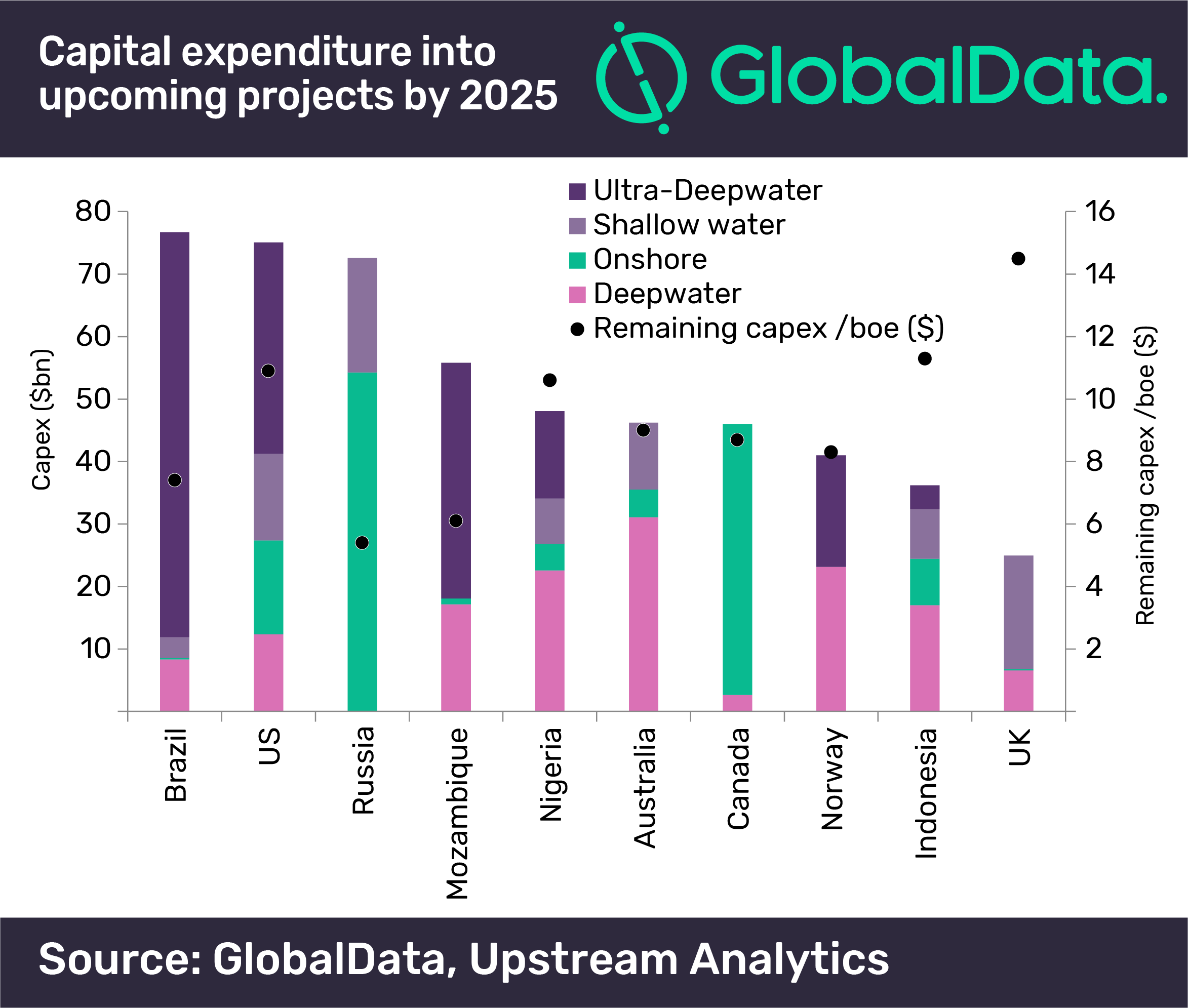

An average capex of US$3 billion per year would be spent on eight oil and gas fields in Mozambique between 2018 and 2020. Capital expenditure into Mozambique’s oil and gas projects, will add up to $9.1bn over the three-year period in upstream capital expenditure by 2020, according to data and analytics company GlobalData.

Ultra-deepwater projects will be responsible for over 65 percent of $9.1bn of upstream capital expenditure in Mozambique, or $6.2bn by 2020. The deepwater projects will account for 25 percent of upstream capital expenditure with $2.3bn by 2020, while onshore projects will necessitate $0.6bn in capital expenditure over the period.

GlobalData expects that Eni SpA and Exxon Mobil Corporation will lead Mozambique in capital expenditure, each investing $1.4bn into the country’s upstream projects by 2020. China National Petroleum Corporation will follow with $1.1bn investment into Mozambique’s projects between 2018 and 2020.

Coral South Project, a planned ultra-deepwater conventional gas field, will lead capital investment with $4.3bn to be spent between 2018 and 2020. Eni East Africa SpA is the operator for the field. Golfinho-Atum Complex, a deepwater conventional gas field in the Rovuma Basin, will follow next with a capex of $2.3bn. Anadarko Mozambique Area 1, Limitada is its operator. Gas from both projects will be marketed as liquefied natural gas (LNG).

GlobalData reports the average remaining capital expenditure per barrel of oil equivalent (capex/boe) for Mozambique projects at $6.0. Deepwater projects have the highest remaining capex/boe at $6.8, followed by onshore and ultra–deepwater projects with $5.9 and $5.8, respectively.