2018 promises to be an exciting year for the WA Branch Technical Series, with many thanks to our four sponsors; Spectrum (Platinum), CGG (Gold), Searcher Seismic (Gold) and DUG (Gold). At the commencement of the luncheon, WA Branch President Helen Debenham opened the first technical series of the year with the usual Branch introduction, with special thanks to our sponsors, before announcing all the new and exciting upcoming 2018 Branch events to an audience of over 70 people.

Latest News

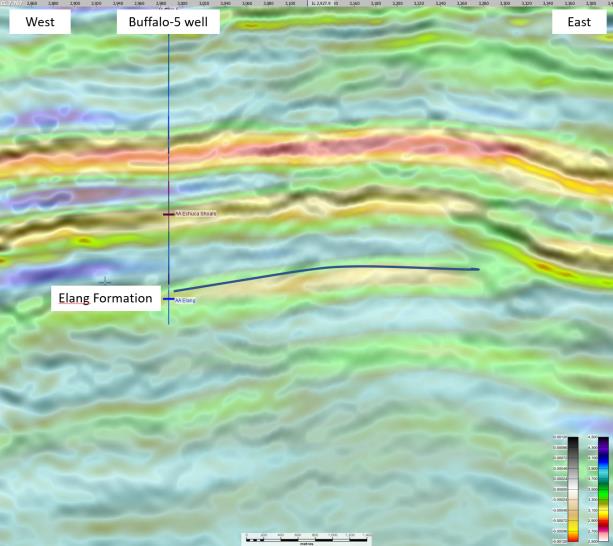

Carnarvon’s Buffalo Project

Perth based junior oil and gas company Carnarvon Petroleum has been working with seismic reprocessing firm, DownUnder Geosolutions to provide an update on Carnarvon's Buffalo project. Quality new seismic data has recently been received showing clear definition around the Elang formation, the producing reservoir in the Buffalo oil field. With this new data the reservoir in this region is clearly identifiable on seismic and has been reconciled with important well data within the oil field.

It’s official – wholesale gas prices fell in 2017

In fact, as the latest report to the Council of Australian Governments (COAG) confirmed just two weeks ago, wholesale gas prices fell by six per cent in 2017.

“The report found that wholesale prices fell in all eastern states in 2017,” said APPEA Chief Executive Dr Malcolm Roberts.

“A newspaper article published (recently) confuses the wholesale gas market with the tiny daily spot market. Less than 0.1 per cent of east coast gas is traded through the spot market, meaning that spot prices are not a reliable guide to the prices paid by customers.

“The article admits as much when it notes that ‘most Australian gas is sold at contract prices’. The

H2Oil & Gas delivers produced water treatment package for plant in Malaysia

H2Oil & Gas, an Aquarion Group company, has completed a contract to design and supply equipment for a produced water treatment plant in Malaysia. The high pressure (117 bar) system reduces the oil in water content from 3000ppm down to <20ppm with an optimized process design that uses the existing gas in the system, eliminating the use of additional fuel gas used on standard Compact Flotation Units. This design, together with a carefully developed layout, produced a low weight compact skid for use on an offshore module that was at a critical weight limit.

CGG GeoConsulting and Petroleum Corporation of Jamaica Announce First Reported Discovery of Live Oil Onshore Jamaica

CGG GeoConsulting and the Petroleum Corporation of Jamaica (PCJ) have announced the discovery of two independent live oil seeps from different parts of the island of Jamaica. This significant find marks the first documented occurrence of ‘live’, or flowing, oil from onshore Jamaica and will be of particular interest to oil explorationists focused on Central America and the Caribbean. The oil seeps were found during fieldwork for a recently completed multi-client Robertson Study (Red Book) of the petroleum potential of on- and offshore Jamaica entitled ‘Petroleum Geological Evaluation of Jamaica’ made jointly by CGG GeoConsulting and PCJ.

