Pipeline gas to Europe declined 10% in May but robust Europe and Latin America demand saw LNG exports rise 3.5% year-on-year as gas storage sites continued refilling in the USA and Europe, the latest report from the Gas Exporting Countries Forum has revealed.

The report summed up the global gas landscape as follows:

Global economy

The projected global GDP growth for 2023 is expected to decelerate to 2.2%, as indicated by Oxford Economics. Inflationary pressures have been easing due to weaker energy and other commodity prices, as well as the alleviation of supply chain bottlenecks. Global inflation is anticipated to gradually subside to 5.6% in 2023. During the G7 Hiroshima Summit, the leaders acknowledged the importance of supporting investment in the gas sector in order to avert potential supply shortages.

Gas consumption

In May 2023, the European Union experienced a 6% y-o-y drop in gas consumption, reaching 20 bcm. However, amidst this decline, the residential sector defied expectations by embracing a surge in gas usage due to an unusually chilly two-week weather spell. Meanwhile, China showcased its insatiable thirst for progress by soaring to 129 bcm of apparent gas consumption from January to April 2023, a 3.5% y-o-y increase. As for the United States, gas consumption rose by 1% y-o-y in May, with a significant 5% growth in the power generation sector (equivalent to 1.3 bcm).

Gas production

In April 2023, Europe experienced a 3.2% y-o-y drop in its gas production, reaching an output level of 15.6 bcm. This reduction was primarily attributed to declining production in both the Netherlands and UK. In contrast, May 2023 witnessed a 5% y-o-y increase in gas production in the seven major US shale oil and gas regions, culminating in an output of 85.1 bcm. On a global scale, the gas rig count for May 2023 showed a slight monthly dip of 25 units. However, the gas rig count still marked a significant yearly growth of 36 units, bringing the total count to 383 units.

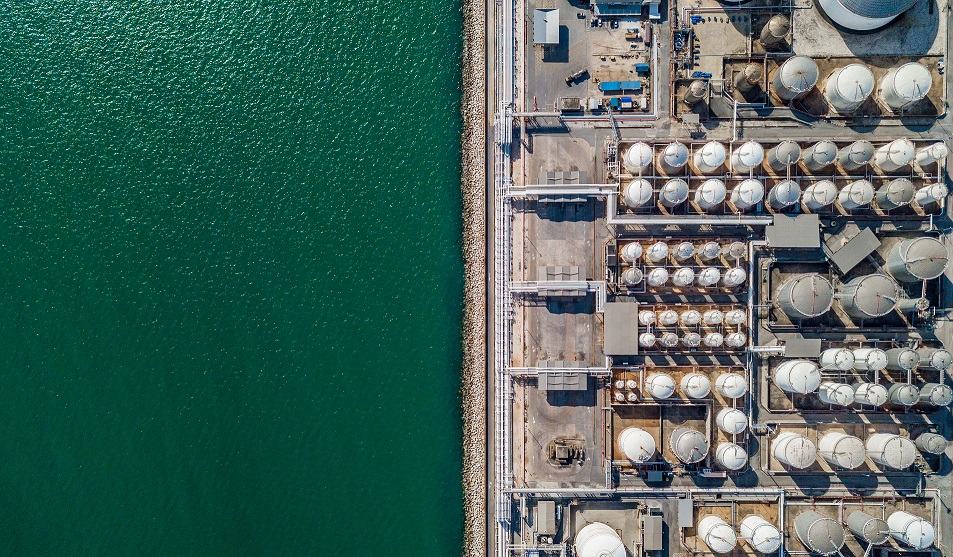

Gas trade

In May 2023, pipeline gas imports to the EU fell by 10% m-o-m, reaching 12.7 bcm. Global LNG imports experienced a 3.5% y-o-y growth, reaching 34.4 Mt. This growth was primarily driven by robust LNG demand in Europe and Latin America and the Caribbean (LAC), which offset weaker imports in the Asia Pacific and MENA regions. Despite favourable spot LNG prices in the Asia Pacific, there was a continued flow of LNG towards Europe. The expansion of European LNG imports can be attributed to the declining pipeline gas imports. In the LAC region, Argentina witnessed a doubling of LNG imports compared to the previous year, as pipeline gas imports from Bolivia continued to decline. Moreover, Hong Kong joined the ranks of LNG importers in May 2023.

Gas storage: The restocking of gas storage sites in Europe and North America continued during May 2023, albeit at a slower pace when compared to the same period in 2022. In the European Union, the average level of gas in underground storage was 67.3 bcm, which represents 65% of the region’s storage capacity. The reduced injection demand exerted downward pressure on gas and LNG spot prices. Meanwhile, in the United States, the level of underground gas storage rose to 64.9 bcm, representing 48% of its capacity. The combined LNG in storage in Japan and South Korea was estimated to be 10.6 bcm.

Energy prices

Gas and LNG spot prices in Europe and Asia reached their lowest levels in two years, primarily due to ongoing weak gas demand and ample EU storage levels. This resulted in downward pressure on prices. The average spot prices for TTF and NEA LNG stood at $10/MMBtu, marking declines of 27% and 17%, respectively, compared to the previous month. The relatively low gas spot prices are expected to encourage coal-to-gas switching in Europe, potentially leading to price increases. In addition, the emerging buying interest from price-sensitive LNG importers in South and Southeast Asia may contribute to some upward movement in prices.