Energy intelligence group Wood Mackenzie expects exploration investment to be lower in 2018 than in 2017, albeit in a year where may companies can begin to look forward to a brighter economic outlook.

Wood Mackenzie expects most oil companies to retain a cautious approach this year with well counts remaining low, but says the industry’s focus in recent years on reducing costs will likely producer better returns in 2018.

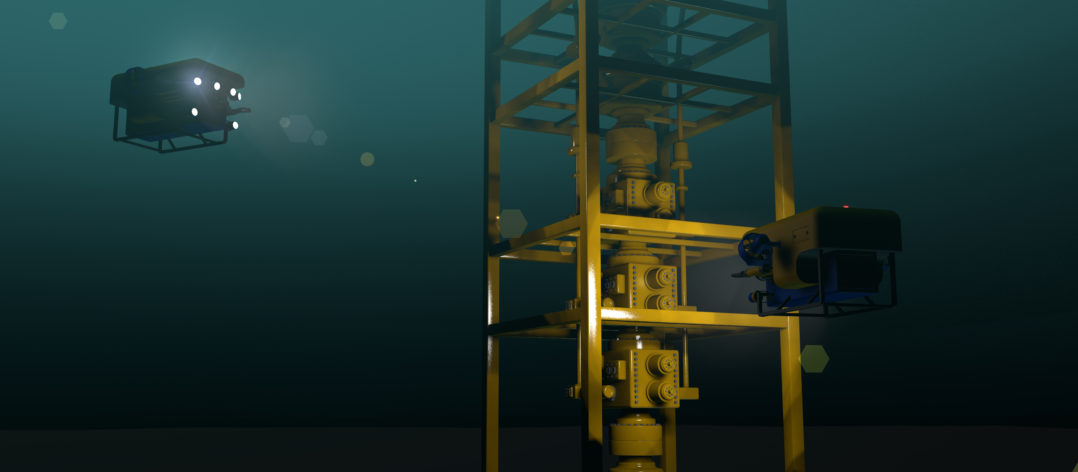

Wood Mackenzie believes the favoured plays will be deepwater sweet spots promising high resource density, rapid commercialization and breakeven prices below US$50/bbl.

With exploration spend in upstream investment eroding to below 10% since 2016, the days of one dollar out of six or seven being spent on exploration may be over, the report said.

In 2018 Wood Mackenzie expects investment in conventional exploration and appraisal to be around $37 billion – 7 % less than 2017 spend and over 60% below its 2014 peak.

Half of all oil and gas volumes will again be in deepwater and explorers will avoid high-cost areas, difficult logistics, and slow-to-drill wells. Prospects with less than a one-in-ten chance of success are unlikely to be drilled.

For future planning a key focus will be capturing new acreage for the longer term. Wood Mackenzie expects strong competition for quality acreage in the 40 licencing round this year as players compete for a smaller pool with licencing rounds in Brazil and Mexico the focal points.

With exploration costs having halved since 2014 peaks, Wood Mackenzie expects the industry to make double-digit returns in 2018. Demand for quality acreage could push up prices in a year where fewer, better wells will target commercially attractive plays.

However, following a few difficult years, the economic outlook is looking brighter for explorers.