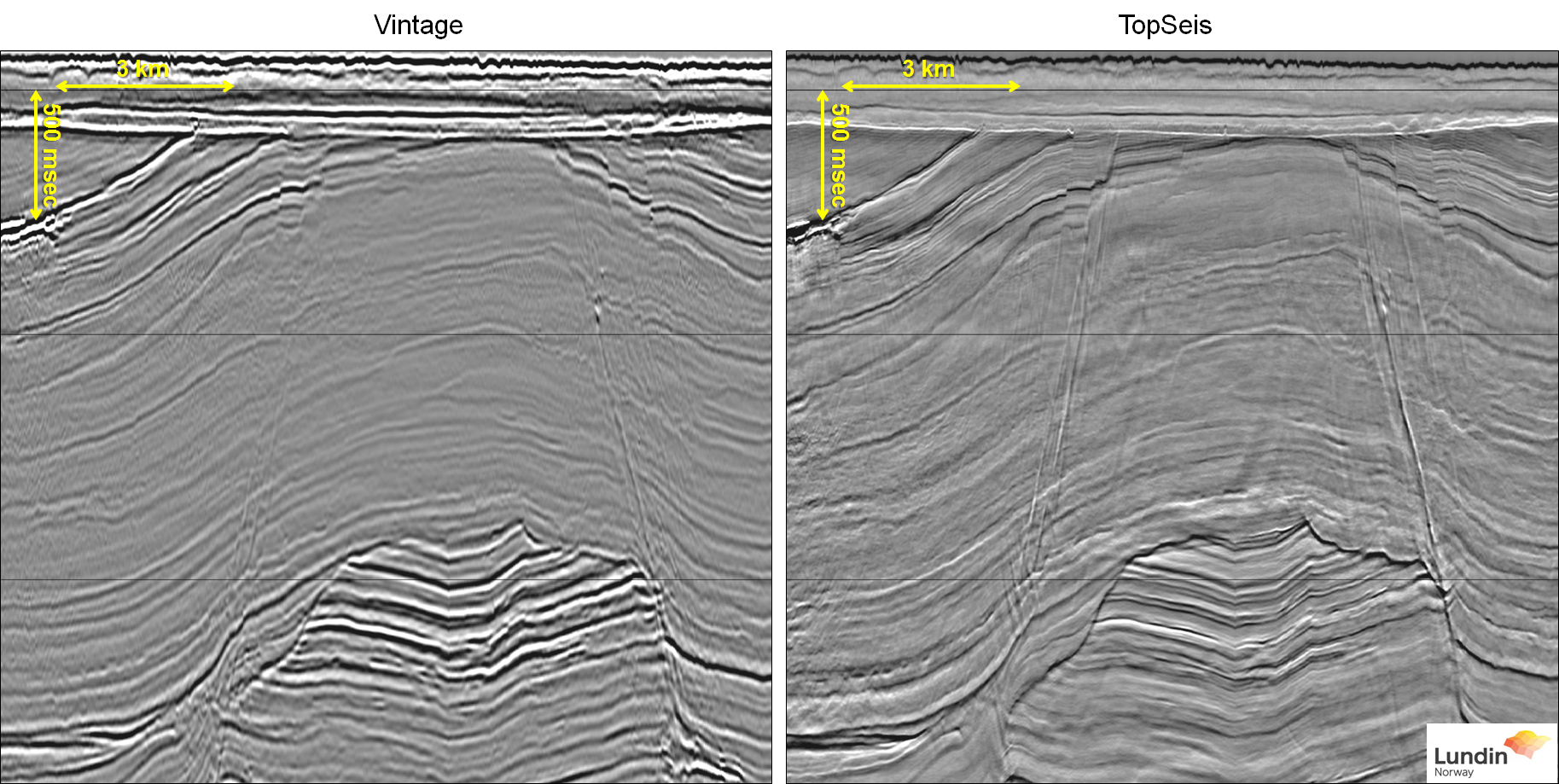

CGG and Lundin Norway AS have been awarded the NCS Exploration Innovation Prize 2019 for TopSeis™, a next-generation marine source-over-spread acquisition and imaging solution that delivers a step-change in imaging by providing massively increased near-offset coverage from a split spread with zero offsets. The Exploration Innovation Prize is “awarded to a license group, company, team or person who, during the last couple of years, has given a courageous and innovative technological contribution in exploration for oil and gas on the Norwegian continental shelf.

