The Norwegian Petroleum Directorate’s has predicted that oil and gas production will recover from a slight dip in 2019 and increase in the period 2020 to 2023 as it approaches record production set in 2004.

The NPD Director General, Bente Nyland, said: “The activity level on the Norwegian Shelf is high. Production forecasts for the next few years are promising and lay a foundation for substantial revenues, both for the companies and the Norwegian society. There is considerable interest in exploring for oil and gas.”

During 2018 exploration activity rose substantially from the previous two years and last year 87 new production licences were awarded, representing a new record, the NPD said.

Fifty-three exploration wells were spudded last year, compared with 36 in 2017 and the NPD said the number was likely to remain similar in 2019. Eleven discoveries were made in 2018 and a preliminary resource estimate of 82 million standard cubic metres of recoverable oil equivalents was higher than the three previous years.

“The high level of exploration activity proves that the Norwegian Shelf is attractive. That is good news. However, resource growth at this level is not sufficient to maintain a high level of production after 2025. Therefore, more profitable resources must be proven, and the clock is ticking,” said Nyland.

The Barents Sea, containing almost two-thirds of the undiscovered resources, has been flagged as an important area for sustaining high production over the long run.

“In the time ahead, there will be more available capacity in pipelines and other infrastructure for gas. This means that it is more attractive to explore for gas, and it is important that the industry exploits this opportunity,” Nyland said.

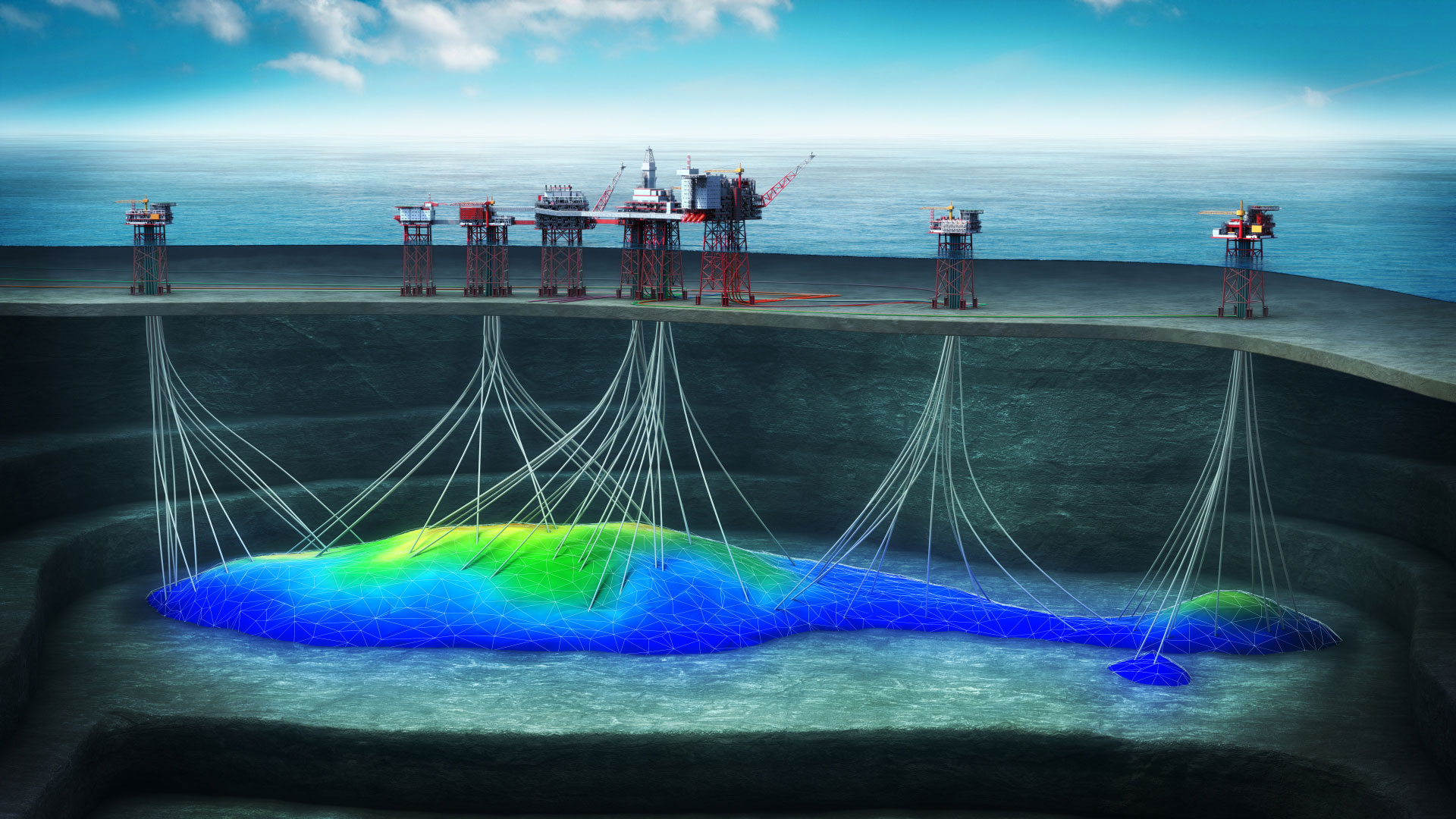

By the end of 2018, 83 fields were producing on the Norwegian Shelf.

“A lower cost level is also reflected in the new projects that are approved. These are projects that are profitable for both the companies and the Norwegian society. The general scenario is that the new development projects will be profitable with significantly lower oil prices than the current level,” Nyland concluded.