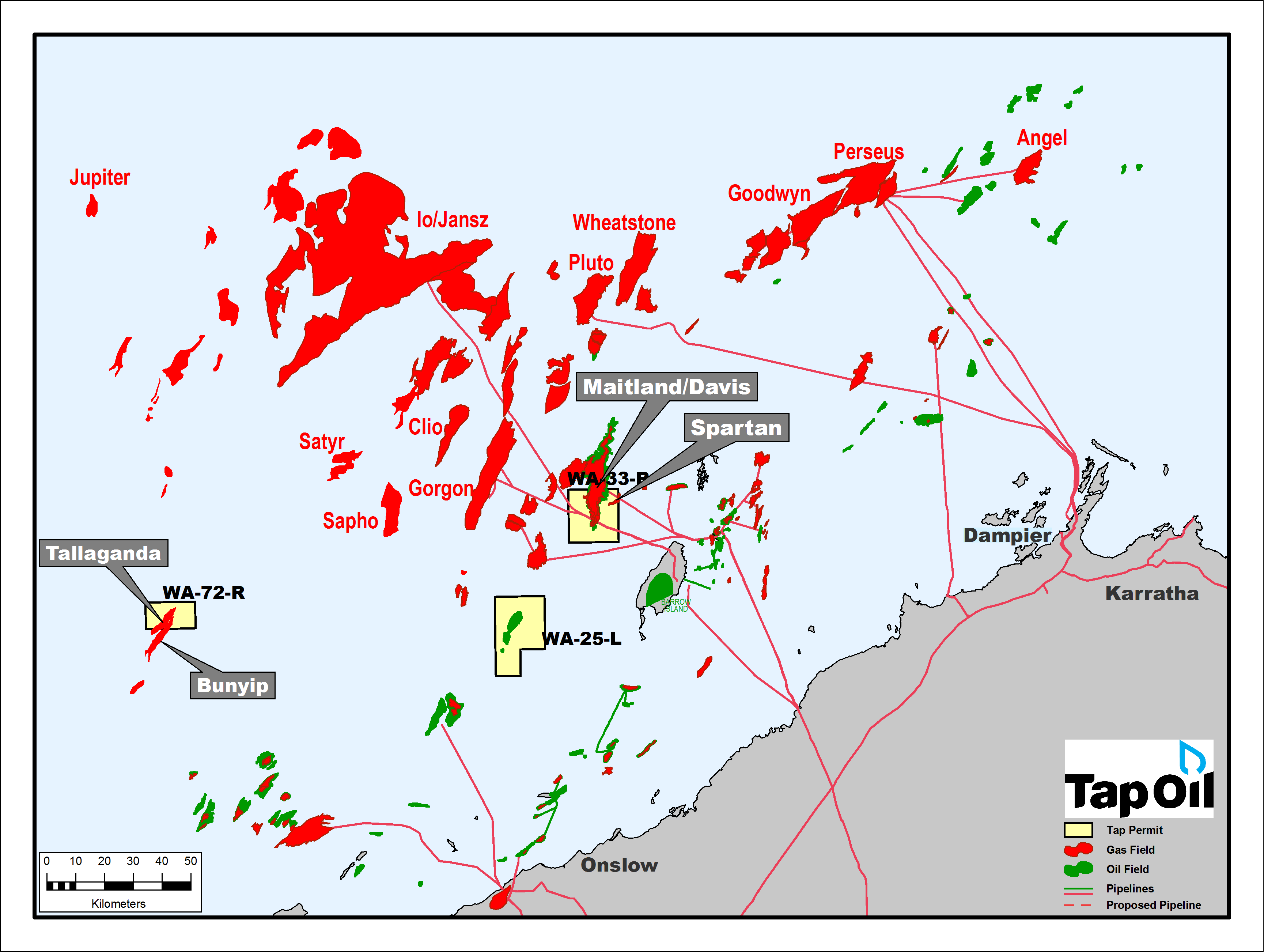

Tap Oil has entered into a sale and purchase agreement for the sale of its 22.474% non-operated interest in WA-33-R in the offshore Carnarvon basin of WA.

Tap said the development was consistent with its strategy to monetize and rationalise its Australian portfolio and pursuant to the terms of the SPA, the company’s subsidiary, Tap Shelfal, will sell its interest in WA-33-R to its joint venture partners Quadrant Oil and Santos with Tap Shelfal’s interest being split between the buyers 12.361% and 10.113%, respectively.

Santos already has an 18.7% interest in the license for which Quadrant was the operator until the recent completion of the acquisition of the latter by the former, whereby Santos becmae the operator of the project.

Tap said that the effective date of the transaction is July 1, 2018, being the date from which the buyers assume Tap Shelfal’s interest. Tap Shelfal retains capped exposure to pre-effective date liabilities, for a limited period. The transaction consideration and residual liabilities are not material to Tap.

As is standard, the parties may unwind the transaction if regulatory approval is not obtained within a defined period.

The WA-33-R block contains the Maitland gas discovery for which the company previously recognized a net 2C Resource of 34.8 PJ gas and 0.3MMstb liquids in the ‘Development not Viable Category’.

Tap said: “The sale of WA-33-R is consistent with the company’s strategy to rationalize and monetize its Australian portfolio and focus its financial resources and technical skills on extending production and reserves in and around the Manora Oil Field in G1/48 Gulf of Thailand, where Tap has a 30% working interest.”