Company Updates

Shell gets NOPSEMA approval for Bratwurst-1 well

Shell has won approval from NOPSEMA to drill the Bratwurst-1 exploration well in AC/P64 offshore Western Australia. The original plan was submitted by Shell in January this year for a well which is located within the Northern Browse Basin in Commonwealth Waters in water depths of approximately 155 meters. The plan was officially approved by NOPSEMA on May 15. Shell will target gas/condensate and has plans to deploy a semi-submersible rig for the operation.

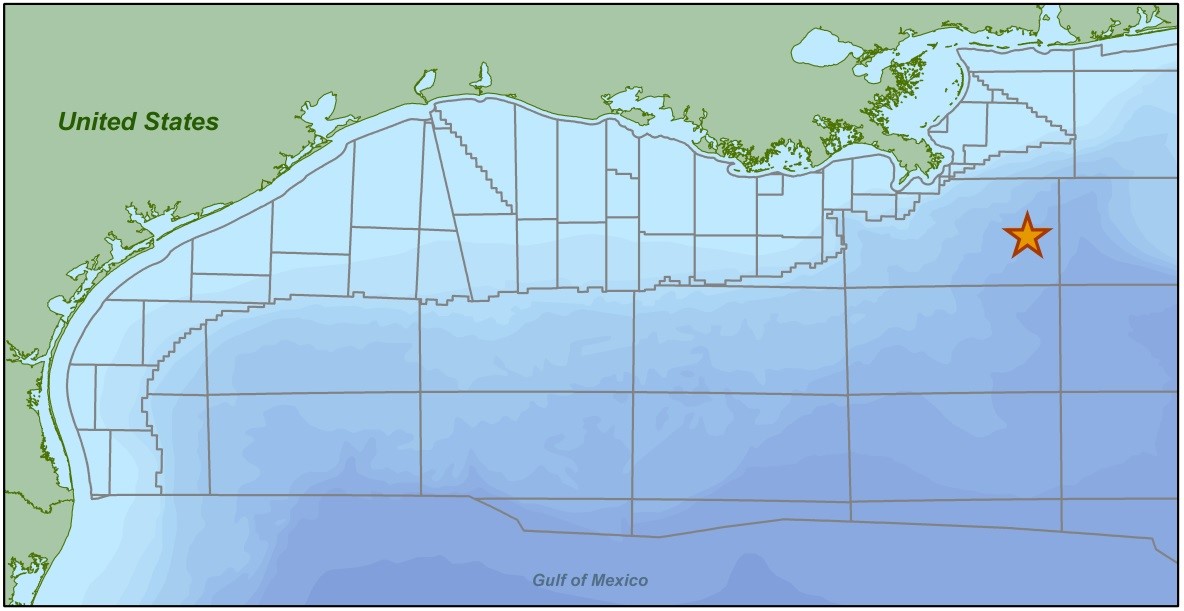

CGG Begins First Multi-Client Ocean Bottom Node Survey in Mississippi Canyon, Gulf of Mexico

CGG has announced commencement of its first multi-client ocean bottom node (OBN) survey, taking CGG’s offshore data library to the “next level of excellence”. Located in the north-central region of the Gulf of Mexico, this dense OBN survey will provide well-sampled, full azimuthal coverage with long offsets, to deliver exceptional data for imaging the geologically complex structures in Mississippi Canyon, CGG said. Acquisition services are being provided by Seabed Geosolutions and the data will be processed by CGG Geoscience’s Subsurface Imaging in Houston.

Oil price spike boosts Bass Oil’s bottom line, despite shutdowns

Australian-based, Indonesian oil producer, Bass Oil has released a monthly operations update for April 2019 production from the Tangai-Sukananti field onshore Indonesia of 20,273 barrels of oil (11,150 barrels of oil net to Bass). Bass said monthly oil production and sales were down slightly during March with April production rates averaging 676 bopd. However, oil prices were up 8% during April. The average monthly realised oil price was US$67.39 compared with a monthly average oil price of US$62.49 per barrel recorded in March.

