The biggest announcement of the fourth quarter was the go-ahead for Woodside’s Scarborough LNG project. However, Scarborough and Barossa are the only two new LNG projects Australia has going while the North West Shelf is already starting to decline.

Against this background, Graeme Bethune, CEO of EnergyQuest, has asked the question: “What’s next for Australian LNG?”

His report highlighted several milestones in the last three months of 2021, including:

- East coast wholesale domestic gas prices (both spot and contract) increased by 28.7% qoq in Q3 . Spot prices increased in November to $10-13/GJ. Domestic spot prices remain well below international spot prices, which are around $40/GJ, but high international spot prices are certainly encouraging strong exports from Gladstone, including high-priced spot cargoes. One east coast LNG cargo is reported to have been sold in November at the North East Asian spot price (similar to the JKM) less US$0.27-0.29/MMBtu, which could have been worth over $180 million each.

- Domestic gas prices in WA are also significantly higher. WA wholesale domestic gas prices, as measured by ABS, were 7.0% higher qoq in Q3 2021.

- The share of coal power generation (CPG) in the NEM slumped to 62.3% in Q3, a record low, and gas power generation’s (GPG) share fell to 6.1%, a Q3 record low. Renewables reached a 23.7% share. Total clean energy (including hydro) was 31.6%.

- In South Australia the share of renewables has grown from 66% in September to 76% in November, with the gas share slumping from 33% to 24%.

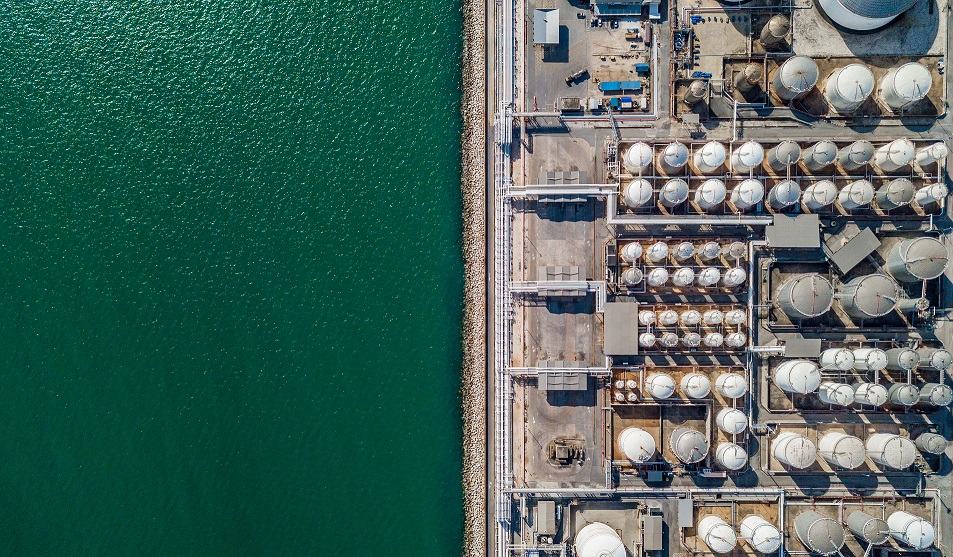

- National petroleum production climbed to a quarterly record in Q3 2021, driven by record LNG exports. The record result reflected a recovery in national LNG production, which was affected throughout FY 2021 by rolling shut-downs of all three trains at Gorgon and patchy results from the North West Shelf (NWS). A strong recovery in production from Ichthys compared to Q2 2021 and the fact Prelude was finally running at near nameplate capacity were also significant factors in the national record.

- Australia exported 21.1 Mt of LNG in Q3 2021 – a quarterly record. The strong performance continued into October, when the industry shipped a record 7.23 Mt (105 cargoes), up from 6.96 Mt (101 cargoes) in September.

- The main threat to Australia’s LNG industry is not emissions reduction but a lack of reserves. Based on the life of existing reserves, the NWS could exhaust its reserves by 2028; Wheatstone by 2033; Prelude and Darwin (including Barossa) by 2044 and Ichthys, Gorgon and Pluto/Scarborough by around 2050.

- East coast LNG projects shipped a total of 5.9 Mt in Q3 2021, up from 5.7 Mt in Q2 2021 and 5.3 Mt in Q3 2020.. The industry shipped 2.12 Mt (32 cargoes) in October and averaged 96% of nameplate capacity.

- National oil production increased from 9.6 MMbbl in Q2 2021 to 10.4 MMbbl in Q3 2021 thanks to good results from Woodside’s Vincent project and the NWS, and a rebuild of volumes from the Santos-operated Van Gogh project.

- South Australia is at the centre of boom in exploration for natural hydrogen, which began with the chance rediscovery of historical reports of hydrogen results from two wells drilled in the 1930s. From a starting point of zero activity in February 2021, SA now has 18 Petroleum Exploration Licences (granted or applied for) from six companies targeting natural hydrogen. The combined area under permit is 570,000 km2 or 32% of the entire state.

- Gas production in New Zealand continues to decrease rapidly, while a new report commissioned by government on the outlook for gas supply has confirmed what we already knew – policy is driving down production and sidelining the gas industry long before the country has the energy alternatives it needs.