In a report likely to cause consternation in Washington and Brussels, Rystad Energy says Russian Crude exports were far above target level in October.

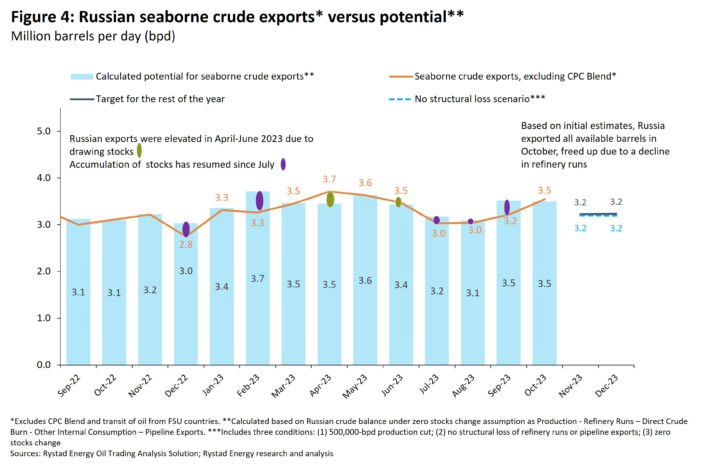

Rystad Energy’s latest Oil Market Update from Jorge Leon found that Russian crude exports in October significantly exceeded the country’s target, based on initial Rystad Energy estimates of seaborne volumes, as the nation was unable to fulfil its 300,000-barrels-per-day (bpd) voluntary crude export cut.

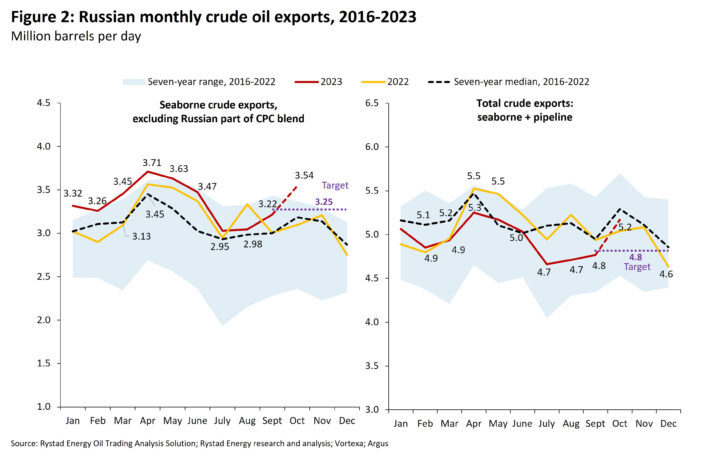

Seaborne exports in October, excluding CPC and KEBCO crude grades, totalled 3.54 million bpd and exceeded the target by around 300,000 bpd, which could lead some to question whether sanctions are having a significant effect on Russia for its invasion of Ukraine.

Considering the seasonal increase in pipeline exports in October, Rystad Energy preliminarily estimates total exports exceeding the target level by about 400,000 bpd.

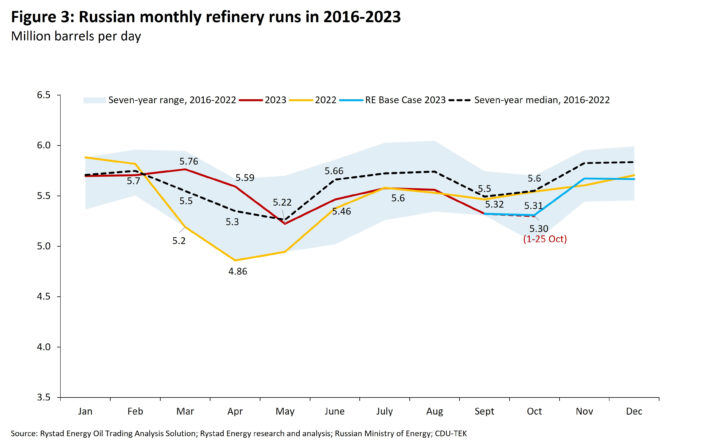

It is likely that Russia will argue that this lack of compliance with agreed OPEC+ cuts is due to its domestic fuel crisis, which was followed by a temporary ban on diesel and gasoline exports and a decrease in exports of oil products.

The structural loss of refined product exports is estimated at 300,000 bpd, which could be a strong argument for the Kremlin.

In addition, the recovery of refinery runs in November and December will lead to a decline in crude exports to target levels.

OPEC+ has been known to make relaxations for countries under special circumstances.

If Russian exports fall steadily to target levels in the coming weeks, it is likely that the breach of commitments in October will not lead to disputes between Russia and OPEC kingpin Saudi Arabia.

