced the launch of the new polytetrafluoroethylene (PTFE) based O-Ring energized single-acting rotary seal, Turcon® Roto Glyd Ring® DXL, specifically designed to meet the demands of high pressure rotary applications within the oil and gas industry. The Fort Wayny, Indiana-based company said the “innovative design” of the Turcon® Roto Glyd Ring® DXL “provides improved dynamic sealing efficiency and reduced friction by balancing the contact force on the dynamic lip under all service conditions, allowing for superior extrusion resistance and low torque.

Sercel Delivers Land Acquisition System and Neo Vibrators to Algeoland

Sercel has announced the delivery of a 25,000-channel 508XT land seismic acquisition system and 15 Nomad 65 Neo broadband vibrators to Algeoland, Algeria’s leading private geophysical company. Algeoland will deploy the Sercel equipment to conduct a major 3D seismic survey over a 2,000-km² area of the Rhourde-Nouss desert region in north east Algeria, on behalf of the national oil company. Sercel said the 508XT system drives productivity, data quality and adaptability to an unprecedented level thanks to its X-Tech architecture.

Largest lease sale in history attracts a luke warm response

Seventy-seven million acres were up for grabs in the US Gulf of Mexico, however bids were only made for 815,403 acres. The largest lease sale in history generated $124,763,581 in high bids for 148 tracts covering 815,403 acres, with 33 companies participating in the lease sale submitting $139,122,383 in bids. Lease Sale 250 included 14,474 unleased blocks, located from three to 231 miles offshore in water depths ranging from three to 3,400 meters. BP, with 27 bids, submitted the largest number of high bids $20 million.

$9.1bn will be spent on Mozambique’s upstream capex by 2020, says GlobalData

An average capex of US$3 billion per year would be spent on eight oil and gas fields in Mozambique between 2018 and 2020. Capital expenditure into Mozambique’s oil and gas projects, will add up to $9.1bn over the three-year period in upstream capital expenditure by 2020, according to data and analytics company GlobalData. Ultra-deepwater projects will be responsible for over 65 percent of $9.1bn of upstream capital expenditure in Mozambique, or $6.2bn by 2020. The deepwater projects will account for 25 percent of upstream capital expenditure with $2.3bn by 2020, while onshore projects will necessitate $0.

