SUPERMAOR ExxonMobil has signed a sale and purchase agreement with Eni to acquire a 25% indirect interest in the natural gas rich Area 4 block, offshore Mozambique.

In a joint statement the two companies said terms included a cash price of approximately US$2.8 billion and that the acquisition would be completed on a number of condition precedents being met, notably clearance from Mozambican and other regulatory authorities.

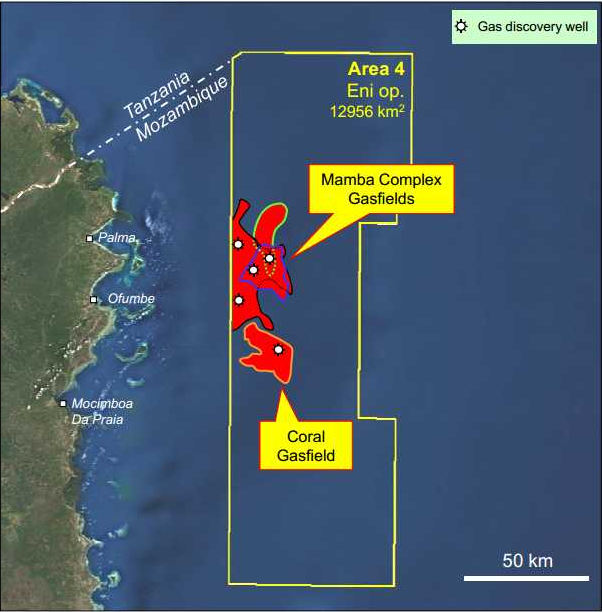

Eni holds a 50% indirect share in the block via a 71.4% stake in Eni East Africa, which owns 70% of the Area 4 concession which has been estimated to contain 85 trillion cubic feet of natural gas.

Eni Chief Executive Officer Claudio Descalzi said: “This deal represents material evidence of our exploration strategy based on the early monetization of our exploration discoveries, as a part of our ‘dual-exploration’ model. Through this strategy, Eni has been able to cash in more than $9 billion in the last four years. Moreover, the agreement confirms the world class quality, production potential, technical and financial robustness of the entire project.”

Darren W. Woods, chairman and chief executive officer of ExxonMobil, described the asset as a major addition to the company’s global development portfolio.

“This strategic investment will enable ExxonMobil’s LNG leadership and experience to support development of Mozambique’s abundant natural gas resources,” said Woods.

The agreement makes provision for Eni to continue leading the Coral floating LNG project and all upstream operations in Area 4, while ExxonMobil will lead the construction and operation of natural gas liquefaction facilities onshore.

“This operating model will enable the use of best practices and skills within Eni and ExxonMobil with each company focusing on distinct and clearly defined scopes while preserving the benefits of a fully integrated project,” the companies said.

On completion of the transaction, Eni East Africa S.p.A. will be co-owned by Eni (35.7%), ExxonMobil (35.7%) and CNPC (28.6%). The remaining interests in Area 4 are held by Empresa Nacional de Hidrocarbonetos de Mozambique E.P. (ENH, 10%), Kogas (10%) and Galp Energia (10%).

In November last year Eni approved the investment plan for the Coral South FLNG project off Mozambique. The plan makes provision for the drilling and completion of six subsea wells and the construction and installation of a Floating LNG facility, the capacity of which will be around 3.4 MTPA.

PESA SA‑NT Research & Scholarship Prizes NOW OPEN — $1,000 and $1,500! Click On Scholarships to Apply — DEADLINE 19 Feb 2026

Exxon inks $2.8 billion Mozambique deal with Eni

Posted by Dale | 12/03/2017