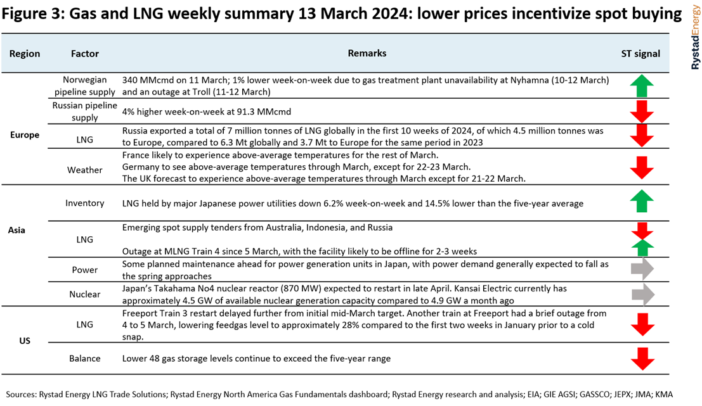

Energy’s gas and LNG market update from senior analyst, Masanori Odaka:

Spot prices in Asia remain under $10 per million British thermal units (MMBtu), well below those seen in the same period in 2022 and 2023, leading to revised optimization demand from buyers.

In general, gas demand and consumption in the northern hemisphere is set to fall in the coming weeks as most countries enter the spring season.

In Europe, April prices on the Netherlands-based Title Transfer Facility (TTF) fell 9.8% week-on-week to approximately $7.9 per MMBtu on 12 March.

Minor supply outages and restocking demand while prices are low may set a floor for spot prices.

ASIA

The Asian spot LNG price for April delivery has been hovering around $9 per MMBtu, with the monthly average likely to settle around $8.5 per MMBtu on 15 March.

Financial derivatives for May 2024 were down approximately 5.2% week-on-week to $8.7 per MMBtu on 12 March.

For some Asian importers, this is lower than their oil-linked long-term contract prices which range from $10 to $12 per MMBtu.

It means that major importers in mainland China, Japan and South Korea are likely to prioritize spot purchases and minimize purchasing from long-term contracts which are usually priced as a slope to oil prices, exercising the downward quantity tolerance (DQT) clause if their long-term contracts allow them to do so.

Some market participants believe this may be the reason for recent tenders from suppliers such as Oman, which is offering two cargoes for either Asia and Middle East delivery in May, from Australia’s Ichthys, which is offering two cargoes for 31 March to 4 April delivery and 10 to 14 June loading, from Russia’s Sakhalin Energy, which is potentially offering cargoes for May loading, and from Indonesia’s Tangguh, which is offering four cargoes on a free on-board (FOB) basis in April and May.

In Indonesia, supply from Tangguh LNG has been reduced since February due to Train 2 facing production hiccups, although the plant may restart in mid-March.

Total exports from Tangguh LNG for weeks 1 to 10 was around 1.4 million tonnes in 2024, compared to 1.7 million tonnes for the same period in 2023.

In terms of demand, Asia imported a total 50.2 million tonnes of LNG in weeks 1 to 10 this year, compared to 47.6 million tonnes for the same period in 2022 and 47.5 million tonnes over the same timeframe in 2023, indicating that supply to the region remains robust.

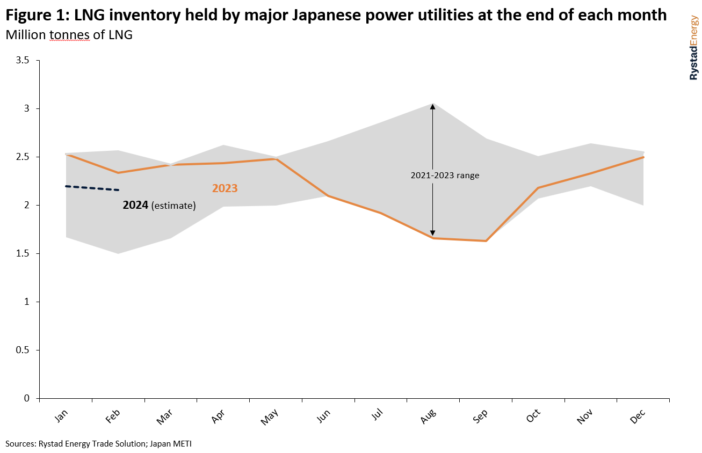

In Japan, major power utilities reported combined gas storage levels of 1.83 million tonnes on 10 March. This is down 6.2% week-on-week, 14.5% lower than the five-year average from 2018-22 for the end of March, and 21.5% lower than the 2.33 million tonnes reported at the end of March 2023.

