Beach Energy has released its FY21 Full Year results as well as FY22 guidance, announcing an underlying Net Profit After Tax of $363 million.

Beach retained a strong balance sheet with net debt of $48 million, net gearing of 1.5% and liquidity of $402 million at year end. Despite the recent downgrade to Western Flank production and reserves, the Board has maintained its 1 cent per share dividend for shareholders.

The Company’s underlying EBITDA of $953 million was towards the mid-point of original FY21 EBITDA guidance of $900 – 1,000 million provided in August 2020. This was supported by two favourable arbitration outcomes over a contract dispute relating to a Kupe GSA and the Otway Lattice gas price review.

Step on the gas

Managing Director, Matt Kay, said that while FY21 was a challenging year for Beach on the Western Flank, the Company remains in a strong position as it delivers on its gas growth projects, primarily in the Perth and Victorian Otway Basins.

“Beach had two exploration successes in the Victorian Otway, we delivered two value accretive bolt-on acquisitions to grow existing production hubs, and we reached FID on the Waitsia Gas Project Stage 2, bringing Beach closer to supplying gas into the global LNG market for the first time.

“In our 60-year history, there has never been a bigger project than our Otway Offshore campaign. This saw the successful drilling of Geographe 4 and Xmas trees placed on top-hole locations at Geographe 4 and 5.

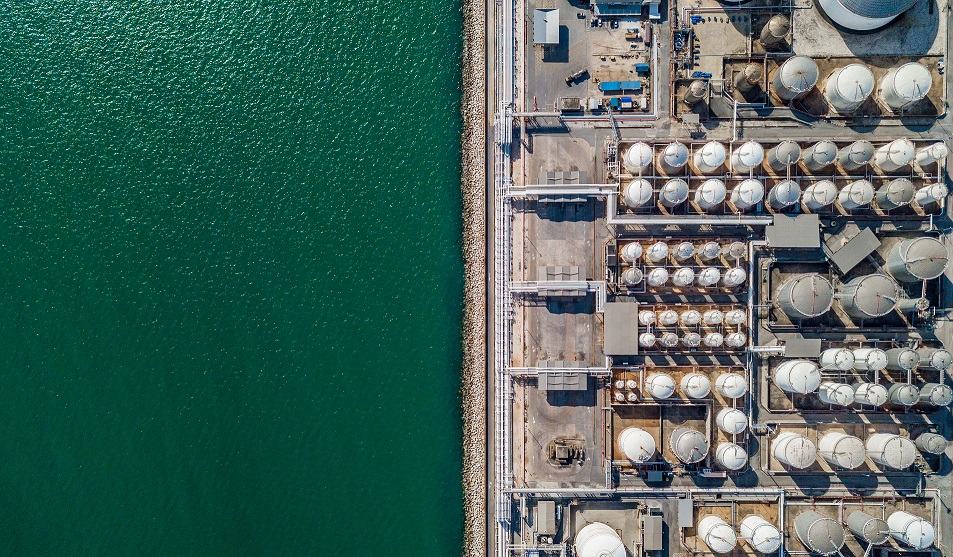

“We also doubled the production deliverability at our Perth Basin facilities, and we are in the final stages of commissioning at the Kupe compression project, extending the life of this important asset in New Zealand.

Commenting on FY22 guidance, Mr Kay said that Beach expects production to be further impacted by the declining Western Flank fields, ahead of the ramp up of production in the Perth Basin and Victorian Otway Basin development projects.

“The Offshore Otway campaign will progress throughout the year with first gas from the new Geographe development wells on track for mid-FY22 and all six development wells expected to be drilled by the end of FY22, pending stable weather conditions.

“These wells, once connected to the Otway Gas Plant, will help to supply the constrained East Coast gas market, which is facing supply shortfalls in the coming years.

“We are also excited to see construction commence at the Waitsia 250 TJ/day gas processing facility.

“FY21 was also Beach’s safest year on record, and we have chalked up 3 million hours without a Lost Time Injury – that alone, is a reason to be very proud of the efforts of the Beach team.

“On the sustainability front, Beach commenced FEED studies on the Santos-operated Moomba CCS project in the Cooper Basin, where we have a 33% interest. The project plans to leverage existing Cooper Basin JV infrastructure and sequester up to 1.7 million tonnes of CO2 per annum. It is supported by the Federal Government and was recently granted $15 million of funding from the Carbon Capture Use and Storage Development Fund.

“Beach also announces an aspiration of reaching net zero Scope 1 and 2 operated emissions by 2050 and made progress on our 25 by 25 emissions targets, delivering five key emission reduction initiatives. At the end of FY21 our estimated emissions were 12 per cent lower than they were in FY18.