New research from Interact Analysis shows that hydrogen ICE vehicles are in their infancy in terms of rollout. However, mass production is predicted to take off within 5 years.

Although the costs of the engine and the vehicles themselves are relatively low, their running costs are currently high, making the total cost of ownership (TCO) unfavourable. This, coupled with the lack of refuelling infrastructure required, means they are less attractive compared with fuel cell and battery electric alternatives.

Hydrogen ICE vehicles require a series of minor changes compared with traditional ICE vehicles, including different spark plugs and other changes to materials. On their own, individual changes do not present too much of a challenge, but in combination the total cost of manufacturing the vehicle soars. In addition to this, adding greater complexity increases the potential risks once the vehicle is in mass production. Hydrogen ICE vehicles are most attractive to those companies who are most climate aware, or where battery electric alternatives are either unavailable for a particular vehicle or not fit for purpose. Without either of these catalysts for adoption, uptake of hydrogen ICE vehicles is likely to remain low in the short term. Off-road vehicles are perhaps best suited to this technology since battery electric and fuel cell alternatives face greater infrastructure challenges in off-road environments.

The total cost of a hydrogen engine is only slightly higher than that of a diesel engine. On average, for a class 8 40-tonne truck, a hydrogen tank would cost around $76,000, a figure far in excess of the price of a diesel equivalent. However, the unit price of an H2 vehicle is still less than a FCEV alternative. Therefore, because the average cost of fuel per mile for H2 vehicles is higher than for FCEV and BEV vehicles, H2 technology is best suited to applications with low mileage/hours per day. Interact Analysis predicts that the cost of hydrogen will reduce significantly over time and, if it continues to fall at pace, it could become more competitive across a wider range of applications in the future. Although maintenance costs for H2 vehicles will be similar to those of other vehicles, fuel costs for hydrogen vehicles mean the TCO will be worse than for diesel and battery electric alternatives. Therefore, H2 vehicle application is likely to be limited to applications or regions where diesel has been legislated against or where BEV alternatives are not available.

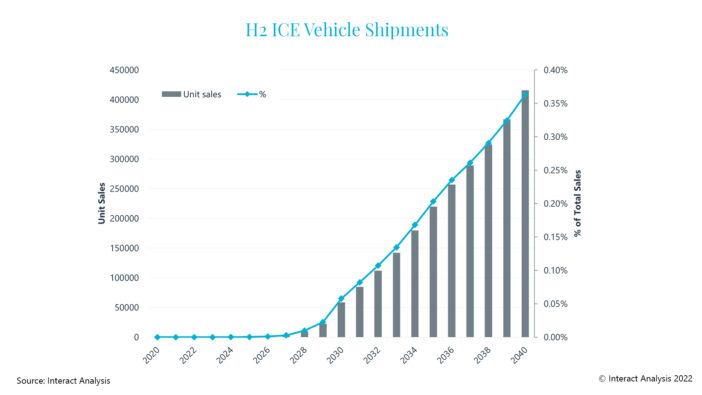

Jamie Fox, Principal Analyst at Interact Analysis adds, “The number of registered H2 ICE vehicles is forecast to grow to 58,000 in 2030. Covering all on road and off-road vehicles (including trains, agricultural equipment, trucks and passenger cars), this figure is set to see significant growth post 2030, with uptake of H2 ICE technology projected to soar to more than 400,000 shipments by 2040.”

“Due to unfavourable TCO and high fuel costs H2 ICE vehicles are unlikely to become the market leader. Despite the many environmental benefits to the use of hydrogen vehicles, for mass adoption to occur the refuelling infrastructure required must be developed and customer payback improved. We are still seeing many limitations to refuelling infrastructure for battery electric vehicles so it is unlikely that we will see a significant amount of change in the H2 infrastructure for many years.”