Anadarko signals imminent FID for giant Mozambique LNG gas project

Anadarko Petroleum is weeks away from an anticipated final investment decision for its Mozambique LNG project next month. Chevron exited takeover talks with Anadarko last week, but the company is still being wooed by Oxy and said that FID for the Mozambique offshore gas project would be made on June 18. Anadarko CEO Al Walker said: “With commitments for financing in place, off-take secured, and all other issues under negotiation successfully addressed, we are excited to take the next step with the expected announcement of a Final Investment Decision (FID) for the Mozambique LNG project on June 18.

Otto acquires available interest in Gulf of Mexico lease

West Perth-based Otto Energy has acquired the remaining 50% working interest in the VR 232 license located in the US Gulf of Mexico from Byron Energy. Otto announced that the lease is subject to a 12.5% Federal Government royalty and the lease rental is US$31,681 per annum. The lease expires in June 2023. VR 232 is adjacent to South Marsh Island Block 71 (SM 71) oil field and production platform, which is operated by Byron with partner Otto holding a 50% interest. The platform has capacity to produce up to 5,000 bopd from up to six wells.

TGS acquires Spectrum in major merger deal

TGS will acquire Spectrum in a deal which has been announced as a merger set to create a “leading provider of 2D and 3D seismic data”. This follows an agreement of shareholders of both companies, triggering a transaction which is expected to be completed as a statutory merger pursuant to Norwegian corporate law between TGS and Spectrum. Under the terms of the agreement, Spectrum shareholders will received 0.28 shares for one Spectrum share in addition to a cash consideration of US$0.

Santos spuds appraisal well at Dorado

Santos has started drilling the Dorado-2 appraisal well in WA-437-P offshore Western Australia. Dorado is operated by Santos with Carnarvon Petroleum as a partner with a 20% interest. Carnarvon Petroleum said the Noble Tom Prosser jack-up drilling rig had been mobilized from the Corvus-2 well location to the Dorado-2 well on April 26. After arrival at the Dorado-2 location, located 2.2 km from the original Dorado-1 well, the rig had concluded the ready to operate process and had drilled the surface hole and installed the surface casing.

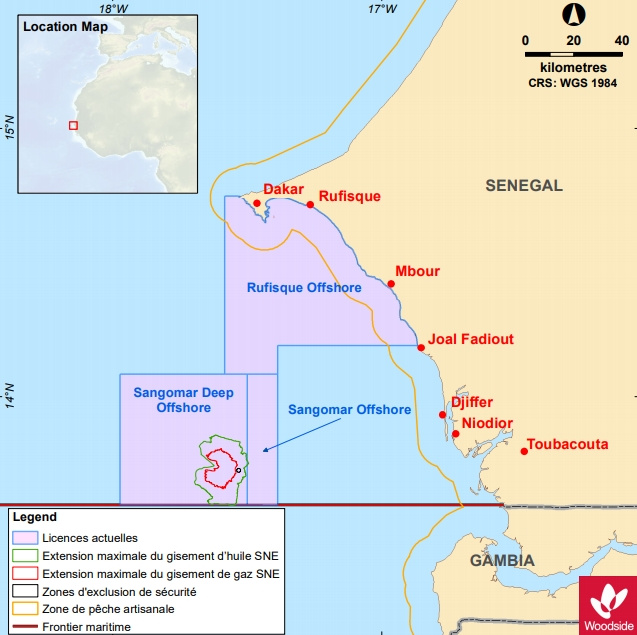

Shearwater set to shoot seismic at SNE field

Shearwater has won a contract to conduct a 3D seismic survey over the SNE field offshore Senegal. This was revealed in a first quarter update recently by FAR, which said the high-definition 3D marine seismic survey contract was awarded to improve reservoir definition supporting SNE well positioning and optimization. FAR said the survey was scheduled to begin in June as part of the SNE field development encompassing the Rufisque Offshore, Sangomar Offshore and Sangomar Deep Offshore (RSSD) joint venture, which is operated by Woodside and includes JV-partners Cairn Energy, FAR Limited, and Petrosen.