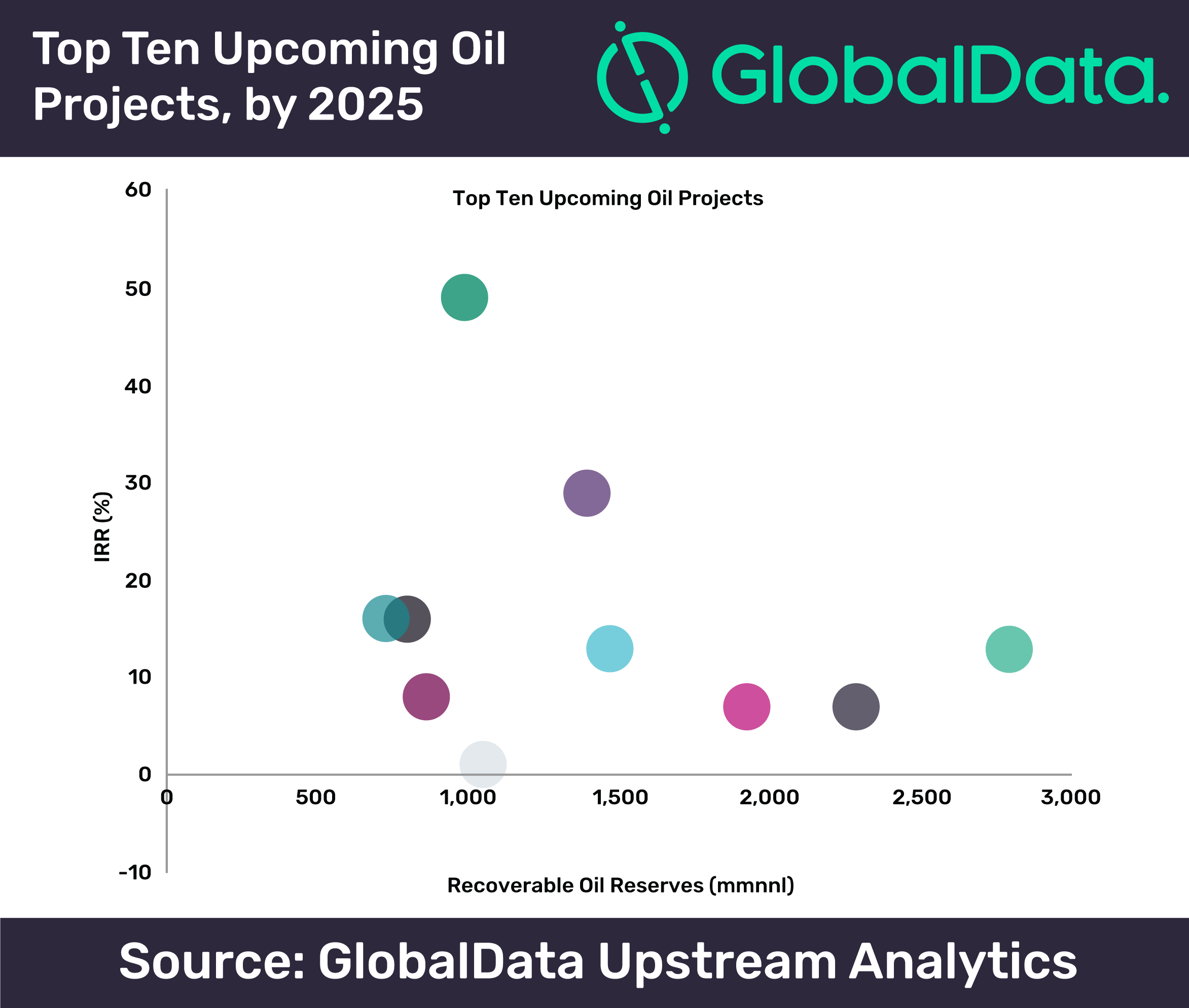

Investment of $97bn on top ten offshore oil projects to add over 1.6 million barrels per day by 2025, says GlobalData

Over $151.5bn in capital expenditure will be spent over the lifetime of the top ten offshore oil projects to produce 14.3 billion barrels of crude, according to GlobalData, a leading data and analytics company. These ten projects, selected from 236 upcoming offshore projects globally, will contribute incremental capacity of 1,613,319 barrels of oil per day to global supply by 2025. Johan Sverdrup in shallow water Norway is the largest with anticipated peak production at 600,512 barrels of oil per day in 2024 at an estimated cost of $25.4bn.

