Rystad Energy’s Gas and LNG Market Update from Senior analyst Lu Ming Pang has revealed a slump in Title Transfer Facility (TFF) prices.

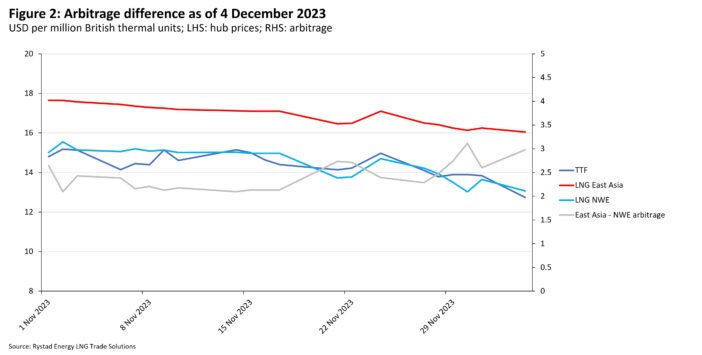

TTF prices were down to $12.07 per million British thermal units (MMBtu) on 6 December, compared to $13.71 per MMBtu on 28 November.

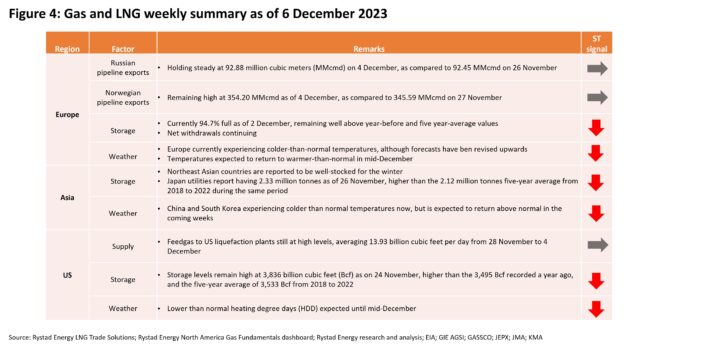

Despite expectations of colder weather earlier last week, the forecasts have since been revised to warmer weather, tempering demand amid high underground storage levels of 108.30 billion cubic meters (Bcm) at 94.7% full on 1 December.

The Asia spot LNG price was also down to $16.06 per MMBtu as of 6 December, compared to $16.42 per MMBtu on 28 November.

This is despite news of cold weather in mainland China and South Korea in the current week, signaling that these major consumers are already well prepared for the winter.

The US Henry Hub price remains deflated at $2.70 per MMBtu as of 6 December, compared to $2.84 on 28 November.

This is because US production remains high amid high storage levels and relatively low demand.

Europe

Forecast temperatures were revised upwards this week, limiting gas demand for heating amid a period of solid gas pipeline and liquefied natural gas (LNG) supplies entering the region.

TTF prices have fallen slightly to $12.07 per MMBtu from $13.71 per MMBtu last week.

The weather is expected to remain colder than average until 8 December before transitioning to warmer-than-normal temperatures until mid-December.

Withdrawals from underground storage have continued since early November, although levels remain high at around 108.30 Bcm or 94.7% full as of 2 December.

This is higher than the 99.61 Bcm or 91.6% reported on the same date a year ago.

Europe has comfortably hit the 90% storage target set for 1 November 2023, exceeding the target and being close to 100% full as of the target date.

Pipeline flows from Norway remain strong at 354.20 million cubic meters per day (MMcmd) as of 4 December, compared to 345.59 MMcmd a week ago on 27 November.

Pipeline supplies from Norway have comfortably held above 300 MMcmd since the beginning of November following extended maintenance during the summer months and are anticipated to undergo maintenance on a similar scale in February 2024.

The current flow rates are marginally higher than the highest daily Norwegian pipeline flow of 343.20 MMcmd experienced on 9 January 2023, the previous winter season.

Pipeline flows from Russia remain stable at about 92.88 MMcmd as of 4 December, in line with the 92.45 MMcmd seen a week ago on 26 November.

Russian pipeline flows have remained steady in this range after the TurkStream facility completed maintenance in mid-June 2023.

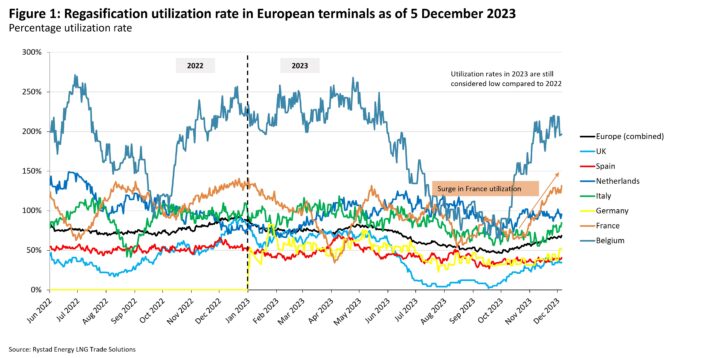

Entering the depths of winter, regasification utilization rates in Europe from European terminals have also increased.

