Red Sea tensions could significantly impact Europe’s LNG deliveries, but a TTF price jump was short-lived as fundamentals keep gas prices muted.

Settings

That is according to Rystad Energy’s latest gas and LNG market update from senior analyst, Lu Ming Pang:

Title Transfer Facility (TTF) prices are at $10.72 per million British thermal units (MMBtu) as of 20 December, compared to $11.22 per MMBtu on 12 December.

Recent attacks in the Red Sea have led to multiple ship diversions, with several operators, such as UK major BP, choosing to bypass the Suez Canal and the adjacent Red Sea to avoid vessels being entangled in an escalating situation.

TTF prices rose to $11.41 per MMBtu on 18 December due to potential disruptions along the major trade route, although prices promptly fell due to stronger bearish global fundamentals on a warmer Northern Hemisphere winter so far, along with strong underground gas storage levels.

Asia spot liquefied natural gas (LNG) prices are now at $11.78 per MMBtu as of 19 December, following general price movements downwards as observed in the TTF price.

Despite cold weather pummeling mainland China and South Korea, strong inventory levels and an expected warmer winter have not yet caused concern to increase demand for LNG in East Asia.

The US Henry Hub price increased to $2.52 per MMBtu as of 20 December, reversing weeks of general decline since the end of October.

This is despite high domestic production, a relatively warm start to the winter, and storage still at high levels compared to previous years.

The Henry Hub price is expected to fluctuate until more clarity on the weather forecast for the winter leading into January and February.

Red Sea attacks

An increasing number of attacks on vessels transiting through the Red Sea has kept shipping players on their toes.