Jera, Japan’s largest electricity producer, briefly shut combined-cycle gas turbine (CCGT) Unit 7-1 and Unit 7-2 at its Kashima power complex on 11 March due to technical issues, but then restarted both units within 24 hours, according to Japan Electric Power Exchange (JEPX).

Jera’s Sodegaura gas-fired power plant Unit 2 (1 GW nameplate capacity) began maintenance work on 12 March without a planned restart date, according to JEPX.

As previously mentioned, Jera’s 1.07 GW-coal-fired Taketoyo power plant Unit 5 has been offline since February with no announced restart date as of 13 March. In western Japan, J-Power’s Tachibana coal-fired power plant (1.05-gigawatt [GW] nameplate capacity) has been offline since 15 February.

Europe

Underground gas storage facilities in Europe are down 2.6% to approximately 67 billion cubic meters (Bcm) or 60% full as of 11 March, with LNG for delivery into Europe trading at $7.5 per MMBtu on 11 March, 6% down on the week and 40% lower than at this time a year ago.

Europe imported approximately 22.6 million tonnes of LNG in the first 10 weeks of 2024, compared to 22.32 million tonnes and 23.95 million tonnes in the same period for 2022 and 2023, respectively.

In Norway, total pipeline flows into Europe were lower at 340 million cubic meters per day (MMcmd) on 11 March, down 1% week-on-week.

A gas treatment plant at Nyhamna was unavailable from 10 to 12 March, while Troll was offline from 11 to 12 March.Gas pipeline flows from Russia to Europe are up 4% week-on-week to approximately 91.3 MMcmd as of 10 March.

