Woodside, is aiming to commercialise Senegal’s first ever oilfield by 2022, Mr Jamie Stewart, Woodside’s Business Integration Manager for the Senegal Field Development, told the Paydirt 2018 Africa Down Under mining conference in Perth last week.

In an update on the SNE Development – Phase 1, Mr Stewart said a number of important items have already been ticked off in the lead-up to a Final Investment Decision (FID) in 2019 for the world-scale project, with a number of key decisions on the horizon.

These include the submission of the draft Environmental and Social Impact Assessment Report and the SNE Field Development Evaluation Report.

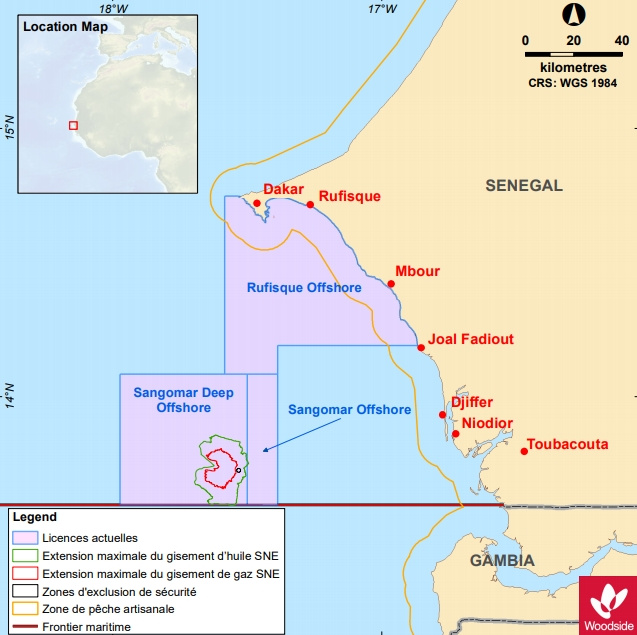

Woodside and its Rufisque, Sangomar and Sangamor Deep (RSSD) JV partners are currently evaluating tender responses for key contracts, and a number of cost reductions approaching 10% are being progressed and secured.

One of the looming decisions is the selection of the winning contractor for the Front End Engineering and Design (FEED) for the proposed use of a Floating Production, Storage for Offloading Facility for Phase 1.

Second half 2018 activities will include submission of the final Environmental and Social Impact Assessment and the field exploitation plan in the lead-up to FEED entry for the project.

The deepwater SNE Field will be Senegal’s first oil field and is expected to provide a significant social and financial boost to Senegal, with Phase 1 proposing to commercialise total recoverable oil of ~240 MMbbl.

Mr Stewart told the ADU audience that a major focus of local development will be the port of Dakar, which will be a critical piece of infrastructure for the Phase 1 development.

The Dakar port had also been identified as providing significant opportunities for local content involvement.

Woodside, which currently holds a 35% interest in the RSSD JV, acquired a material position in the highly prospective offshore region of Senegal in 2016 as a joint venture participant in the RSSD exploration blocks, located 100km south of the capital of Dakar.

The SNE field commercialisation concept is based on a phased development proposal, focusing first on the less complex lower reservoir units. Subsequent phases will target more complex reservoir units.

Woodside achieved a concept select decision at the end of 2017 and entered concept definition. The Phase 1 development concept for the SNE field is a stand-alone FPSO facility with subsea infrastructure. It will be designed to allow subsequent SNE development phases, including options for potential gas export to shore and for future subsea tiebacks from other reservoirs and fields.

The Australian company, which is making the transition to Operatorship of the RSSD JV, introduced FPSO technology into Africa in 2006 when it acquired the Chinguetti field into production off the coast of Mauritania and currently operates a number of FPSO-based developments off the West Australian coast.

Woodside’s expertise in horizontal well and completion design, subsea gathering system design, project execution and production excellence will also prove important in the Phase 1 development of SNE.

Phase 1 will include up to 26 oil production and gas and water injection wells. The expected FPSO oil production capacity is approximately 100,000 bbl/day. Gas sales opportunities are being explored to support incremental gas export.