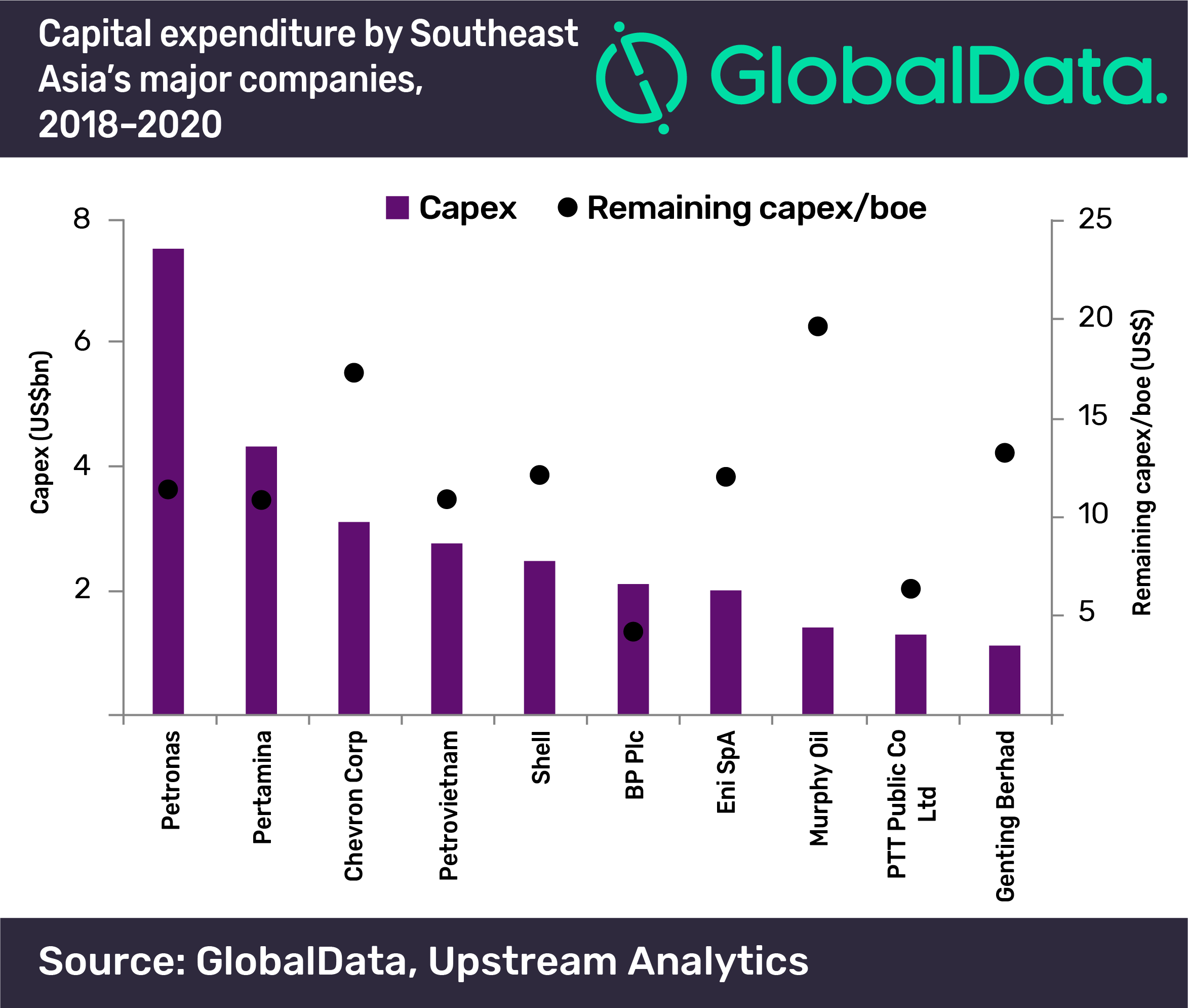

An average capital expenditure (capex) of $17.8bn per year will be spent on 336 oil and gas fields in Southeast Asia between 2018 and 2020, according to GlobalData, a leading data and analytics company. Capex on Southeast Asia’s traditional oil projects will add up to $8.3bn over the three-year period, while heavy oil fields will require $1.7bn over the same period. Investments into gas projects in Southeast Asia will total $43.4bn in upstream capex by 2020. Jonathan Markham, Oil & Gas Analyst at GlobalData said, “Shallow water projects will be responsible for over 63 percent of $46.

Archives for May 2018

May 2018

BP Commits to Sell Gas to Alaska LNG Project

The Alaska LNG Project has reached a "historic milestone" as BP Alaska and Alaska Gasline Development Corporation (AGDC) announced the parties have agreed to key terms of a Gas Sales Agreement, including price and volume. The terms are captured in a Gas Sales Precedent Agreement which was signed on May 4, 2018. In a statement Alaska Gas Development Corporation said both the parties anticipate finalizing a long-term gas sales agreement in 2018 for AGDC to purchase BP Alaska’s share of 30 trillion cubic feet (TCF) of gas from the Prudhoe Bay and Point Thomson units.

