Italian oil company Eni said it expects production to increase by 3.5% per year over the next four years and has plans to invest US$1.1 billion per year on exploration activities in its quest to discover two billion barrels of new resources.

This was revealed by Eni CEO Claudio Descalzi in the company’s 2018-2021 Strategic Plan, which builds on the transformation started by the company back in 2014.

Descalzi said over the past four years, in a very low price environment, Eni had increased its hydrocarbon production and restructured its mid-downstream businesses to drive positive structural result.

“We have reduced our cash neutrality from $114/barrel in 2014 to $57/barrel in 2017,” Descalzi said.

“We are now entering a new phase of expansion, which will allow us to further strengthen the company and increase value for our shareholders. Our strategy is based on a deep integration of all our businesses and a continued focus on efficiency and strict financial discipline.

“Over the next four years, we expect production to increase by an average of 3.5% per year and to discover two billion barrels of new resources. Based on the trend in first quarter, with a 4% growth year on year we are perfectly in line with our previously announced growth target for 2018.

“In the Gas & Power business we will increase EBIT to 800 million euros in 2021, generating 2.4 billion euros of free cash flow over the Plan period.”

Descalzi also added: “Over the next four years, we expect total cash flow from operations to continue to grow while we hold capital expenditures flat compared to the previous Plan.”

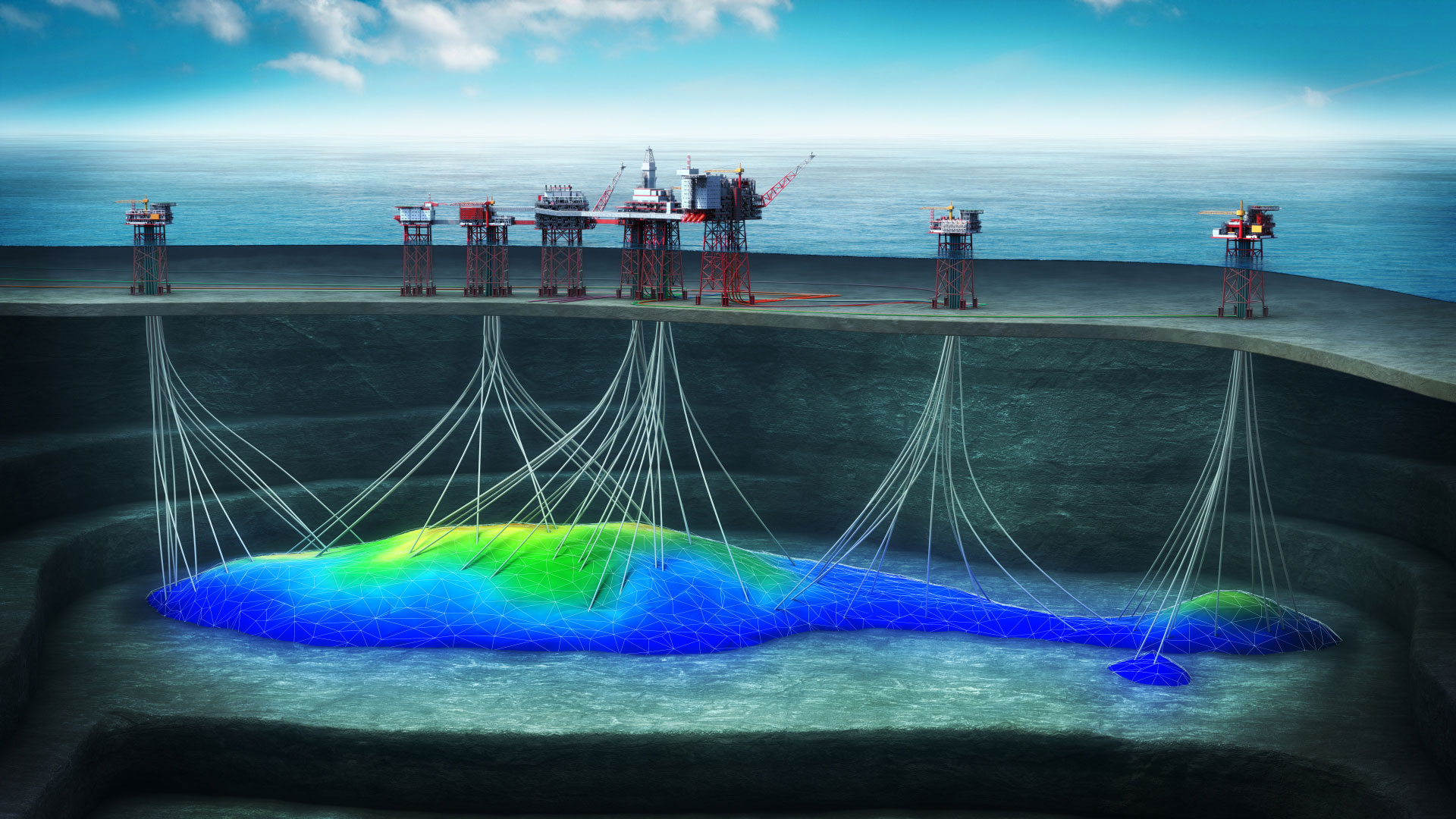

During the four-year Plan, Eni will spend €900 million per year on exploration activities, targeting approximately 2 billion boe of new equity resources at approximately $2 per barrel and continuing to implement its dual exploration model.

The company said it will leverage its renewed exploration portfolio – which is equal to 100 million acres, almost three times 2013 levels – with a net risked resources potential of 10 billion boe.