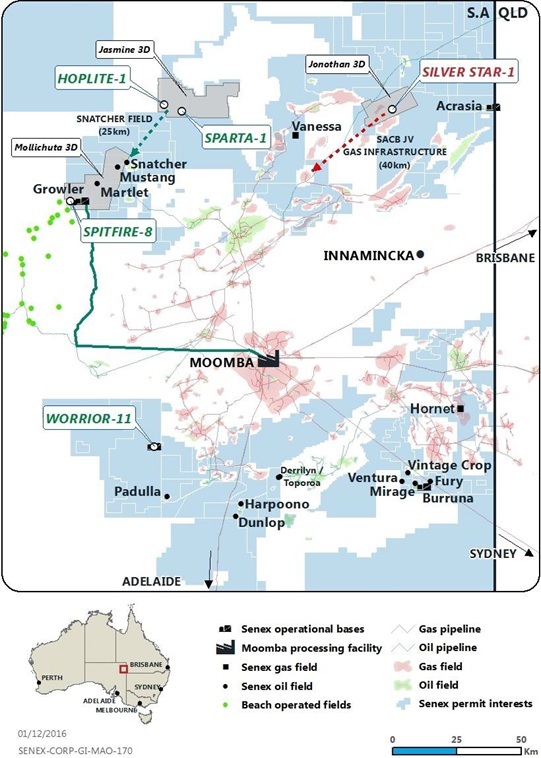

88 Energy has announced that drilling of the production hole at the Charlie-1 appraisal well on the Alaska North Slope at Project Icewine will commence imminently.

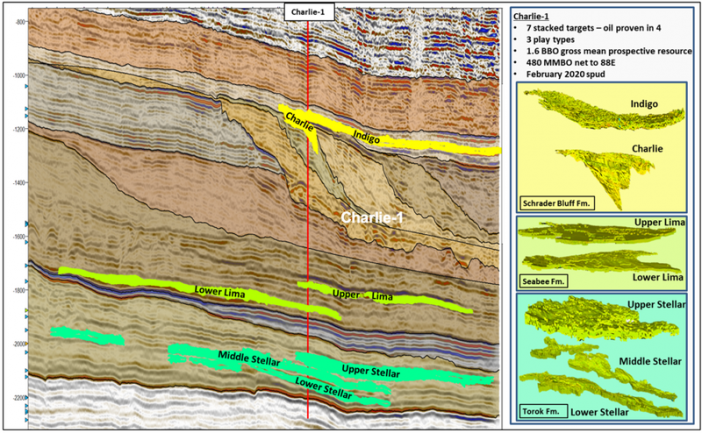

88E and farm-in partner Premier Oil are targeting 1.6 billion barrels of gross mean prospective oil resource potential, with 480MMBO net to 88E.

As part of the farm-in deal, 88 Energy will operate Charlie-1 via its 100% owned subsidiary Accumulate Energy Alaska, Inc and the cost of the well will be funded by Premier Oil Plc up to US$23 million.

BP legacy

The Charlie-1 well has been designed as a step out appraisal of the Malguk-1 well which was drilled in 1991 by BP.

Malguk-1 encountered oil shows with elevated resistivity and mud gas readings over multiple horizons. Testing was abandoned due to complications and Malguk-1 was drilled using vintage 2D seismic, which was insufficient to adequately determine the extent of any of the prospective targets.

88 Energy subsequently undertook revised petrophysical analysis, which identified what is interpreted as bypassed pay in the Malguk-1 well.

88E also completed acquisition of modern 3D seismic in 2018, in order to determine the extent of the discovered oil accumulations.

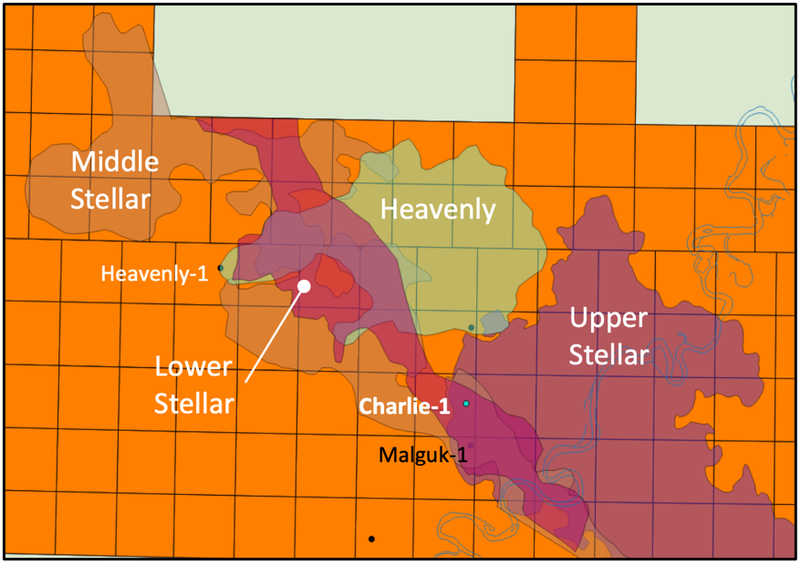

Charlie-1 will intersect seven stacked prospects.

Four of these targets are interpreted as oil bearing in Malguk-1 and are therefore considered appraisal targets.

Drilling commenced on 2 March, with flow testing expected to be completed next month.

Drilling is a planned to a total depth of 11,400 and the program is expected to be completed in 60 days.

Wireline results are in April, followed by flow test results.