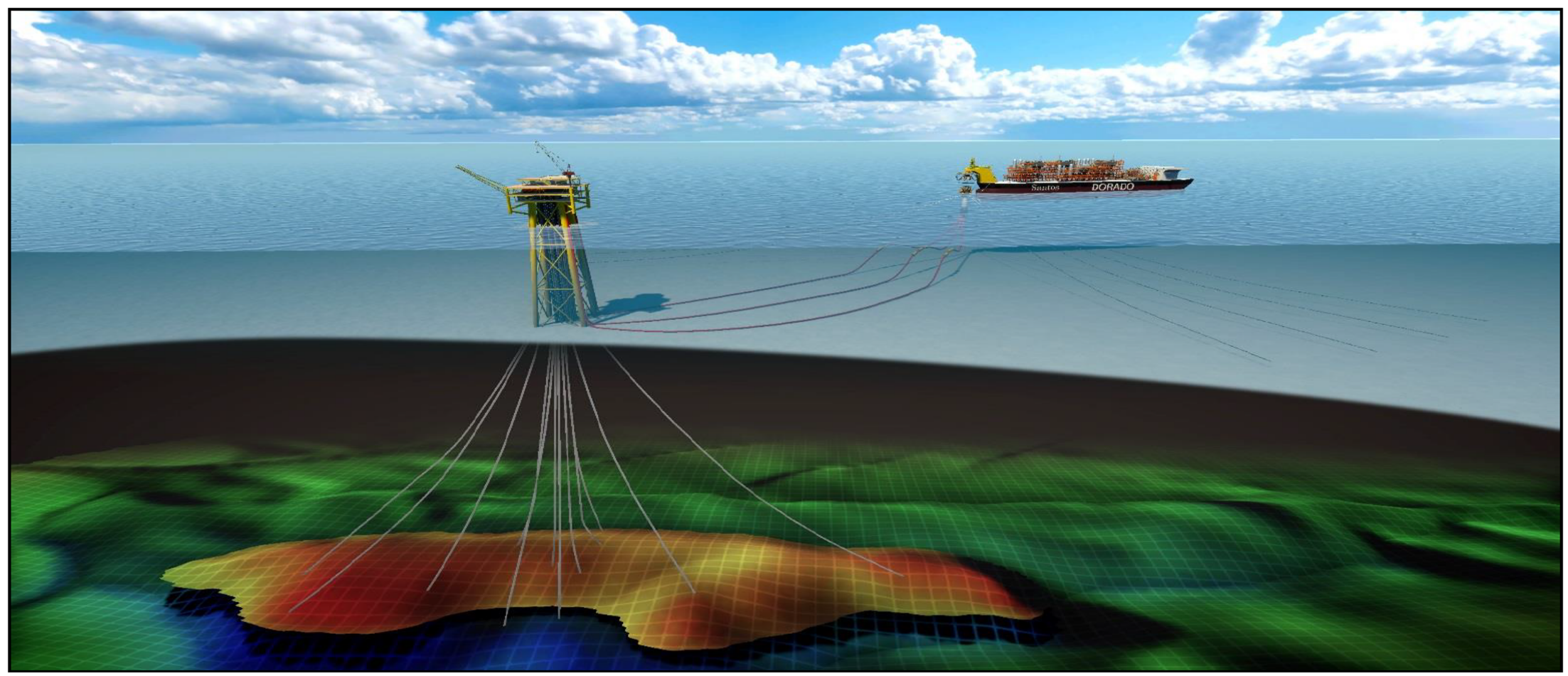

Carnarvon Energy says it is closing in on a mid-year deal to sell 10% of its stake in the Bedout Basin to CPC subsidiary, OPIC Australia.

This follows a binding agreement in February whereby Carnarvon announced that as part of the arrangement, it would receive US$146 million in cash comprising an upfront payment of ~A$80 million on completion of the transaction and a further carry of ~A$129 million) towards Carnarvon’s share of the Dorado development costs once a Final Investment Decision (FID) is taken.

