TGS will acquire Spectrum in a deal which has been announced as a merger set to create a “leading provider of 2D and 3D seismic data”.

This follows an agreement of shareholders of both companies, triggering a transaction which is expected to be completed as a statutory merger pursuant to Norwegian corporate law between TGS and Spectrum.

Under the terms of the agreement, Spectrum shareholders will received 0.28 shares for one Spectrum share in addition to a cash consideration of US$0.27 multiplied by the exchange ratio subject to the transaction closing after the ex-date for the TGS dividend, payable in the third quarter and expected to be in early August.

The Exchange Ratio and the cash consideration imply a transaction share price of Spectrum of NOK 61.9 per share (based on closing of the TGS share on 2 May 2019), corresponding to a market capitalization of US$ 422 million on a fully-diluted basis.

The transaction was supported by the board of directors of both companies, as well as Spectrum shareholders representing more than 34% who also agreed to vote their shares in favour of the deal.

Definitive merger documents are expected to be entered into during May, with closing of the transaction expected during the third quarter of 2019 following shareholder approvals in EGM and regulatory clearance.

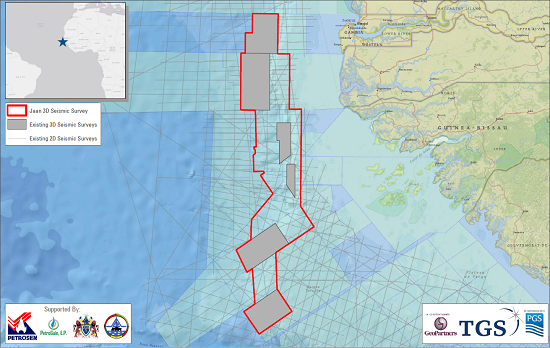

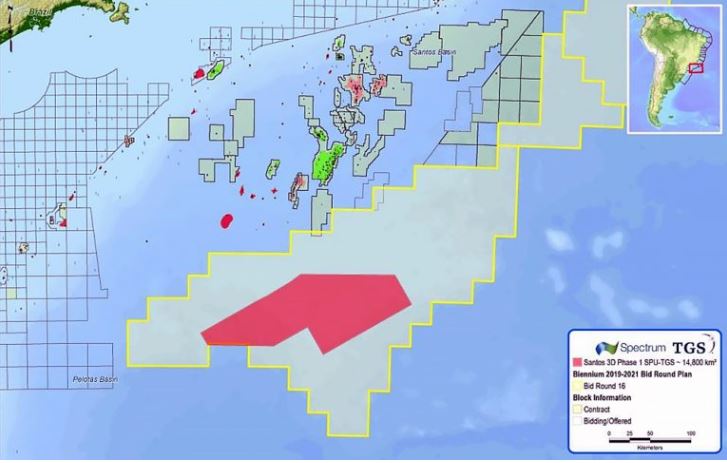

TGS said: “The transaction will create a leading multi-client geophysical data provider with a 2D and 3D seismic data library covering all major mature and frontier basins world-wide. Spectrum has successfully built a substantial presence in the South Atlantic and other important frontier regions. With TGS’ extensive library and financial robustness, the combined entity will be well positioned to accelerate 3D seismic investment plans in an improving market. Furthermore, the combined libraries will have a scale that will help accelerating TGS’ data analytics strategy

“In addition to providing a platform for further profitable growth, the combination will benefit from significant cost synergies with a preliminary estimate of approximately US$20 million annually.

Pål Stampe, Chairman of the board of Spectrum and partner at Altor Equity Partners, the investment advisor to Altor Fund IV, commented: “Over the past years, Spectrum has been through a growth phase with particular focus on establishing profitable positions in non-mature exploration basins, especially along the Atlantic margin.

“TGS´ interest in Spectrum is a manifestation of the solid position built by the Spectrum organization over a long time. Being ready for the next phase of the strategic growth plan, TGS is an excellent match, with its asset-light multi-client strategy and strong balance sheet. Altor Fund IV are proud to be part of creating a leading multi-client company, with a strong presence in all the major basins and superior cash generation capabilities.”

Rune Eng, President & Chief Executive Officer of Spectrum, added: “The strategic combination of TGS and Spectrum will form a stronger and better company with a world class data library, people and opportunities. We look forward to joining forces with TGS.”