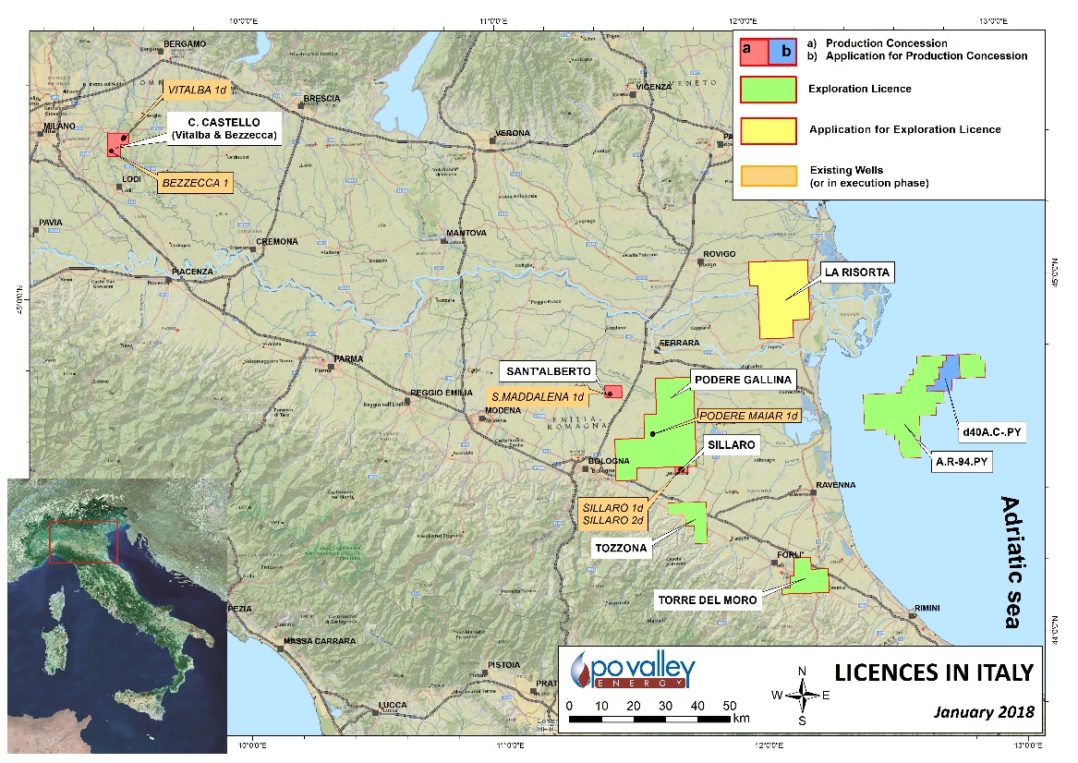

Po Valley raises funds for Italian operations

Po Valley Energy Limited has secured funding of $2.5m through the issue of a convertible note with a conversion price of $0.042 per share and a maturity of three years. The ASX-listed company said the funds will be used to expedite a final investment decision for its successfully drilled onshore Selva field in Italy and to complete seismic work on its large oil condensate/gas Torre del Morro explorations licence. Company directors Kevin Bailey and Michael Masterman both intend to participate in the note issue for $700,000 and $300,000 respectfully, subject to shareholder approval, Po Valley said.

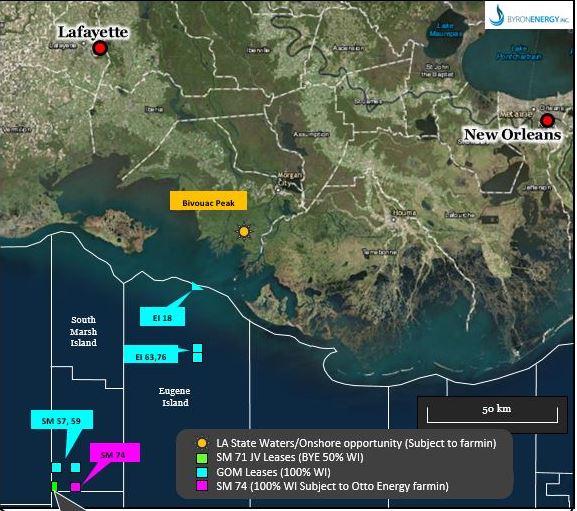

Byron hits 90% production mark in Gulf of Mexico

ASX-listed Byron Energy has hit 90 percent production capacity at its SM 71 F platform in the Gulf of Mexico, ramping up operations following a pipeline shut-in earlier in April. Production from the company’s SM 71 F platform began on March 23 from the SM 71 F1 and F2 wells with the F3 well following suite on April 6. For the period March 23 to April 25, the three wells produced a total gross sales volume of 83,000 barrels of oil and 55.5 mm cubic feet of natural gas.

Blue Energy raises concerns over hydraulic stimulation

Blue Energy is concerned about that additional layers of regulation governing hydraulic stimulation could burden an already labouring oil and gas industry. Barely two weeks after the Northern Territory government lifted the moratorium on hydraulic fracturing in the north of Australia, Brisbane-based Blue Energy welcomed the development, but also noted some concerns in its quarterly activities report released last week.