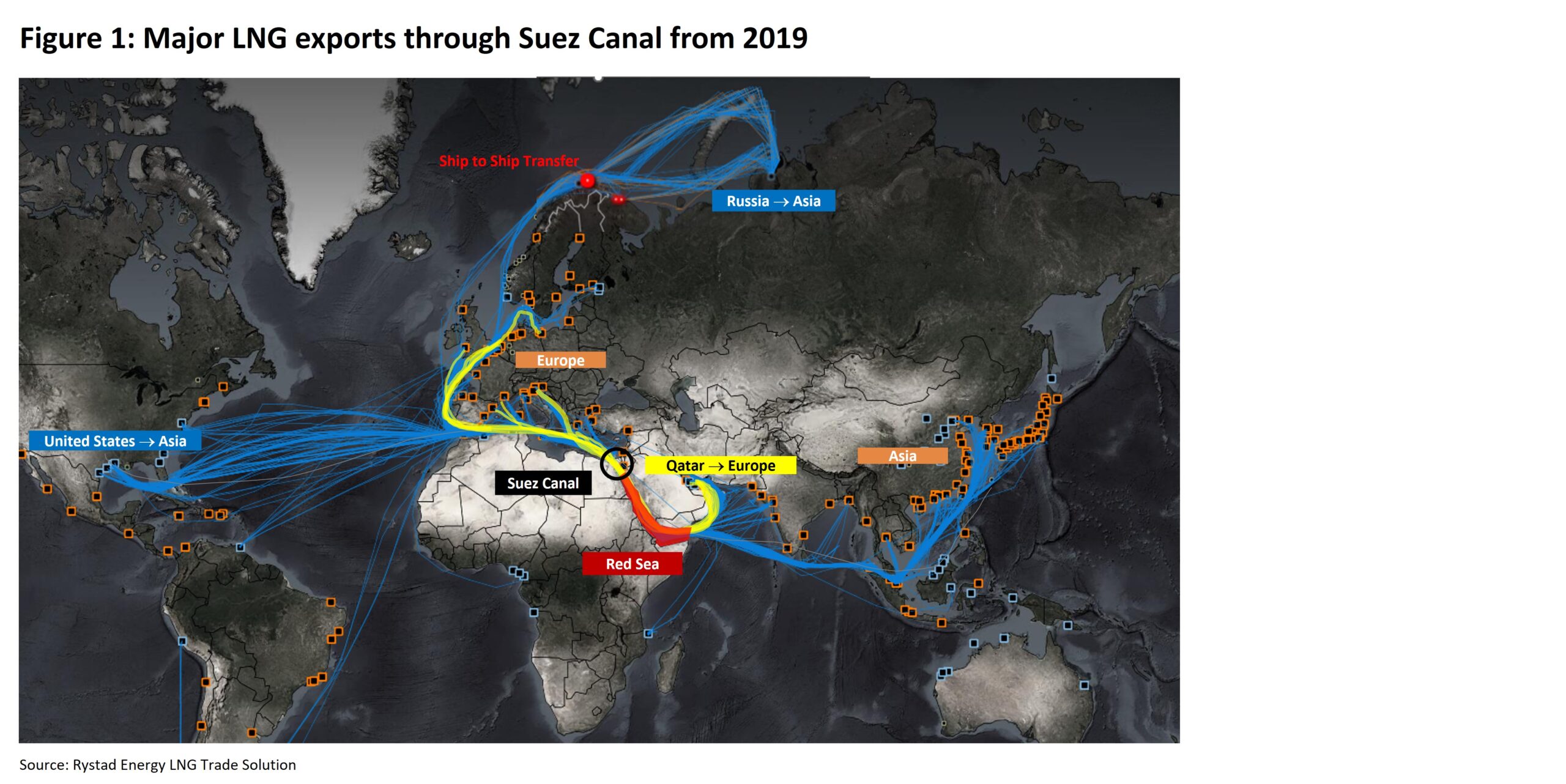

Russia’s exported a total 7 million tonnes of LNG globally in the first 10 weeks of 2024, of which 4.5 million tonnes of LNG was discharged in Europe for the same period, compared to 6.3 million tonnes globally and 3.7 million tonnes to Europe for the same period in 2023.

US

Henry Hub prices were down 13% to approximately $1.7 per MMBtu on 12 March at the tail end of the winter demand season.

However, the market is approaching the floor for spot gas prices following recent news that Chesapeake Energy and EQT Corporation have curtailed gas production.

This has started to materialize in Appalachia production levels, which have declined from highs of 35 billion cubic feet per day (Bcfd) in January to around 34 Bcfd currently.Lower 48 gas storage continues to exceed the five-year range, ensuring there is a short-term ceiling for prices and that withdrawals remain modest due to mild late-winter temperatures.

Storage levels are now 13.6% higher than in 2023 and nearly 31% higher than the five-year average.

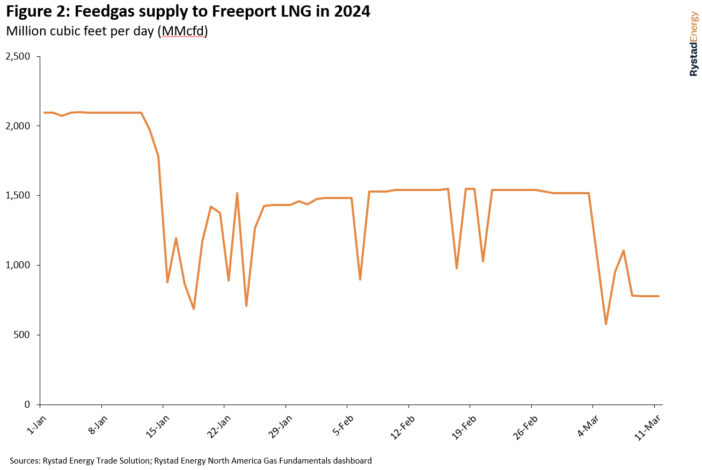

Late-winter temperatures are too mild to significantly impact storage. However, Freeport LNG train 3 remains offline with bleak prospects of returning in the timeline last communicated by the developer.

Feedgas flows averaged 997 million cubic feet per day (MMcfd) last week, 37% below January utilization levels, ensuring balances remain in surplus territory.

US dry gas production has declined about 9 Bcfd from highs of 105 Bcfd in week 10.

We anticipate supply will average 103 Bcfd in March. Approximately 13.32 Bcfd of feedgas was supplied to US LNG terminals on 11 March, up 5.4% compared to 12.64 Bcfd a year ago.