Shareholders in Australian gas producer, Po Valley Energy have moved a step closer to benefiting from a three-way deal to become part of a larger European energy play under formal contract signings announced recently.

Perth-based Po Valley said the signed binding Share Sale and Purchase Agreement with AIM-listed Saffron Energy meant Saffron would acquire onshore and offshore oil and gas production, development and exploration assets in northern Italy held by Po Valley Operations, a 100%-owned subsidiary of Po Valley Energy.

The Transaction is subject to shareholder approval and is part of a broader three-way commercial deal intended to create a large European oil and gas business and from which Saffron intends to expand its interests to include South East Asian oil and gas assets.

Po Valley currently holds 100 million shares (53.8%) of Saffron. The asset change will deliver Po Valley shareholders participation in a strongly capitalised and London LSE-listed European natural gas company which plans to broaden operations in both Europe and South East Asia.

Under the agreement, Saffron will acquire Po Valley Operations from Po Valley for 200 million Saffron shares and also acquire fellow Italian-based Sound Energy Holdings Italy for 185.9 million Saffron shares through a reverse takeover.

This will increase Po Valley’s holding in Saffron to 300 million shares.

As part of this larger transaction, agreements have been reached with large international institutional investors for Saffron to raise $24.3 million at an issue price of 4.38p per Saffron ordinary share.

Po Valley plans under the broader Transaction is to eventually distribute its 300 million shares in Saffron to existing shareholders on a pro-rata basis.

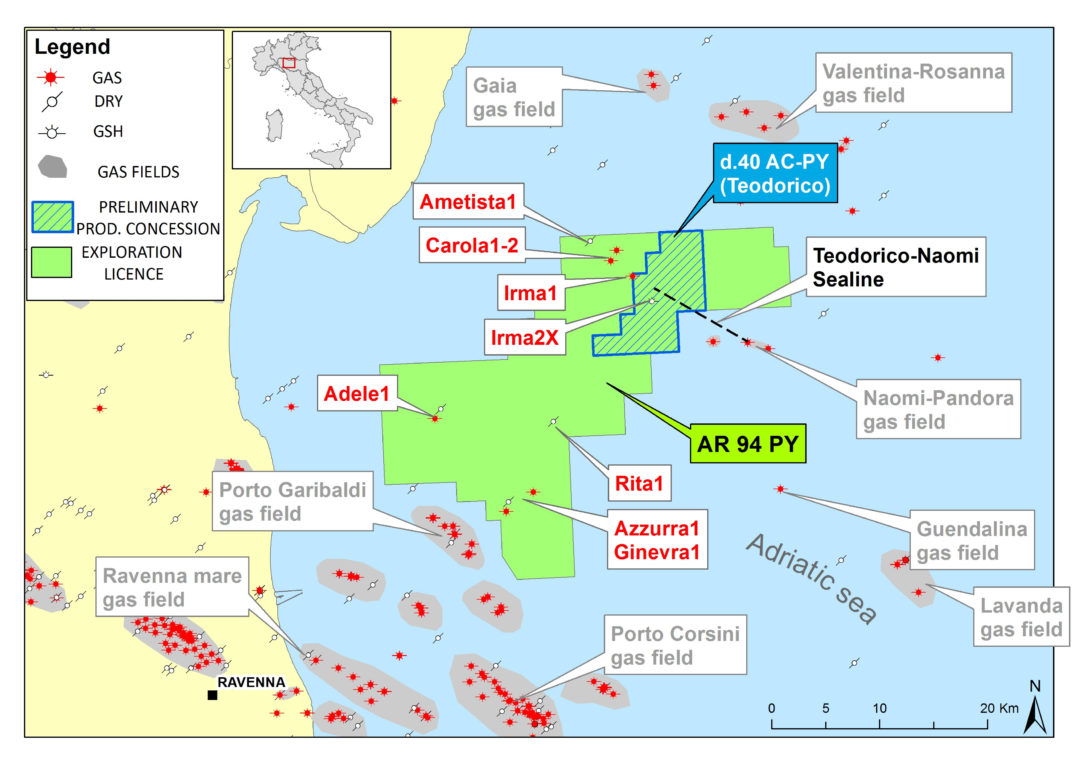

Po Valley said shareholders will emerge from the transaction with a direct shareholding in a more strongly capitalised Saffron which will then hold and operate five natural gas production fields, develop the large Selva and Teodorico gas fields in northern Italy and advance a number of large-scale gas and oil exploration assets.

Po Valley will retain a 5% royalty interest in the successful recently drilled Selva gas field and be reimbursed for its development funding of this field.

It will also retain the cash proceeds of $1.7 million from the sale of the Grattassasso and Cadelbosco exploration licences in Italy.

The completion of this transaction is awaiting formal Italian Ministry approval.

The broader Saffron transactions are subject to Po Valley, Saffron and Sound Energy shareholder approval and the readmission of Saffron Energy to the AIM operations of the LSE as part of the Reverse Takeover of Saffron Energy.

Po Valley said more details will be provided to shareholders in the Notice of an EGM, anticipated to be held in March 2018.

Po Valley Chairman and CEO, Mr Michael Masterman, said benefits to PVE shareholders include: Direct shareholding in a much better capitalised Saffron; listing on the higher-liquidity AIM market which has a strong following of Europe’s natural gas markets; substantially stronger capitalisation through the $24.3million placement and an expanded and consolidated European and Italian asset base through the combination of the Saffron, Sound Energy, and PVO assets, with South East Asia a target for future project expansion.