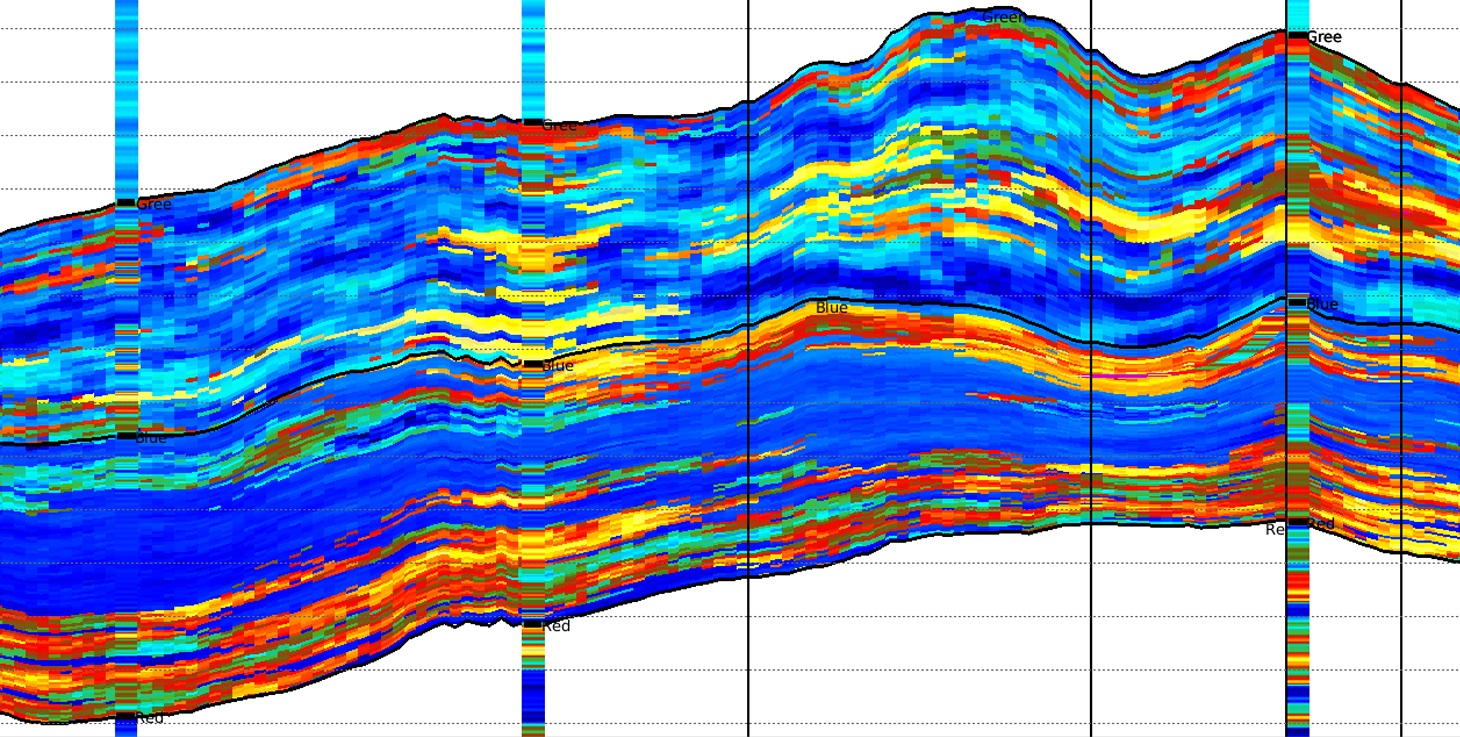

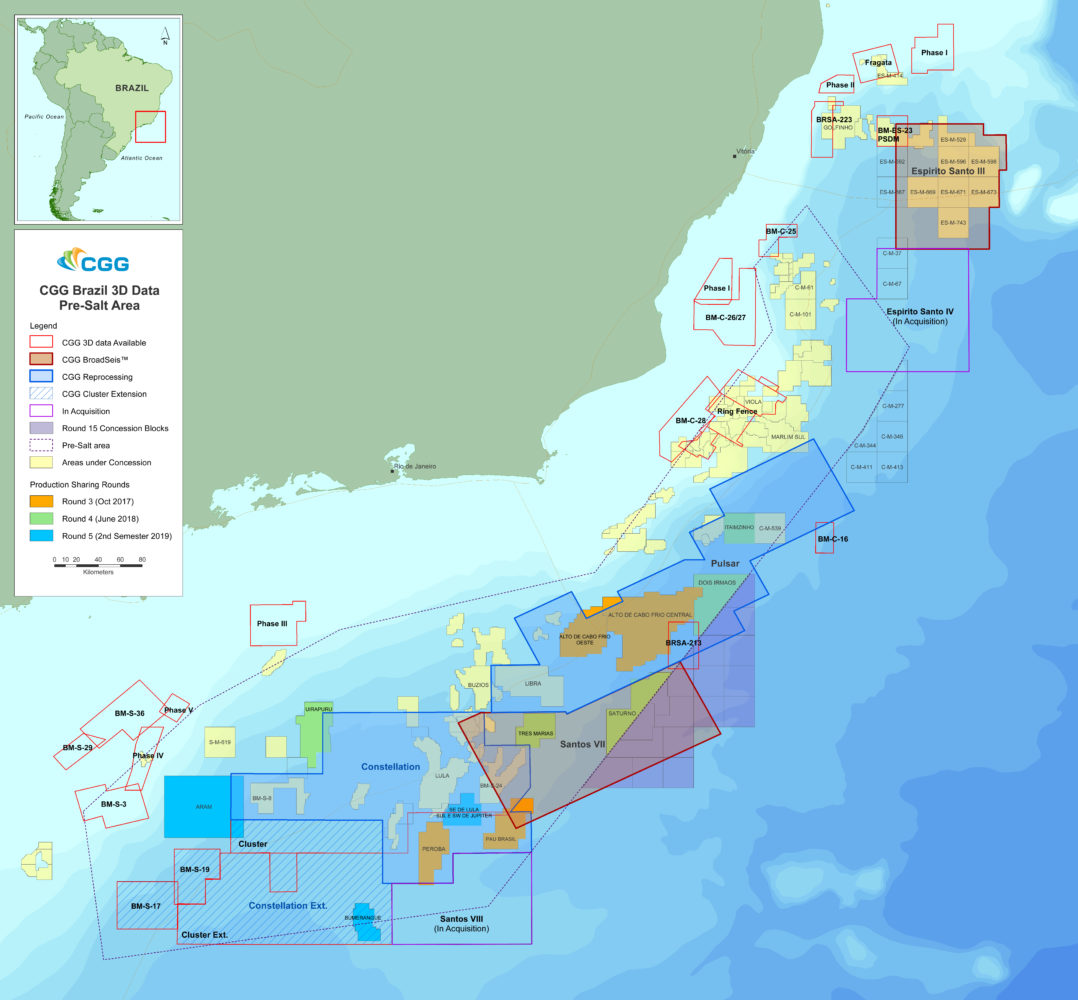

CGG adds new Santos VIII multic-client survey to broadband coverage offshore Brazil

CGG has commenced acquisition of a large broadband 3D multi-client survey in the pre-salt area of the deepwater Santos Basin. The geoscience company said Santos VIII is the most recent survey in CGG’s vast on-going pre-salt program that delivers “ultramodern seismic data, enabling exploration companies to better evaluate pre-salt opportunities in advance of Brazil’s pre-salt licensing rounds”. Santos VIII covers an area of over 8,000 km2 adjacent to the Peroba, Pau Brasil and Boumerangue fields.

Transocean rig heading for Phoenix South well

The Transocean-owned semi-submersible drilling rig GSF Development Driller-1 has started the final leg of its journey from Port Louis (Mauritius) to Australia for the task of drilling the Phoenix South-3 well for Quadrant Energy. Quadrant is the operator of the Phoenix project off Western Australia with an 80% interest with Carnarvon Petroleum holding the remaining 20%. Carnarvon said in a market update that slower than anticipated towing speeds had delayed the rig’s arrival, which was now scheduled for late March for drilling in early April.

CGG appoints three new board members

Following a board meeting on March 8, CGG has appointed three new board members. The company announced that Colette Lewiner will replace Hilde Myrberg, who will step down following a meeting to approve the financial statements for the fiscal year ending 31 December 2018. Lewiner graduated from Ecole Normale Supérieure and has a PhD in Physics. She is a nuclear energy specialist and worked for many years in the consultancy business in energy, utilities and chemicals. She is presently independent board director at EDF, Groupe Bouygues, GETLINK (former Eurotunnel), EDF, Nexans and Ingénico. Mario Ruscev replaces Dr.