Cairn Energy has agreed to sell its 40% stake in the Rufisque Offshore, Sangomar Offshore and Sangomar Deep Offshore contract area to Russia’s Lukoil for a cash consideration of up to $400 million, in addition to reimbursement of capital expenditure incurred since January.

Completion of the sale is expected to be finalised in the fourth quarter of 2020 and Cairn said it will return at least $250 to shareholders.

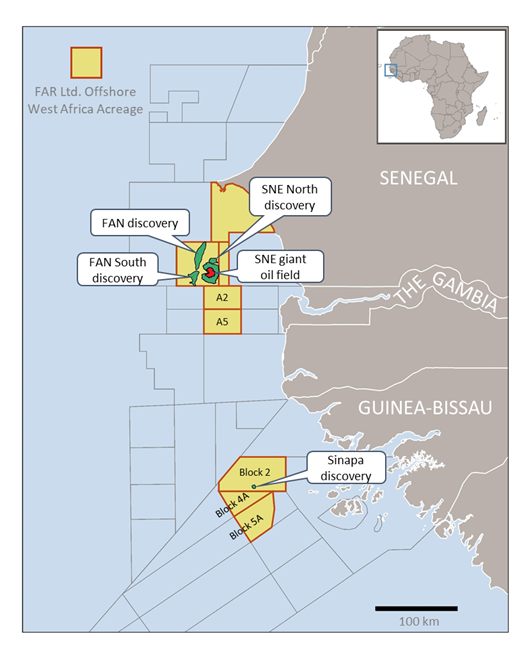

This come after FAR Limited said it had received a “good level of interest” for the sale of its 15% stake in the $4.2 billion Sangomar oil and gas development offshore Senegal.

The Melbourne-based explorer was hard hit by the COVID-19 outbreak earlier this year which had a double-whammy on crude oil prices which plunged to as low as $10 a barrel in the second quarter.

Financing reversal

This left FAR in a precarious position as the company was unable to secure $300m in debt to fund its share of the project. In January FAR announced that it had tied up a $300m senior secured reserve-based lending facility, but lead banks subsequently said that the were unable to complete the syndication in the current environment.

FAR then defaulted on its project contributions in June. The company said it would forfeit its interest without compensation if its obligations had not been fulfilled within six months.

FAR then started a process to sell all or part of its working interest in the project and in its recent quarterly report, managing director Cath Norman said: “As time progresses and global markets continue to be stressed, there remains uncertainty around FAR’s ability to conclude a financing option. At this point in time, a sale or partial sale is a more likely outcome. FAR has run data rooms for this purpose and has had a good level of interest.”

Simon Thomson, Chief Executive of Cairn said of the Lukoil deal: “We are proud of what Cairn has achieved in Senegal. Our discoveries were the country’s first deep-water wells and opened up a new basin play on the Atlantic Margin. What’s more, they successfully laid the foundations for Senegal’s first oil and gas development, which will deliver enduring benefits to its people.

“With a strong balance sheet, low breakeven production and limited capital commitments, Cairn will have enhanced financial flexibility to invest in and grow the business whilst always remaining committed to returning excess cash to shareholders.”

Processing of the high definition seismic survey over the Sangomar field and FAN discovery has been completed and interpretation of this data has started. Processing of the seismic data over the exploration area to the north of the Sangomar field is continuing.

Woodside, the operator of the development, has undertaken a program to rescope, reschedule and reprice the Sangomar project to reduce capital expenditure to ease the pressure on financing or the development.

The project is believed to be on track for first oil in 2023, in spite of reports that Senegal had been forced to delay its first oil and gas projects by up to two years due to the coronavirus, and is expected to deliver five million tons of crude oil per year.