Beach Energy’s revenue climbed 13% to $1.8 billion on the back of soaring oil and gas prices, but the company delivered lower production figures after a Western Flank downgrade had significantly diluted the company’s value.

Chief Executive Officer Morné Engelbrecht said The 2022 financial year had “brought into sharp focus the important role natural gas currently plays in providing energy security, and will continue to do so for decades to come.

“Beach’s multi-basin strategy is to develop the assets within our portfolio, keep our plants processing at higher rates for longer, and in doing so maximise gas supply. The benefits of this strategy were clearly evident in our financial results this year.

“Despite lower production, increased demand and pricing for our products saw a rise in earnings and cash flows. Total revenue increased 13% to $1.8 billion and underlying earnings before interest, tax, depreciation and amortisation increased 17% to $1.1 billion.

“These results contributed to a strengthening of our financial position. We ended the year with total available liquidity of $765 million and $752 million in free cash flow pre-growth expenditure generated. This leaves Beach in great shape to deliver its current growth projects and balance longer-term growth aspirations with capital management initiatives.

“In the field, Beach is demonstrating its ability to deliver large and complex projects. Beach is safely achieving key milestones which are de-risking growth and strengthening the foundation for our FY24 production growth target.

“In the offshore Otway Basin, the seven-well drilling campaign was successfully completed and delivered one new gas discovery at the Artisan field and six successful development wells in the Geographe and Thylacine fields. Geographe 4 and 5 were connected to the Otway Gas Plant and contributed to a 47% increase in Otway Basin production. Connection of the final four wells in mid-2023 is targeted.

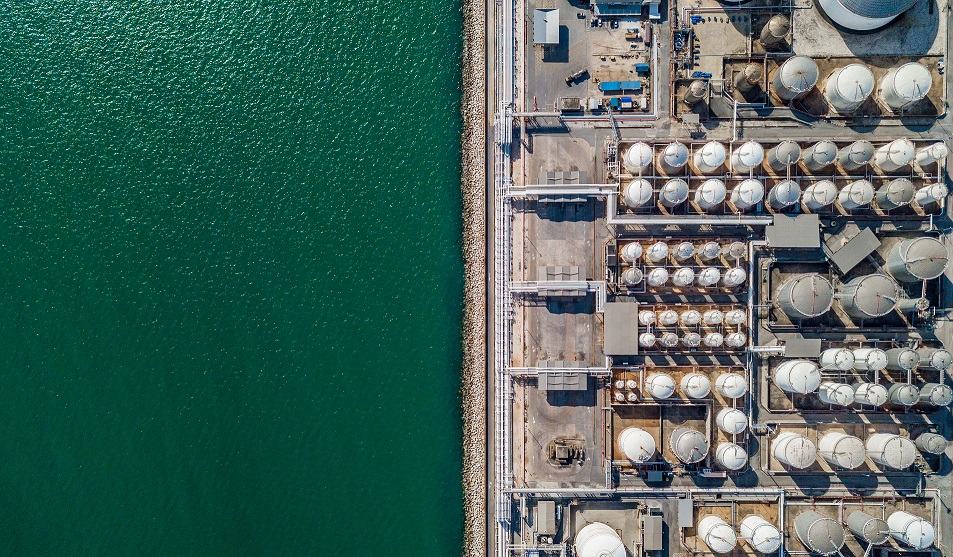

“In the Perth Basin, the transformational Waitsia Stage 2 project commenced with good progress made on plant construction and development well drilling. First LNG sales in the second half of 2023 is targeted, which will herald Beach as a new entrant in the global LNG market.

“Another key milestone was the recent signing of the LNG Sale and Purchase Agreement which will see bp purchase all 3.75 million tonnes of Waitsia Stage 2 LNG. This is equivalent to ~200 million MMBtu of LNG which represents material revenue from LNG to Beach over the five-year term.

“Beach also made good progress with its decarbonisation plans and has announced a new Emissions Intensity Reduction Target of 35% by 2030. We also maintain our aspiration to reach net zero Scope 1 and 2 emissions by 2050. A key plank of our emissions reduction journey is the globally significant Moomba CCS project. A Final Investment Decision was taken in FY22 and we are targeting first CO2 injection in 2024.

“We have a busy schedule in FY23 completing the major projects that will deliver material free cash flow from FY24. Key activities include connecting the Thylacine and Enterprise wells to the Otway Gas Plant, Waitsia Stage 2 progress, Perth basin exploration drilling, ongoing Cooper Basin drilling, and planning for exploration and development activity in the Otway, Bass and Taranaki basins”, Mr Engelbrecht said.

Beach ended FY22 with 283 MMboe of 2P oil and gas reserves (30 June 2021: 339 MMboe). The decrease was mainly attributable to production (-22 MMboe) and Bass Basin revisions (-25 MMboe). The opportunity to increase reserves was limited without exploration or appraisal drilling in FY22 outside of the Cooper Basin.

Bass Basin revisions resulted from re-classification of the Trefoil project from reserves to contingent resources and an associated reduction of Yolla economic life. This follows deferral of the Trefoil development decision, as announced on 20 May 2022. Other revisions included:

• In Western Flank Oil, exploration success, appraisal of Martlet, infill drilling and production performance at Spitfire and Growler, offset by fracture stimulation results at Balgowan, infill drilling results at Kalladeina and production performance at Bauer;

• Revised modelling assumptions in Western Flank Gas and the Taranaki Basin;

• Additional development of Moomba South and production performance in the Cooper Basin JV; and

• Infill drilling and production performance in the Otway Basin.

Beach recorded 2P CO2 storage capacity of 4.4 Mt and 2C contingent storage resources of 11.6 Mt after taking a Final Investment Decision for Moomba CCS.