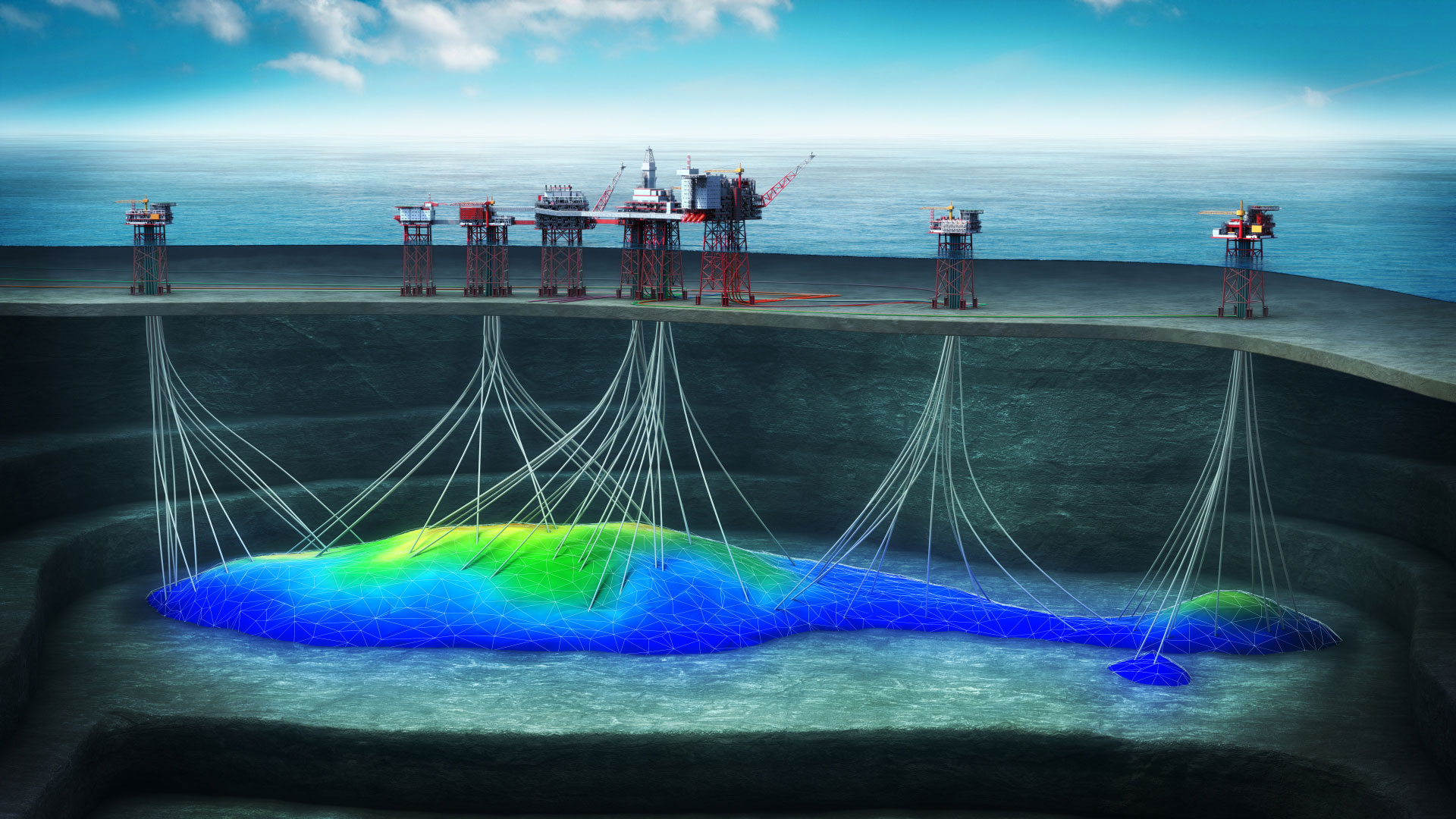

Norwegian E&P company Aker BP is upping the ante this year with a turbo-charged exploration program in 2019 aimed at tripling production by 2025.

The company said from the launchpad of a strong performance in 2018, it now plans to cut production costs from US$12 to US$7 per barrel and to significantly increase dividend payments to shareholders.

“Excellent execution and rapid change towards lower cost, lower emissions and improved efficiency are key ingredients to value creation in Aker BP. As we deliver profitable projects and grow the company, we also increase our ambitions for cash dividends to our shareholders,” said Karl Johnny Hersvik, Chief Executive Officer of Aker BP.

“The future of the E&P industry belongs to the most competitive and efficient oil companies.”

During 2018 Aker BP’s production was 155.7 mboepd. The company has now set guidance for 2019 at 155-160 mboepd and plans to drill 15 prospects this year as part of its ‘high potential exploration program’ targeting net un-risked prospective resources of 500 mmboe.

Aker BP has flagged $500 million to drive its exploration program this year.

“This is a very exciting exploration program. We are investing to find profitable barrels around our hubs, test new plays and to generate new potential stand-alone development opportunities for Aker BP,” Hersvik said.

“We have delivered on the goals we set for 2018. Aker BP is well positioned to deliver on our high ambitions for the coming years,” Hersvik added.

Aker BP reserves swelled to 917 mmboe in 2018, driven by resources converting to reserves, notably in the Valhalla area. Through license acquisitions and discoveries, the company’s contingent resources increased to 946 mmboe.

The Board has proposed dividends for 2019 of US$750 million, up from US$450 million in 2018, “with an ambition to increase the dividend payment by US$100 million per year to 2023”