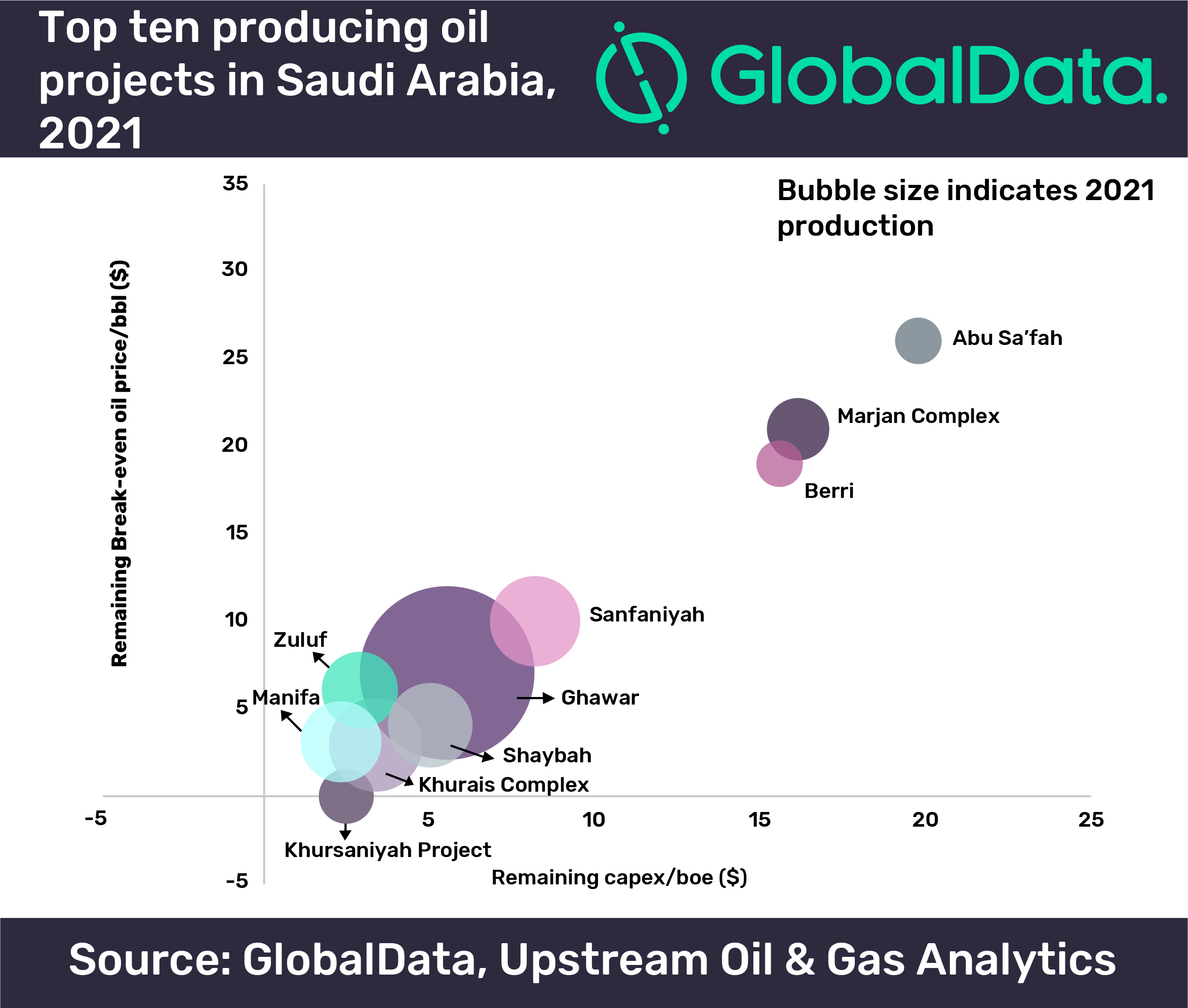

Top three Saudi oil fields to drive 59% of country’s oil production by 2021

Analysis of Saudi Arabia’s crude oil production shows that over $79.6bn in capital expenditure (capex) would be spent by Saudi Arabia Oil Co on oil projects over the next four years, to ensure that country’s production remains around 11.2 million barrel per day (mmbd) in 2021. The company will have 17 fields producing in 2021, of which 13 are conventional oil fields and four are gas fields producing condensate, according to GlobalData, a leading data and analytics company. Saudi Arabia is expected to spend $79.

New UK grants open for Australian fellows

Brunel University in London will soon offer five short-term fellowships to Australian early career researchers, thanks to a new grant from Universities UK International’s (UUKi) Rutherford Fund. Funded by the UK government’s Department for Business, Energy and Industrial Strategy (BEIS), the new fellows will be tasked with researching resource efficient future cities, the environment, and health. The researchers will be selected from the University of New South Wales, Royal Melbourne Institute of Technology, Curtin University, University of Sydney and The University of Queensland, all of which are Brunel strategic partners.