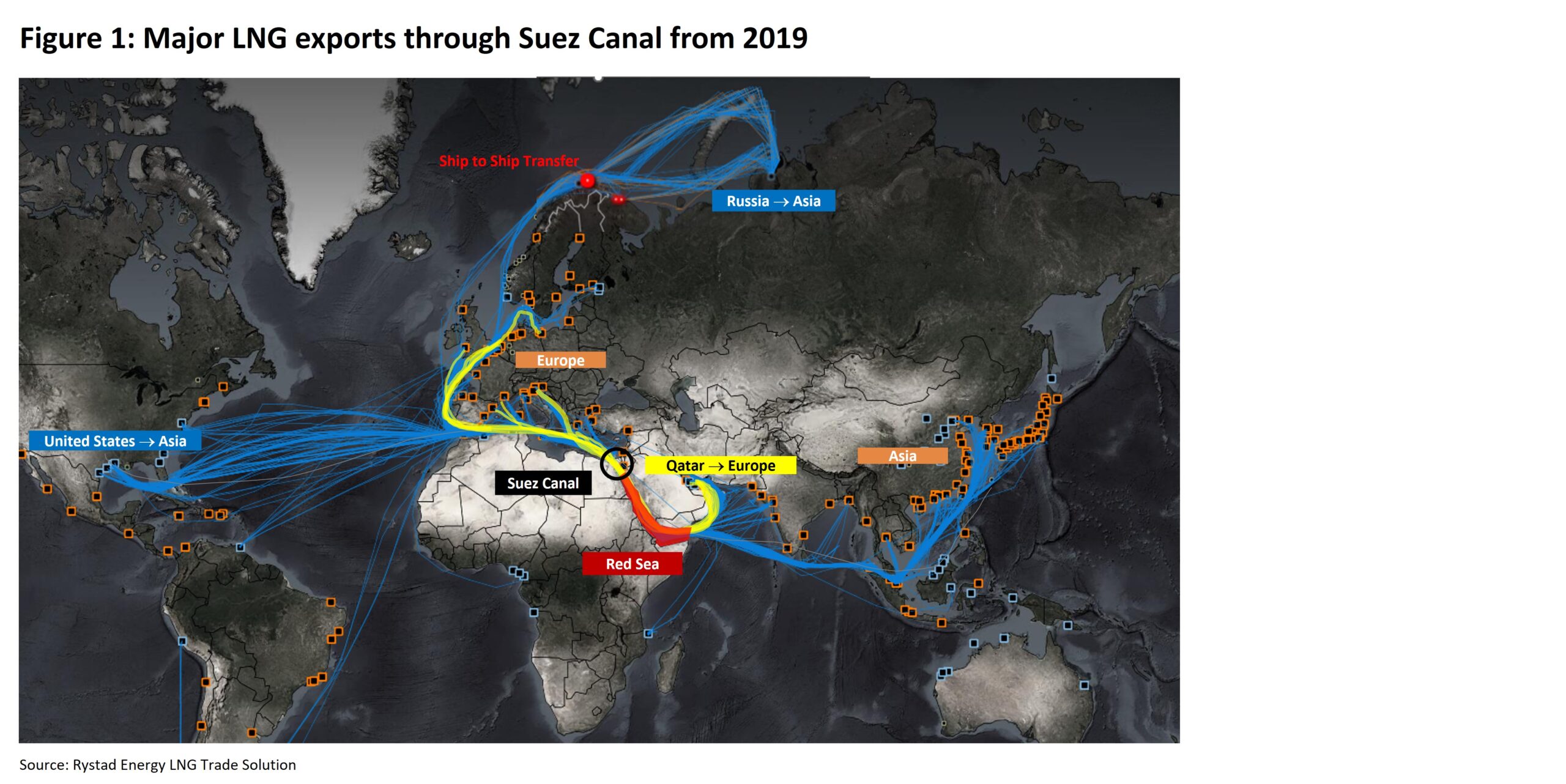

The Red Sea is an important waterway that all vessels passing through the Suez Canal must transit.

The Suez Canal is a major artery for global trade, with significant LNG exports through the canal mainly consisting of deliveries from Qatar to Europe and exports from the US and Russia to Asia.

Based on Rystad Energy’s live vessel-tracking data, virtually all Qatari exports to Europe have gone through the Suez Canal.

In 2022, Qatar exported 19.84 million tonnes to Europe through the Suez Canal, with a year-to-date of 13.74 million tonnes in 2023.

Qatar to Europe trade volumes are the largest LNG trade flow through the canal, compared to the second largest, US exports, which were 6.41 million tonnes in 2022.

Diverting Qatari vessels to Europe via the Cape of Good Hope off Southern Africa would imply that voyage durations would increase by about 17 days, doubling the current duration, assuming a cruising speed of 15 knots.

This is due to an increase in the average distance, which is about 10,400 kilometers via the Suez Canal and about 23,000 kilometers via the Cape of Good Hope.

In 2022, Qatar provided about 20.11 million tonnes out of the total LNG exports of about 123.10 million tonnes to Europe, which is about 16.3%.

Long-term LNG contracts from Qatar to Europe are on a delivered ex-ship (DES) basis, possibly containing destination clauses.

If Qatari LNG cargoes to Europe are disrupted in the Red Sea, additional shipping capacity may be required to cover the additional voyage duration if trade flows are required to pass around the Cape of Good Hope.

Depending on contract clauses and negotiations, arranging for European LNG deliveries through other methods may become feasible.

In 2022, the US exported 6.41 million tonnes of LNG through the Suez Canal, compared to 10.84 million tonnes through the Panama Canal.

The Panama Canal was the more popular route due to vessels taking only an average of 30 days to travel to East Asia.

With the current drought in the Panama Canal limiting transits per day and new troubles in the Red Sea, LNG shippers may have to look towards using the Cape of Good Hope if the situation escalates.

Based on our vessel-tracking data, a voyage from the US to East Asia through the Suez Canal takes about 39 days to complete, compared to 42 days via the Cape of Good Hope.

In the current well-supplied market where both Europe and Asia are currently experiencing lower demand for LNG due to robust inventories built up before the winter, diverting cargoes away from the Suez Canal and the Red Sea to incur a longer voyage duration is not likely to significantly shift bearish market fundamentals.

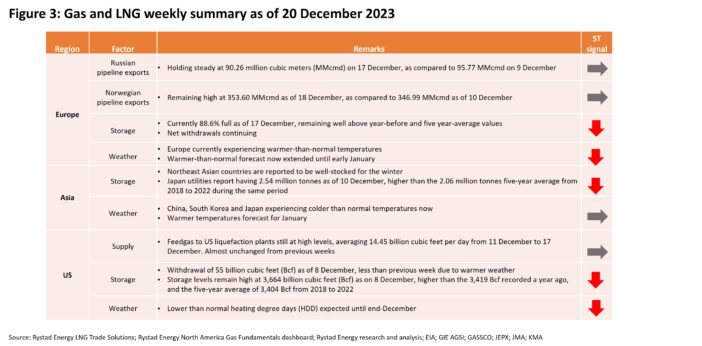

Europe

TTF prices continued to decline to $10.72 per MMBtu as of 20 December, mainly driven by bearish fundamentals due to solid inventory levels and healthy gas pipeline import flows.

European underground storage was at 101.80 billion cubic meters (Bcm) or 88.6% full on 17 December, higher than the 91.19 Bcm or 83.9% full experienced on the same date in 2022.

This is likely due to a warm start to the winter in Europe, with inventories close to 100%, compared to about 95% full in 2022.

The winter has also been warmer than expected, with forecasts for the remaining December and early January indicating warmer-than-normal weather, which would limit gas demand for heating.