Overall utilization in Europe as of 5 December is at 68.56%, higher than the average utilization of 61.95% in November and 52.73% in October.

Most European countries have experienced an increase in regasification rates; however, France has seen utilization jump to 122% as of 3 December, compared to about 107% in November and 70.57% in October.

The current month-ahead January TTF prices are $12.56 per MMBtu, with May TTF prices at $12.35 per MMBtu.

The contango structure – when the futures price is higher than the spot price – seen earlier in the year has since flattened, with a peak of $12.70 per MMBtu in February, which then declines to $12.30 per MMBtu in July 2024.

European buyers with any gas already planned for delivery in the short term or in storage will find it incentivizing to retain these volumes in the summer with the current price structure.

The price difference between the Asian and European hubs is around $2.98 per MMBtu, while the difference between freight shipping between the two markets is about $2 per MMBtu, suggesting that the arbitrage is open.

ASIA

In Asia, news of cold snaps in China and South Korea do not appear to have fazed the continued decline of the Asia Spot LNG price, falling from 16.42 per MMBtu to 16.06 per MMBtu.

Gas and LNG storage levels have been reported to remain high in the main LNG demand centers of Japan, South Korea and China.

A warmer-than-expected winter will likely keep demand low amidst the required storage levels, suppressing prices.

The Korean Meteorological Administration (KMA) reports a higher probability of below-normal temperatures until 17 December before transitioning to a higher likelihood of above-average temperatures through 7 January.

The Japan Meteorological Agency (JMA) forecasts low average temperatures in Hokkaido and normal to high levels of average temperatures for the rest of the country.

Japanese utilities reported having stocks of 2.33 million tonnes as of 26 November, which is higher than the average end-of-November stocks of 2.12 million tonnes from 2018 to 2022.

This is slightly lower than the 2.49 million tonnes reported a week earlier on 20 November and the 2.55 million tonnes reported at the end of November 2022.

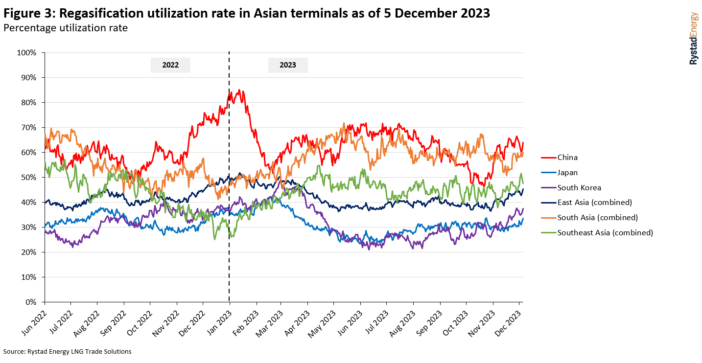

Regasification utilization rates in East Asia have increased overall, mainly due to increases in China and South Korea.

China’s utilization rates have increased from an average of 50% in October to 62% at the end of November. South Korea utilization rates have risen from 28.4% in October to 36% at the end of November.

Japan utilization rates have held at 30% from October to the end of November.

Regasification utilization rates in South Asia and Southeast Asia have mainly held constant.

USA

High gas production in the US of about 119.4 billion cubic feet (Bcf) as of 29 November and high underground gas storage levels are keeping Henry Hub prices deflated, falling from $2.84 per MMBtu last week to $2.68 per MMBtu on 5 December.

Demand for heating remains tepid, with lower-than-average heating degree days (HDD) expected until mid-December for most of the country.

An injection of about 10 Bcf was observed in storage levels to 3.83 Bcf on 24 November compared to 3.82 Bcf reported on 17 November.

This is much higher than the 3.49 Bcf recorded a year ago on 24 November and the 3.53 Bcf recorded on a five-year average from 2018 to 2022 in the same period.

Feedgas into US LNG terminals remained strong at an average of 13.93 Bcfd from 28 December, declining from an average of about 14.45 Bcfd the previous week.

A new contract was signed last week between Cheniere Energy and OMV for approximately 0.85 million tonnes per annum of LNG, delivered into the Netherlands’ Gate terminal.

This contract was signed on a delivered ex-ship (DES) basis from a US-based LNG facility, which is rare, and it was also indexed against the TTF hub, which is rare.