In the short term, at least, Europe will remain dependent on Russian gas supplies for its energy needs.

Following Russia’s invasion of the Ukraine last week Veronika Kustkova, Senior Oil & Gas Analyst at data and analytics company GlobalData, said of the war on Europe’s eastern front and its impact on energy supplies to the continent.

“With Nord Stream 2 coming to a halt, Germany will be losing the additional 150 million cubic metres per day of gas coming from the envisaged pipeline. Gas transit through Ukraine currently holds a yearly capacity of over 100 billion cubic metres (Bcm). As the crisis unfolds, the massive gas imports route via Ukrainian trunk pipelines may stop at any point. This brings an immediate threat to Europe while withdrawals from gas storages continue to rise, but it is doubtful they’ll reach 2018 historical lows.

“European demand for gas has increased since 2020 and is expected to stay at the same level in the short term, placing Europe in an uncomfortable position as Qatar has already declared they will not be able to fulfil the supply shortage. According to Eurostat and GlobalData analysis Russian imports made up 45% of EU imports in the first 10 months of 2021. Similarly, Russian gas exports are reliant on Europe and Turkey, which made up around 78% in 2021 despite increasing volumes going to China.

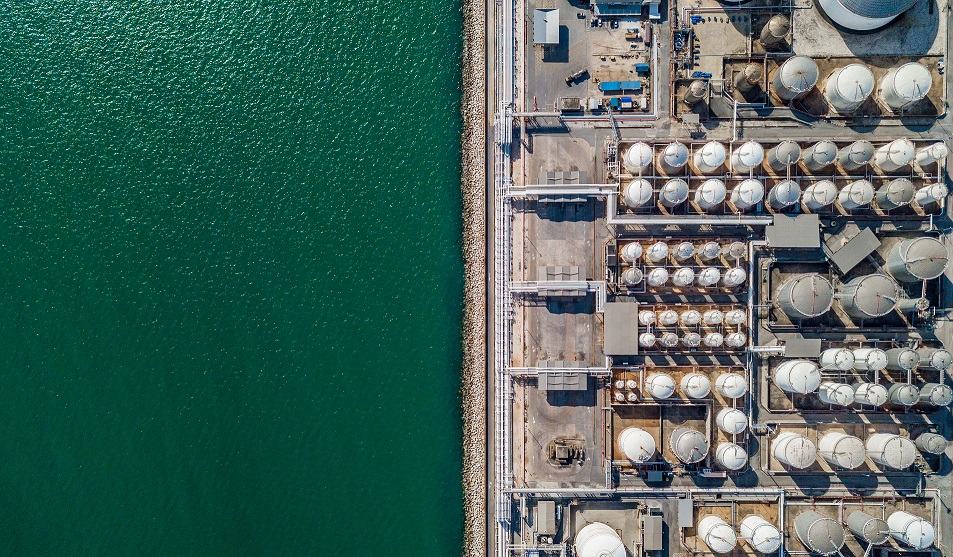

“An alternative source of gas is US LNG imports, but volumes will be constrained by capacity. However, medium-term increases will depend on new projects with the likes of the Rio Grande, which has already seen a delay. However, in the past two months we have seen the US LNG imports to Europe taking over from Russian pipeline gas for the first time in history. Another offset could be from wind and solar, but we will only see a substantial 7% increase in the European energy mix in 2025.”