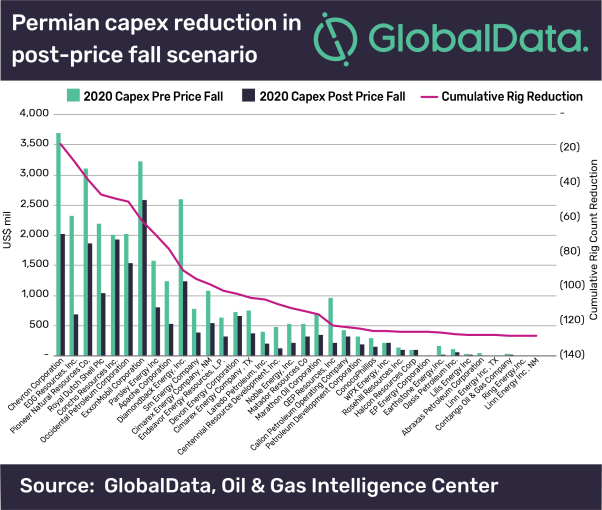

Following the announcement that several key operators in the Permian Basin were significantly reducing capex or production in their positions as a result of the severe oil price fall; Adrian Lara, Oil and Gas Analyst at GlobalData, a data and analytics company, said of the fallout:

Hardest hit

“Of all the unconventional plays, the Permian Basin reduction in forecast production growth will be the largest in absolute terms and exemplifies quite well the collateral effect sought by the oil price war initiated by Russia and Saudi Arabia a few weeks ago,” Lara said.

“The capex reduction of 36 key operators accounting for 75% of total Permian production, indicates a drop of 834 thousand barrels of oil equivalent per day (mboed) in output for this group by 2020 when compared to the forecast for 2020 before the current price fall. This is a significant reduction in shale supply which confirms the level of reaction that this type of production has to steep price movements.

Breakeven US$42

“As in other unconventional plays wells drilled between 2018 to date, most are affected by the price drop. As per GlobalData estimates, the average position full cycle breakeven oil price of top operators in Permian is US$42 per bbl.

“By contrast, the remaining breakeven oil price is at an average of US$25 per bbl and it is pertinent to note that remaining breakeven prices were already relatively low in the pre-price fall scenario, mainly due to operators already being stricter in reaching cost efficiencies so that newer wells aim at achieving as much profit as possible.

“Key Permian operators will remain forced to reduce their capex given the uncertainty generated by low oil demand and the coronavirus (COVID-19) related economic downturn, as well as the escalating narrative between Russia and Saudi Arabia for flooding the oil market. It is very possible that US shale supply operators further adjust their capex plans later this year causing a larger production reduction during 2020 and 2021.”