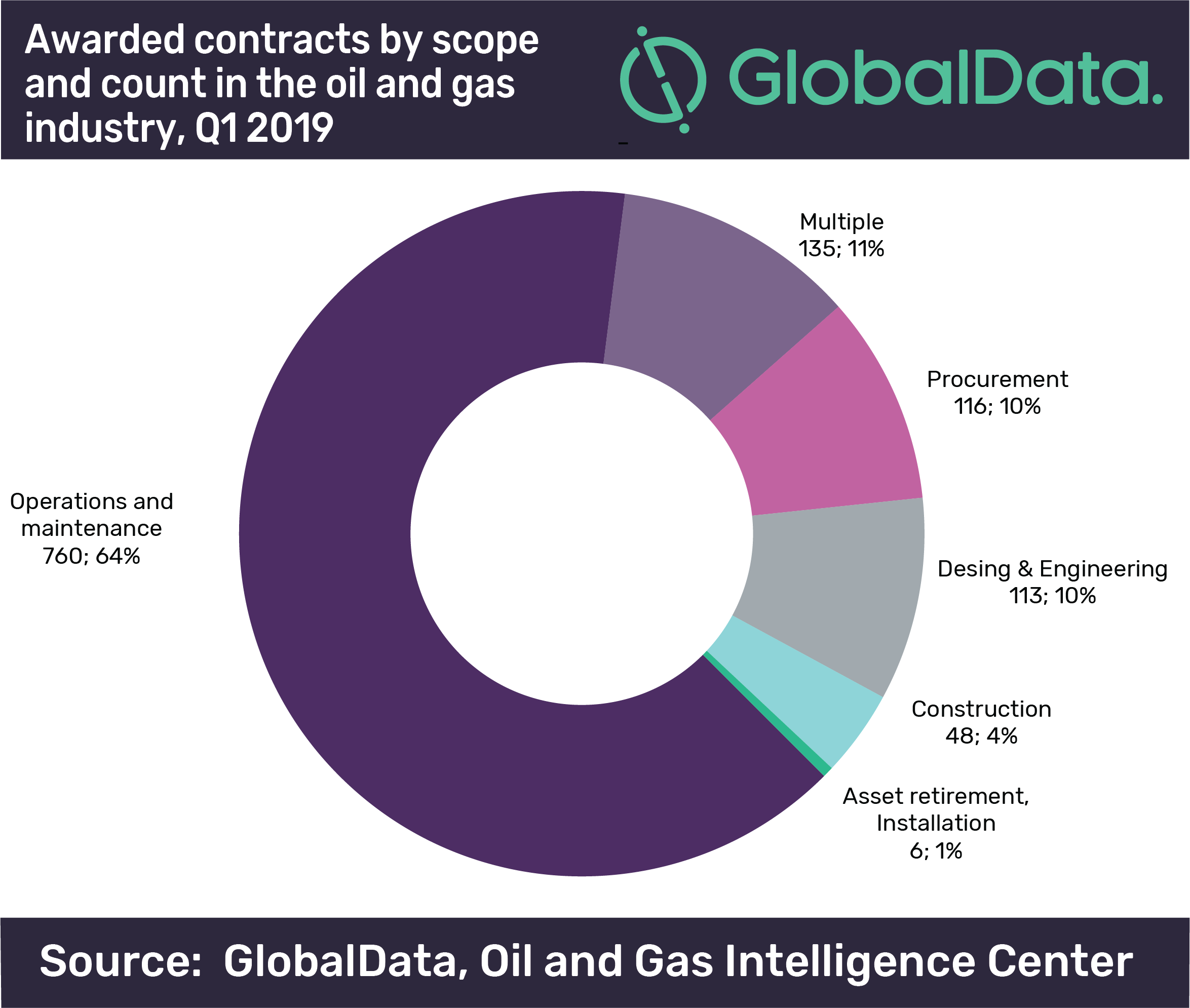

EMEA leads oil and gas contract awards with 569 contracts in Q1 2019

In Q1 2019, the oil and gas industry reported 1242 contracts, of which 1178 were awarded contracts, according to data and analytics company, GlobalData. EMEA (Europe, Middle East and Africa) recorded the most contracts with 569 contracts, representing around 48% of the total awarded contracts in Q1 2019, followed by the Americas region with 366 contracts, accounting for 31% of the total awarded contracts. The company’s latest report states that the upstream sector reported 73% of the total awarded contracts, with 862 contracts.