Oil markets are eagerly awaiting the OPEC+ meeting on Sunday, 26 November, in anticipation of what kingpin Saudi Arabia decides over its voluntary crude oil production cuts of 1 million barrels per day (bpd), writes Rystad Energy’s senior vice president Jorge Leon in the company’s latest oil market update.

Regardless of the path they take, Saudi Arabia’s decision on the production cuts will ultimately shape the short-term future of global oil prices.

The kingdom is balancing the desire to keep prices high by limiting supply with the knowledge that doing so will lead to a further drop in overall market share.

Crude prices have experienced significant downward pressure in recent weeks, with prices fell below $80 per barrel last week after a dramatic sell-off driven by oversupply concerns.

This recent nosedive could be an indicator of what’s to come at the OPEC meeting, as the Saudis have repeatedly demonstrated that their price floor is above $80 per barrel.

The main topic of the 36th OPEC and non-OPEC Ministerial Meeting on Sunday will be confirmation of production quotas next year, which were drafted in the group’s June meeting.

Saudi Arabia announced its voluntary cuts on the sidelines of that meeting, initially committing to a 1 million-bpd output cut for July.

This was then extended on a monthly basis into August and September, while in early September, Riyadh announced the extension until the end of this year.

Oil markets will be looking to see if Saudi Arabia extends these cuts into 2024 or if it chooses to gradually unwind them or simply let them expire at the end of this year.

Whichever way it goes, Saudi Arabia’s decision will have significant implications for oil markets and, in particular, for the oil price next year.

Looming surplus

Rystad Energy’s latest unsolved liquids balance, which assumes the Saudi voluntary cuts will not be extended into 2024, shows supply has surprised on the upside and we now expect a balanced market for next year’s first quarter.

More importantly, a looming market surplus of over 600,000 bpd is in sight for the second quarter.

Going forward, the second half of next year is expected to show a deficit of around 450,000 bpd.

Overall, we now expect the oil market in 2024 to be fairly balanced compared to the significant deficit (-1.2 million bpd) this year.

This latest unsolved liquids balance is looser than what we expected just a couple of weeks ago, when we called for a 2024 deficit of 400,000 bpd.

Additionally, oil price downside pressure has mounted in recent weeks – prices fell below $80 per barrel on 16 November in a severe sell-off driven by oversupply concerns.

This is significantly below oil price levels right after the outbreak of the Israel–Hamas conflict that began in early October, when prices reached almost $95 per barrel.

To add more fuel to the bearish sentiment, recent data shows that US commercial crude inventories have increased in the last four weeks and now stand at 440 million barrels, up from 420 million barrels a month ago.

Despite our latest global mobility indicators showing a strong demand picture, with road traffic above 2019 levels and aviation traffic steady, concerns on the macro side continue to spread in the market.

This recent bearishness in oil markets has increased interest in Saudi Arabia’s next move with respect to voluntary cuts.

Scenario Analysis

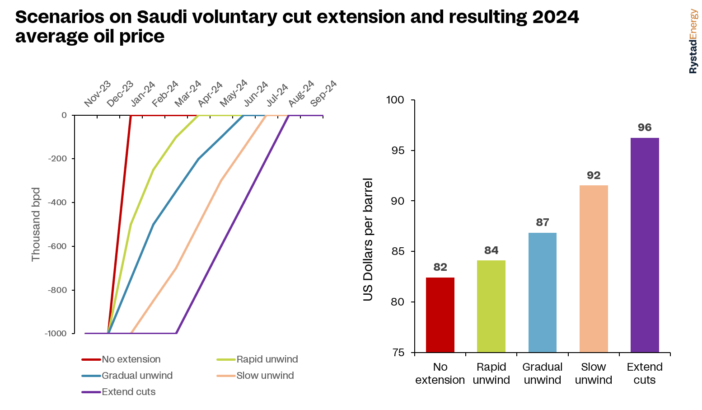

We have run five scenarios depending on the Saudi production policy for the next few months and estimate the impact they would have on oil prices. In particular:

No extension scenario: we assume Saudi cuts are not extended into 2024

Rapid unwind scenario: we assume Saudi Arabia unwinds the voluntary cuts very rapidly so that by April 2024 they are fully unwound

Gradual unwind scenario: Saudi Arabia unwinds voluntary cuts gradually until June 2024

Slow unwind scenario: Saudi Arabia extends the 1 million-bpd voluntary cuts into January and February 2024 and then very gradually unwinds them until July 2024

Extend cuts scenario: Saudi Arabia extends the 1 million-bpd voluntary cuts until April 2024 and, thereafter, gradually unwinds them until August 2024

Our analysis shows that, in the scenario where Saudi Arabia does not extend the voluntary cuts, market bearishness will extend with oil price will average slightly above $80 per barrel next year.

On the other extreme, if Saudi Arabia extends voluntary cuts until April 2024 and then gradually unwinds them, oil price would average $96 per barrel in 2024.

The latest estimate from the IMF suggests that Saudi Arabia oil breakeven price is $86 per barrel.

Our analysis suggest that Saudis will need to keep giving away market share, at least until June 2024, to achieve that price level.

Will the Saudis do it? All eyes will be on Vienna next week and on Saudi Arabia’s next move.