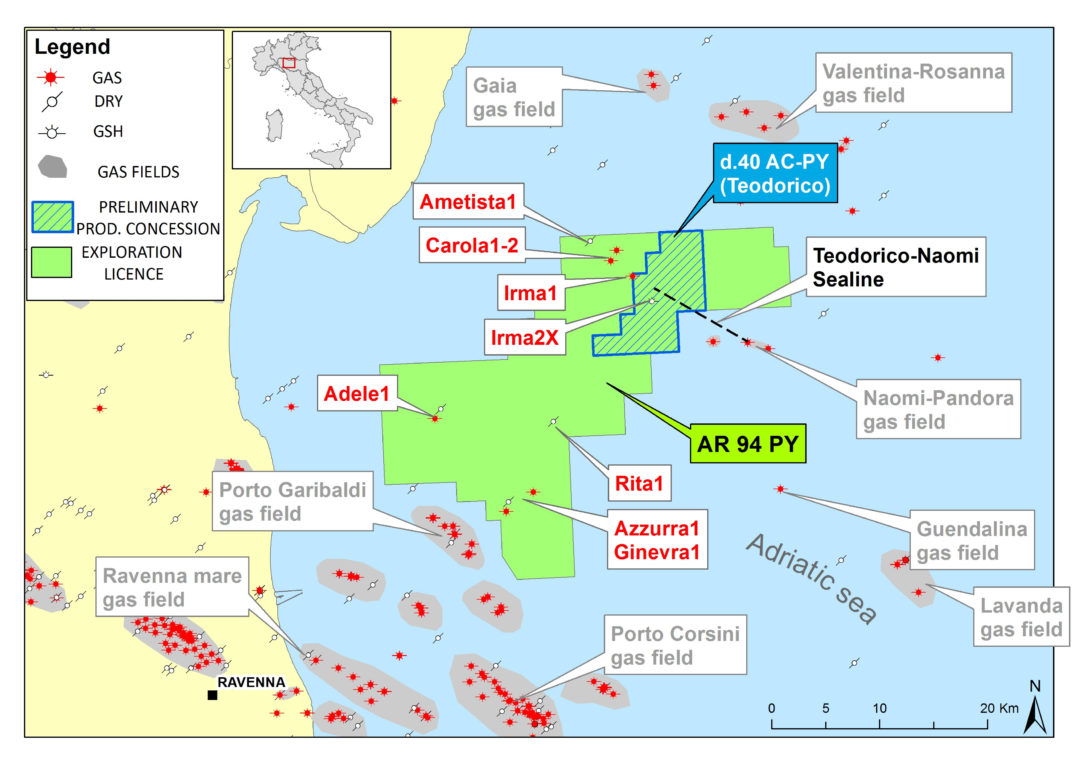

Po Valley upgrades maiden 2P reserves to 36.5 bcf for Teodorico.

Po Valley Energy has upgraded its oil and gas reserves and resources for its 100% owned subsidiary Po Valley Operations, with maiden 2P reserves of 36.5 bcf of gas now declared at the company’s offshore Adriatic development Teodorico gas field. Teodorico has the largest gas in place of all of Po Valley’s gas fields and is at an advanced stage of assessment and is ready for development. The company received a preliminary award of the Teodorico Production Concession last year and is advanced in securing environmental approval which is the critical step before the full grant of the production concession.

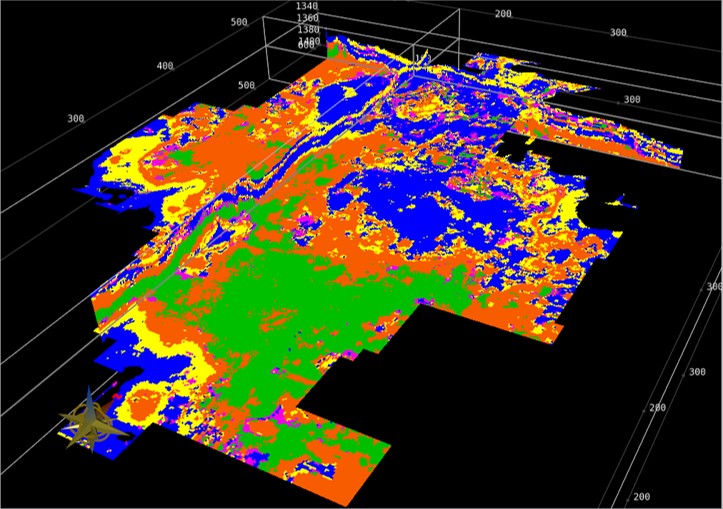

New CGG GeoSoftware Technology ‘Drives Greater E&P Efficiency’

CGG GeoSoftware has announced new releases across its entire geoscience portfolio. Its complementary HampsonRussell, Jason, PowerLog, InsightEarth, VelPro, and EarthModel FT solutions are the industry’s preferred set of tools and support for multi-disciplinary teamwork at every stage from exploration and development to life-of-field production management. In a media release CGG said recent developments “bring exciting new capabilities within each individual solution while offering increasingly integrated workflows from geology and geophysics to reservoir engineering.