Gas pipeline supplies into Europe remain healthy, propping up supply fundamentals in a time of weaker demand.

Norwegian pipeline flows were at 353.60 million cubic meters per day (MMcmd) as of 18 December, with almost no change since the 346.99 MMcmd reported on 10 December. Russian pipeline flows remained relatively unchanged at 90.26 MMcmd on 17 December, compared to 95.77 MMcmd a week ago on 9 December.

A new contract for Equinor to supply 10 Bcm to German state-owned energy firm SEFE from 2024 to 2034 was signed on 19 December.

The deal is estimated to be worth around $50 billion, with an option to extend the contract by a further 29 Bcm across an additional five years.

The deal also includes a non-binding letter of intent that SEFE will be an offtaker of low-carbon hydrogen supplies starting in 2029.

As reported last week, the futures prices of the TTF contract continue to reflect bearish sentiments in the winter market, as referenced from the February 2024 delivered price of $10.87 per MMBtu.

A flat structure then extends into September 2024, with a price of $10.99 per MMBtu.

Asia

The LNG spot price for February 2024 remains at $11.75 per MMBtu as of 19 December, being relatively unaffected on its decline despite East Asia being buffeted by colder-than-normal temperatures.

Strong storage fundamentals that were built up for the winter continue to suppress prices, keeping demand for winter restocking weak.

Most East Asia utilities have reported being well-stocked for the winter, which supports the observations of relatively tepid demand in December so far, even amid cold weather in recent weeks.

China is experiencing colder-than-normal temperatures across most provinces close to the eastern coast.

Beijing is expected to experience temperatures of about -16.9 degrees Celsius (°C) on 20 December, an entire 11.06°C below seasonal norms.

The cold weather has even reached southern provinces, including Guangzhou city in Guangdong province, where temperatures are expected to be below 10°C until 25 December, compared to seasonal average temperatures typically above double digits.

In South Korea, temperatures are below normal and expected to fall further to 7.3°C below normal by 21 December.

However, the forecasts for the remainder of December and January paint a different story.

According to the Korean Meteorological Administration (KMA), there is a 50% probability for normal temperatures expected for the rest of December.

Moving into January, there is a 40% probability of above-normal temperatures for the first two weeks of January before transitioning into an even higher 60% probability of above-normal temperatures for the third week.

The warmer-than-normal temperatures for January will likely dampen gas and LNG demand and may make up for higher consumption during colder weather in recent weeks.

In Japan, the Japan Meteorological Agency (JMA) is expecting high probabilities of below-normal temperatures throughout the country until 22 December.

For the remainder of December, Hokkaido is expected to experience above-normal temperatures, while the rest of the country is expected to experience near-normal temperatures.

Similar to South Korea, January is forecast to bring above-normal temperatures to the whole of Japan, which would dampen gas and LNG demand.

Overall, East Asia has forecast a warmer-than-normal winter due to the El Nino effect, although developments in weather may be challenging to predict up until two weeks before the actual day.

Japan utility LNG inventories were reported to be 2.54 million tonnes on 10 December, up from the 2.19 million tonnes reported on 3 December.

This is slightly higher than the 2.53 million tonnes reported at the end of December 2022 and higher than the 2.06 million tonnes five-year average from 2018 to 2022.

Regasification utilization rates across East Asia have held stable at around 44% in December compared to about 40% in November.

This increase in early December was mainly contributed by Japan, as reported last week.

South Asia utilization rates remain at around 55%, while Southeast Asia was about 45%.

US

The Henry Hub price increased slightly to $2.52 per MMBtu as of 20 December, compared to $2.44 per MMBtu reported on 12 December.

Prices at the Henry Hub have remained relatively deflated since the end of October, as underground inventories and domestic gas production remain at very high levels amid a relatively warm start to the winter.

The increase in the Henry Hub price in the past week may be due to uncertainty about how the weather forecasts may turn out by the end of the year.

US underground storage was 3,664 billion cubic feet (Bcf), or about 87.32% full as of 8 December 2023.

This is higher than the 3,419 Bcf reflected a year ago on 8 December 2022 and the 3,404 Bcf five-year average from 2018 to 2022.

This also reflects a 55 Bcf withdrawal reported on 8 December, compared to a higher withdrawal of 117 Bcf reported on 1 December the week before.

This is likely because warmer-than-expected weather in the week leading up to 8 December may have reduced withdrawals.

Like last week, forecasts expect the number of heating degree days (HDD) to remain below average until the end of December, implying reduced winter heating demand amid warmer weather forecasts.

The number of HDDs is expected to return to slightly below average by the turn of the year.