Debt-free Blue Energy has urged the state of Queensland and the Federal Government — in spite of COVID-related upheavals and oil price haemorrhaging — not to lose sight of an impending domestic gas shortage in 2023 and the urgency of infrastructure projects to stave off this famine.

Blue Management said it has been in active discussions with representatives of both Federal and State Governments to highlight the need for national energy infrastructure projects to ensure timely and reliable delivery of energy to domestic East Coast manufacturers and gas users.

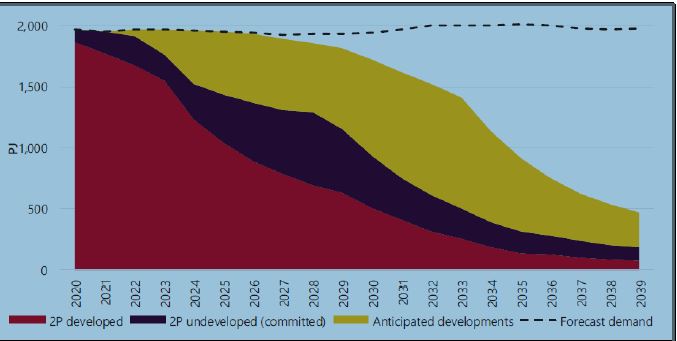

“This is in light of the projected long-term East Coast domestic gas shortfall commencing in 2023, as identified by the latest AEMO GSOO March 2020 report. In those discussions, Blue has directed the Government’s focus to Queensland’s Northern Bowen Basin as the largest onshore, discovered gas resource that remains un-developed and un-connected to the east coast domestic gas market,” Blue Energy said.

Gas pipeline

“With post COVID-19 “shovel-ready’ infrastructure projects critical to the national economic recovery, a single multi-user, 500 km Moranbah to Gladstone/Wallumbilla gas pipeline would be capable of delivering up to 300 terajoules (TJ) per day of gas to the domestic market and is the most advanced, sizeable gas resource that can be delivered to meet the short falls predicted by AEMO,” the company added.

“Government sanction and funding of the line is required to facilitate natural gas and energy field developments in the Northern Bowen Basin.

“It is noteworthy that AEMO now forecasts southern state domestic gas supply shortfalls from the winter of 2023 onward, even accounting for the “2P undeveloped (committed)” blocks of gas reserves. *

“There is no consideration in the AEMO report of the impact on those “committed” projects to develop those reserves (i.e. required drilling), from the recent dramatic fall in oil price, (and hence natural gas prices) and the resultant massive CAPEX reductions made by most oil and gas companies, including all the domestic and foreign major oil and gas producers here in Australia.

“Furthermore, there is even less consideration given in the AEMO forecasts to the impact of reduced CAPEX on the “Anticipated developments” that underpin the east coast gas supply from 2023. Failure of any of these Anticipated developments to eventuate will leave the southern states in a precarious energy position sooner rather than the expected 2023 forecast.

With regard to the crude oil rice crash, Blue Energy said the oil price crash and global CAPEX drought in oil and gas expenditure should be a sensitivity addressed in the AEMO forecast, as the East Coast gas market is dependent on more drilling (CAPEX), largely by the LNG players, to provide domestic gas supply, in the absence of significant dedicated domestic gas activity.

“The key takeaway for Australian gas supply is that the deep, across the board CAPEX cuts undertaken by the global oil majors in response to the COVID-19 induced recession and oil price crash, will impact the gas drilling programs for the “anticipated” new gas supply in the AEMO east coast gas supply forecast.”

Commercialisation activity

Blue said it was continuing to pursue additional gas buyers in the Townsville and Moranbah market (in addition to the already announced MoU with Queensland Pacific Metals signed in 2019).

The company said gas supply for Townsville customers would likely be sourced from Blue’s 100% Sapphire Block in ATP 814, which is in close proximity to existing gas gathering and processing infrastructure and is connected to the Townsville market by the North Queensland Gas Pipeline.

“This will provide the lowest cost and quickest connection for new gas supply. Several new industrial and manufacturing developments and projects (gas users) are under consideration in Townsville as the region strives to grow its economy and attract new industries. More gas supply will assist that growth.

Blue Energy described the broader Northern Bowen Basin Gas Province as a “discovered resource of approximately 15,000 PJ of gas which would be sufficient to underpin the East Coast domestic gas market for the next 30 years, based on current market conditions.

“Blue’s component of this estimate is currently 3,248 PJ+. The solution to the ongoing long-term East Coast gas supply short fall, as Bass Strait declines, is the delivery of more gas supply to the market. Development of the North Bowen Basin gas resource provides the quickest solution. All that is required is a 500 km pipeline connection.”