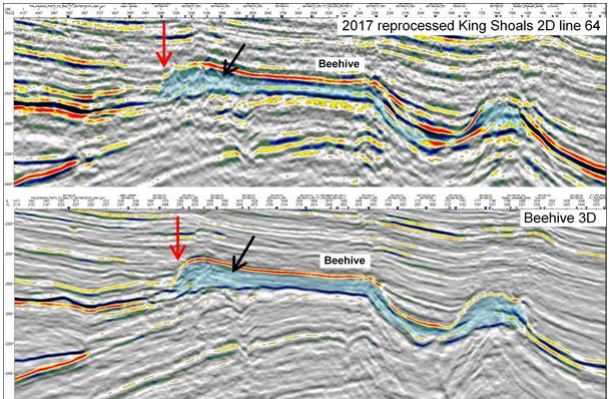

Melbana Energy says preliminary interpretation of the newly acquired Beehive 3D seismic survey off Western Australia confirms some key technical characteristics of Beehive, further de-risking the prospect.

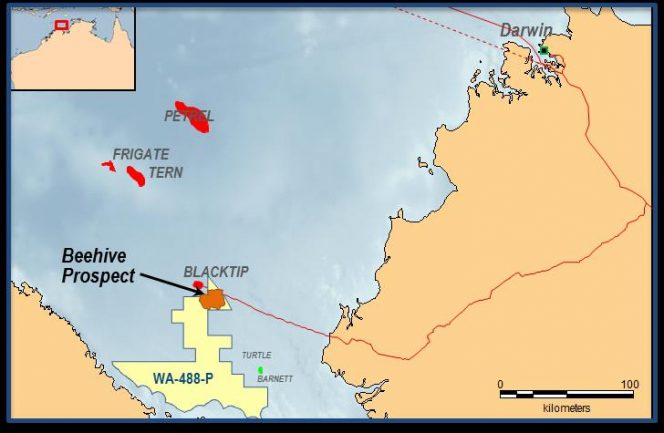

Melbana Energy, operator of the Beehive prospect, located in the WA-488-P offshore permit, said the near vertical edge of the build-up clearly visible on the 3D seismic provides evidence of its isolated nature. Furthermore, the 3D data details depositional patterns within the platform and the seaway that was not able to be resolved on the existing 2D data.

The many benefits of 3D data coverage include that it has allowed for better structural definition overall, particularly to the north east. Observations made at this stage strongly support the existing geological model for Beehive. These improvements in data quality and coverage have further de-risked the Beehive prospect.

Beehive has been assessed by Independent Expert McDaniel & Associates to contain a best estimate prospective resource of 388 million barrels of oil equivalent (Melbana’s share 78 million barrels of oil equivalent).

The estimated quantities of petroleum that may potentially be recovered by the application of a future development project(s) relate to undiscovered accumulations. These estimates have both an associated risk of discovery and a risk of development.

Melbana said future exploration appraisal and evaluation is required to determine the existence of a significant quantity of potentially moveable hydrocarbons.

Total and Santos each have an option, exercisable together or individually, to acquire a direct 80% participating interest in the permit and drill an exploration well, which is planned to be the Beehive-1 exploration well. If the option is exercised, Melbana will be fully carried on all costs incurred from the time the option is exercised until 90 days after the rig is released after drilling this well.

The option to farm-in and drill the first exploration well is exercisable at any time by Total and/or Santos, but no later than October 2, 2019. A number of other parties have expressed interest in reviewing the Beehive opportunity, pending a decision by Total and Santos.

If the option is exercised, drilling is anticipated in the second half of 2020, with Melbana estimating the cost of the Beehive-1 exploration well to be within the $40-$60 million range.

Melbana Energy’s CEO, Robert Zammit, said: “The improved imaging from the Beehive 3D is fully supportive of Melbana’s interpretation and very encouraging. We look forward to Santos and Total finalizing their position regarding their option prior to 2 October, 2019 and them continuing to progress readiness for potential drilling in the second half of 2020 in the event the option is exercised.”