Signals

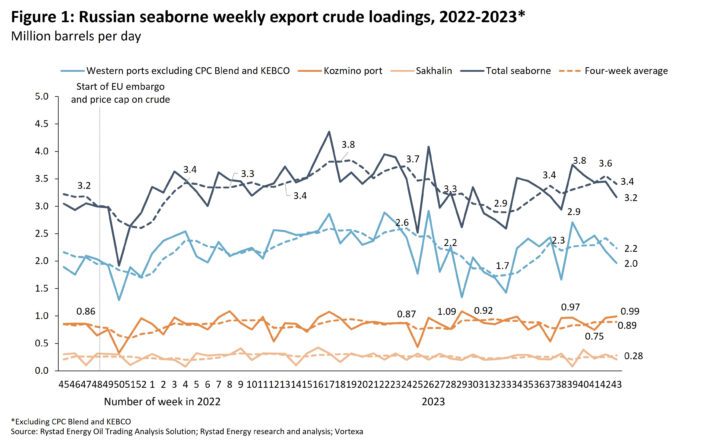

- Based on initial estimates, Russian crude exports by sea (excluding CPC Blend and KEBCO) declined in the last week of October (23 to 29 October) to 3.2 million barrels per day from 3.55 million bpd, the average loadings of the previous four weeks.

However, this weekly decline did not help to bring monthly export flows down to the target level of around 3.25 million bpd.

- On a monthly basis, seaborne crude export loadings (excluding CPC Blend and KEBCO) averaged 3.54 million bpd in October, increased by 320,000 bpd from 3.22 million bpd in September 2023.

- *Considering the seasonal dynamics of oil pipeline exports, actual data for which are received with a time lag of one or two months, we estimate Russian exports at 5.17 million bpd, exceeding the export target by around 400,000 bpd in October.

This is the maximum export volume in the last six months.

• The apparent lack of compliance on voluntary export restrictions in October occurred in the context of lower refinery runs in September and October 2023, the fuel crisis in the domestic market, and the temporary ban on diesel and gasoline exports.

• It is our understanding that, in communication with OPEC+, Russia has argued that the increase in oil exports is a result of the fuel crisis in the domestic market and the decrease in exports of oil products.

• Based on current estimates of the oil balance, Russia exported all available barrels, freed up due to low refinery runs in October after the accumulation of oil stocks during the three previous months.

Going forward, the ongoing recovery in refinery runs will lead to a decrease in Russian crude exports to the target levels for the rest of the year.

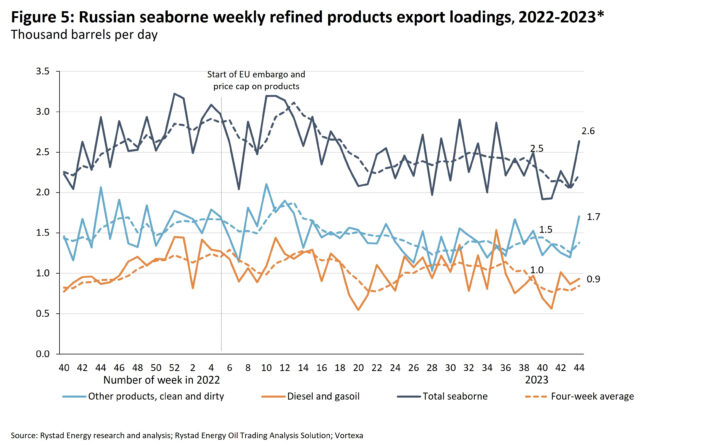

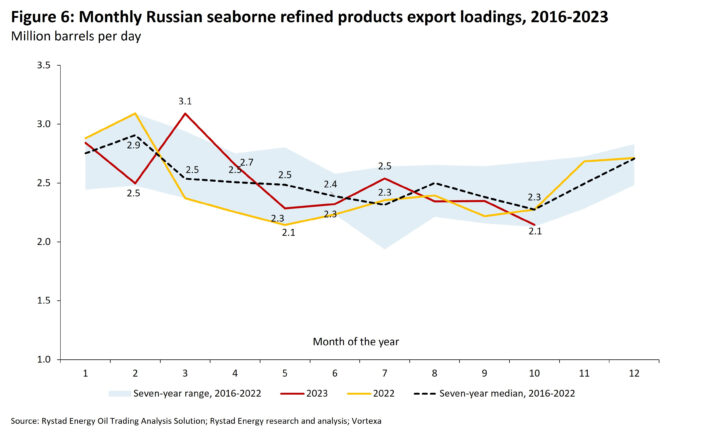

• Weekly Russian seaborne exports of refined products recovered last week to 2.6 million bpd, exceeding for the first time the levels observed in early September, reflecting a recovery in refinery runs after seasonal maintenance and a temporary ban on diesel and gasoline exports.

• On a monthly basis, seaborne product export loadings averaged 2.1 million bpd in October, the lowest level since May 2022, which was 200,000 bpd lower in comparison to the seven-year median for October.

Taking into account that the ban was lifted only on exports via refined product pipelines to ports, the total structural loss of product exports is estimated at around 300,000 bpd.

Signposts

• Russia’s seaborne crude exports in the coming weeks and compliance with OPEC+ quotas in November.

• G7 price cap policy tightening.

• Review of voluntary restrictions by Russia and Saudi Arabia in late November. • Russian refinery runs after an increase in damper payments for the downstream sector.