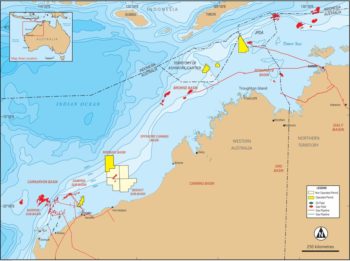

Quadrant Energy has applied to NOPSEMA to conduct a seismic survey in the Bedout sub-basin offshore Australia. Quadrant Energy, which was recently acquired by Santos, is eager to acquire additional subsurface data for further appraisal of identified hydrocarbons in several reservoirs within the Bedout sub-basin. NOPSEMA said the proposed Keraudren seismic survey would be conducted approximately 118km off Port Hedland in water depths of 50m to 150m. The survey is in permits WA-435-P, WA-436-P, WA-437-P and WA-438-P and covers a total area of 5,539 km2, including vessel ramp up zones.

Dale

Polarcus and PGS set for court stoush over patent claim

Polarcus has accepted service of court proceedings filed by PGS Australia Pty Ltd relating to the acquisition of seismic data on three surveys in Australia and the processing of that data. Polarcus said proceedings had followed three years of intermittent correspondence from PGS “in response to which Polarcus, supported by leading patent counsel, provided overwhelming evidence that Polarcus’ activity did not intersect PGS’ patent. “The claim will be vigorously contested and has no impact on any project outside Australia,” Polarcus added.