The transaction is subject to a number of customary conditions in respect of Joint Venture approval, approval by the Foreign Investment Review Board (FIRB) and approval and registration by the National Offshore Petroleum Titles Administrator (NOPTA).

In a recent update Carnarvon said it was pleased to advise that the majority of these conditions had been satisfied, with the parties “working diligently to achieve satisfaction of the final condition in a timely fashion. The parties are continuing to target completion of the transaction mid-year, subject to achievement of the final condition.”

Carnarvon Managing Director and CEO, Adrian Cook, commented: “I am extremely pleased with how the CPC transaction is progressing.

“Completion of this transaction is an important step in funding our share of the Dorado development. Following completion, Carnarvon will hold substantial cash and financial liquidity, enabling it to de-risk project funding in conjunction with prospective debt financing, which has received a strong level of market interest so far.

“Our team has been working closely with CPC since the start of this transaction and, along with the Operator, we are all aligned on progressing the Dorado development to FID as soon as possible.

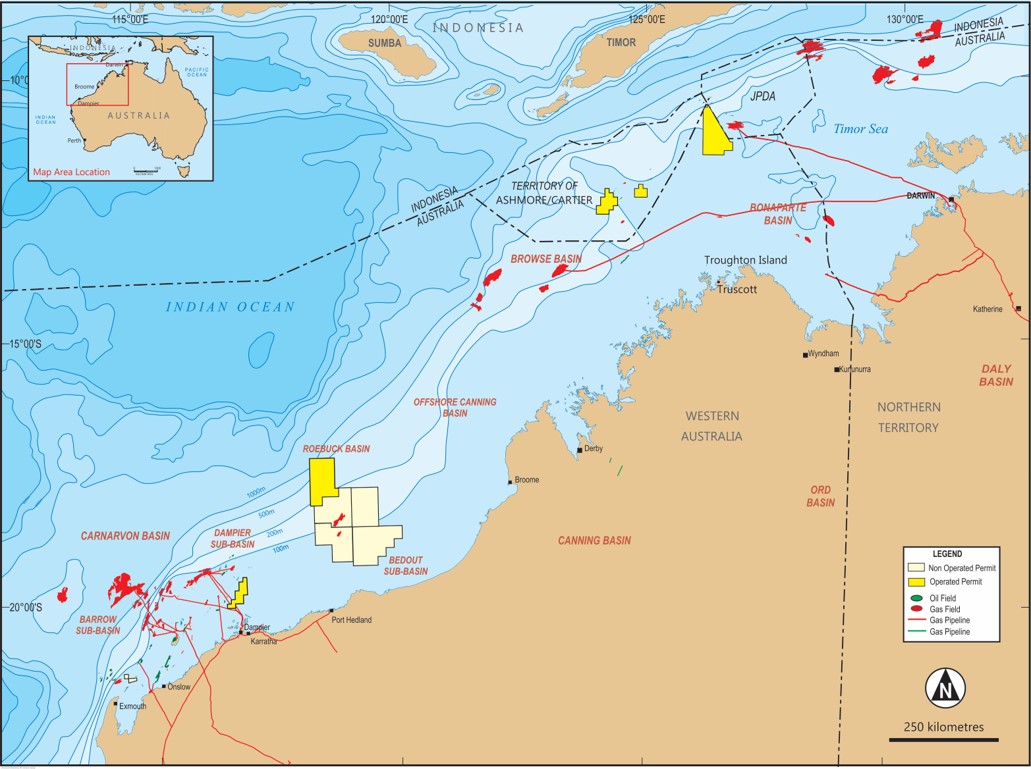

“With the Offshore Project Proposal having also recently been accepted, the Joint Venture has all the primary regulatory approvals required to support development of Dorado, unlocking the significant value of this asset and the Bedout Sub-basin more broadly.”

Azure Capital acted as Carnarvon’s adviser on the transaction and is advising on the ongoing debt financing process for the Dorado development.