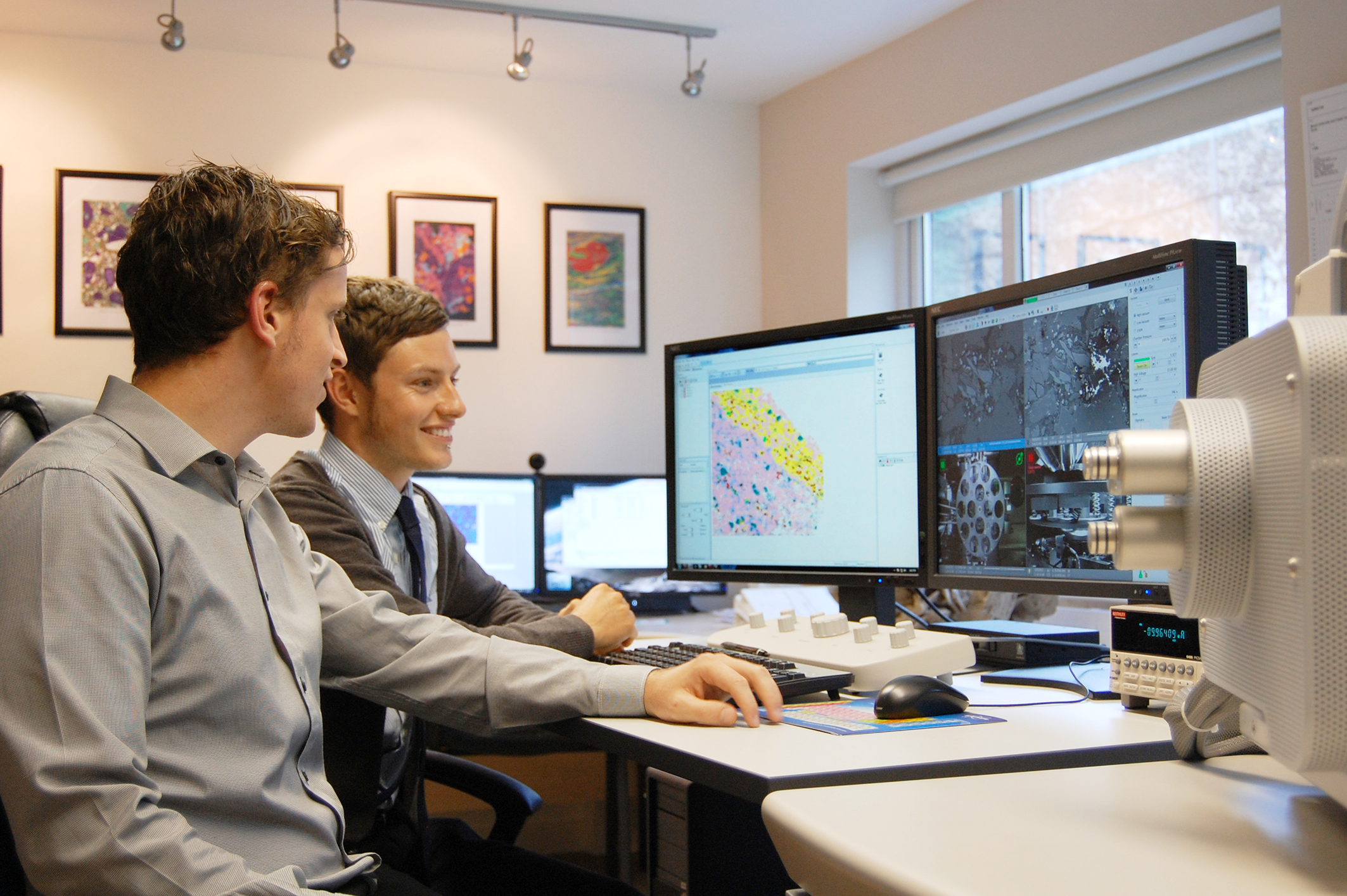

CGG and OMV continue cooperation with Multi-Year extension of dedicated Centre

CGG has announced that its contract with OMV to operate a dedicated centre at its head office in Vienna has been renewed and will run for a further three years. During this period OMV will continue to benefit from onsite access to CGG’s subsurface imaging and reservoir characterization expertise and technology. The support given by the centre to image and interpret OMV’s geophysical data and the collaborative spirit in which the teams work together will help to provide greater insight into OMV’s worldwide acreage, CGG said.

Shell exits upstream operations in Ireland

Shell has exited the upstream sector in Ireland with the sale of its interest in the Corrib gas project to Nephin Energy for US$1.3 billion. The Corrib natural gas field is located approximately 83km off the northwest coast of Ireland, 3,000 meters under the seabed and in water depths of 350 meters. Initial field development started on December 30, 2015 comprising six subsea wells. Gas is transported via an 83 km pipeline to an onshore gas processing terminal and then exported via the Bord Gais Eireann link line to the Irish gas grid.

‘US to top new-build capex spend in oil and gas to 2025’

A total capital expenditure (capex) of $3.6tn is expected to be spent globally across oil and gas value chain on planned and announced projects during 2018 to 2025, according todata and analytics company GlobalData. In its latest report GlobalData said that, globally, the US, Russia, and Canada are the top countries in terms of new-build capex to be spent on planned and announced projects across the oil and gas value chain by 2025. The US tops the list with capex of US$521.4bn expected to be spent on 484 oil and gas projects. Russia and Canada follow with US$317.

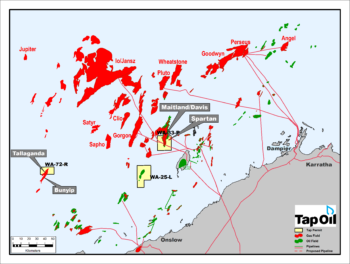

Tap sells Carnarvon basin offshore licence to Santos

Tap Oil has entered into a sale and purchase agreement for the sale of its 22.474% non-operated interest in WA-33-R in the offshore Carnarvon basin of WA. Tap said the development was consistent with its strategy to monetize and rationalise its Australian portfolio and pursuant to the terms of the SPA, the company’s subsidiary, Tap Shelfal, will sell its interest in WA-33-R to its joint venture partners Quadrant Oil and Santos with Tap Shelfal’s interest being split between the buyers 12.361% and 10.113%, respectively. Santos already has an 18.

Gas investors warned Australian states among world’s worst

The Australian states that complain most loudly about gas supply rank among the worst places in the world to invest in developing natural gas resources, a leading global survey has found. The Canadian-based Fraser Institute’s 12th annual survey shames Victoria, New South Wales and Tasmania as among the world’s most unattractive destinations for oil and gas investment. APPEA Chief Executive Malcolm Roberts said Australia’s south eastern states are keeping dubious company in their slide to the bottom as oil and gas investment destinations.

Leigh Creek Energy confirms fertiliser production plans

The former Leigh Creek coal field site will be transformed into an agriculture energy hub, with Leigh Creek Energy (LCK) confirming it will pursue a fertiliser production commercial pathway for its Leigh Creek Energy Project (LCEP). The company has concluded its commercial options analysis for downstream Syngas production, and has determined the most financially attractive choice for the company’s 2,964 petajoules of 2C syngas at the former Leigh Creek coal field site is to make fertiliser products.

Eni given green light to drill appraisal well in the Barents Sea

Eni Norge has been granted a permit to drill an appraisal well in the Barents Sea offshore Norway. The Norwegian Petroleum Directorate (NPD) said the Italian oil and gas giant had received permission for the 7122/7-7 S well to be drilled from the West Hercules rig after it had wrapped up drilling of wildcat well 7324/3-4 for Equinor in production license 615. This follows a gas discovery by Equinor in production license 615, which is located near to the Atlantis gas discovery in the Barents Sea, from the West Hercules rig.

BP brings Clair Ridge to life 41 years after oil discovery

BP, in partnership with Shell, ConocoPhillips and Chevron, has begun first oil production from the Clair Ridge project in the West Shetland, offshore the United Kingdom. The supermajor said that Clair Ridge was the second phase of development of the Clair field, located 75km West of Shetland, which had been discovered in 1977 and has an estimated seven billion barrels of hydrocarbons BP said that two new bridge-linked platforms and oil and gas export pipelines have been constructed as part of the Clair Ridge project. The new facilities, which required capital investment in excess of £4.